2021-3-6 20:30 |

The Bitcoin (BTC) price has bounced at a minor support level and is in the process of moving above a short-term descending resistance line.

The technical analysis for Ethereum (ETH) and Zcash (ZEC) shows no bullish reversal signs. However, both are trading above a strong support area/line.

XRP (XRP) is trading inside a range between $0.36 – $0.63.

Synthetix (SNX) has broken out from a descending resistance line.

Qtum (QTUM) has bounced at a long-term support area but has failed to clear the most recent breakdown level, which is now acting as resistance.

iExec RLC (RLC) has failed to validate the previous all-time resistance area as support, breaking down below it instead.

Bitcoin (BTC)BTC has been decreasing alongside a descending resistance line since Mar. 3, when it was trading at a high of $52,640. Currently, it is trading just below this line.

Earlier this morning, BTC reached the 0.618 Fib retracement support level at $46,600 and bounced. Currently, BTC is trading just below the aforementioned resistance line.

The MACD is potentially providing a bullish reversal sign, but has yet to confirm it. Similarly, the RSI is moving upwards but is still below 50.

A breakout from the descending resistance line would confirm the MACD bullish reversal and cause the RSI to move above 50, confirming that the short-term trend is bullish.

For a longer-term BTC analysis, click here.

BTC Chart By TradingView Ethereum (ETH)ETH bounced after reaching a low of $1298 on Feb. 26 but has lost nearly all of the gains resulting from the bounce.

Currently, ETH is trading just above the $1430 support area, which also coincides with a long-term ascending support line. As long as ETH is trading above these levels, the price action remains bullish.

However, technical indicators are firmly bearish, as evidenced by the bearish cross in the Stochastic oscillator.

A breakdown from the support area/line could cause a sharp drop towards the $1175 region, which is the 0.5 Fib retracement of the most recent upward movement.

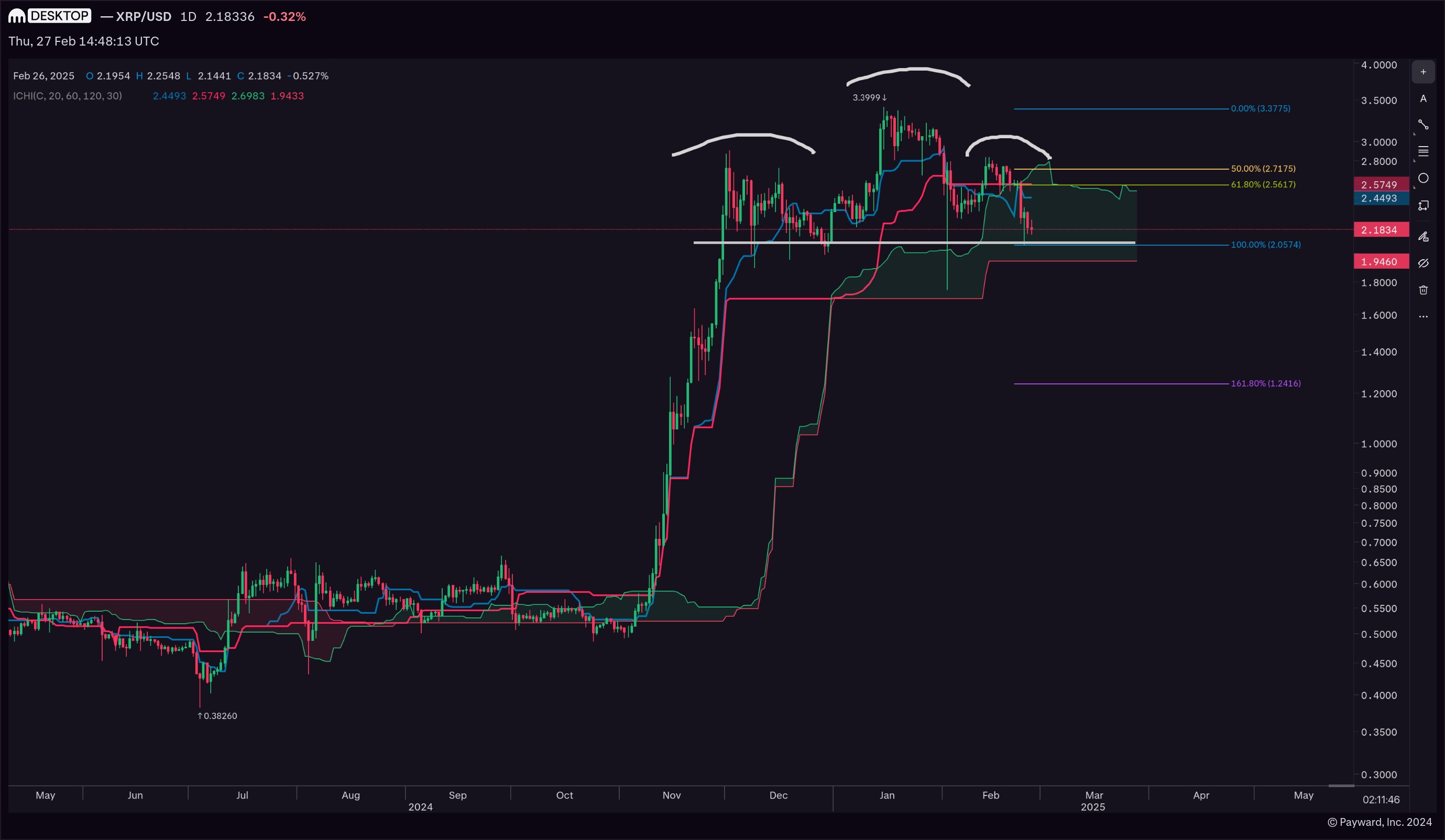

ETH Chart By TradingView XRP (XRP)On Feb. 22, XRP reached the $0.63 resistance area, but was promptly rejected and created a long upper wick. It dropped all the way to the $0.36 support area the next day, but bounced immediately, creating a long lower wick.

XRP has been trading between these two levels since.

Technical indicators are neutral, suggesting that XRP is likely to continue consolidating inside these levels.

XRP Chart By TradingView Synthetix (SNX)On Feb. 14, SNX reached an all-time high price of $28.98 but began to decrease afterwards, following a descending resistance line in the process.

The decrease continued until SNX dropped to the 0.5 Fib retracement level at $15.60, where it bounced, leaving a long lower wick behind (green arrow).

The bounce caused a breakout from the aforementioned descending resistance line. As a result, SNX is now retracing after breaking out.

The MACD has given a bullish reversal signal, the RSI is bouncing above the 50 line and the Stochastic oscillator has begun to move upwards.

Therefore, it is likely that the trend for SNX is bullish. If so, this would lead to a new all-time high price.

SNX Chart By TradingView QTUM (QTUM)On Feb. 25, QTUM reached a low of $4.24 but bounced almost immediately afterwards, creating a long lower wick in the process.

The bounce was also important since it served to validate the previous all-time high resistance area of $0.425 as support.

Despite the bounce, QTUM has been rejected by the minor resistance of $6. This is the 0.382 Fib retracement of the most recent downward move.

Technical indicators are neutral. Thus, more consolidation is expected before a potential breakout.

QTUM Chart By TradingView Zcash (ZEC)ZEC has been moving downwards since creating the second portion of a double top on Feb. 19. The high reached was at $190.

The drop has taken ZEC all the way to the $115 support area, which previously acted as resistance. The area coincides with an ascending support line that has been in place since Dec. 15, 2020.

The price action and technical indicators are similar to those of ETH.

On one hand, the price action is bullish as long as ZEC does not close below this horizontal area and ascending support line.

On the other, technical indicators are firmly bearish.

ZEC Chart By TradingView iExec RLC (RLC)On Feb. 12, RLC broke out above the previous all-time high resistance area of $1.95, proceeding to reach a high of $2.59 in the process.

However, it failed to validate the same area as support, breaking down right through it instead.

The drop took it to the $1.40 support area, where RLC has initiated a weak bounce.

The MACD has given a bullish reversal signal but both the RSI & Stochastic oscillator are bearish.

Therefore, similarly to QTUM & XRP, some consolidation seems like the most likely option.

RLC Chart By TradingViewFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post BTC, ETH, XRP, SNX, QTUM, ZEC & RLC: Technical Analysis for March 5, 2021 appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|