2021-10-26 20:00 |

Wall Street has previously not been at the forefront of bitcoin trading in the past. However, that looks poised to change. The approvals of three bitcoin ETFs in the past week have brought about more institutional interest in the digital asset and Wall Street brokers are starting to turn their attention to the cryptocurrency. The first Bitcoin ETF recorded trading volumes of over $1 billion on its first day. This success has not missed the radar of Wall Street.

Analyst Christopher Brendler sat down with Coindesk to talk about the future of bitcoin in Wall Street. According to Brendler, Wall Street brokers are getting increasingly positive about BTC investments. It is important to note that bitcoin has outperformed both the Nasdaq and the S&P year-over-year, as seen in a report from Wealthier Today.

Interested In Bitcoin And MiningBrendler had previously collated data on how the bitcoin mining industry was being viewed by players in Wall Street. He found that brokers had a positive view of the industry in the short term. Brendler estimated that about 15% of Wall Street brokers from the payments side of things were beginning to take investments in the cryptocurrency more seriously. This number at been at a meager 5% of Wall Street brokers at the beginning of the year.

Related Reading | American Singer Mariah Carey Offers Free $20 In Bitcoin To Promote Adoption

Interest has mostly grown due to the growth of bitcoin in the past year. The asset whose price had been below $30,000 at the beginning of the year had grown over 100% to a new all-time high in October.

BTC price suffers beatdown from $63K | Source: BTCUSD on TradingView.comThe asset itself has not been the only one to record tremendous growth in recent months. Mining stocks have also benefitted from the market rally. The report stated that mining stocks Marathon Digital and Riot Blockchain have seen growth up to 1,500% and 600% respectively in the past year, considerably higher than the 377% of BTC in the last year.

Institutional Investors Are Pouring InInstitutional investors have continued to pitch their tent with bitcoin. This has translated into more interest in the market from Wall Street brokers. Bendler noted some skepticism from these investors. However, they still remained bullish on the digital asset in the long term. “While most investors are still new to this area, there was also quite a few already involved and able to dig deep into our new coverage,” said Bendler.

Related Reading | Analyst Puts Bitcoin Bottom At $50,000, Here’s Why

As interest from Wall Street grows, it is expected that we will see more inflows in bitcoin. The money coming in will help to drive the price of bitcoin both in the short and the long term.

Bendler explained that the investors familiar with the market were bullish crypto miners. Although they erred on the side of caution when it came to valuation in the space. This has, however, not caused them to shy away from the space. With returns from the crypto market beating out traditional investment vehicles, it is only a matter of time before Wall Street is fully invested in the market.

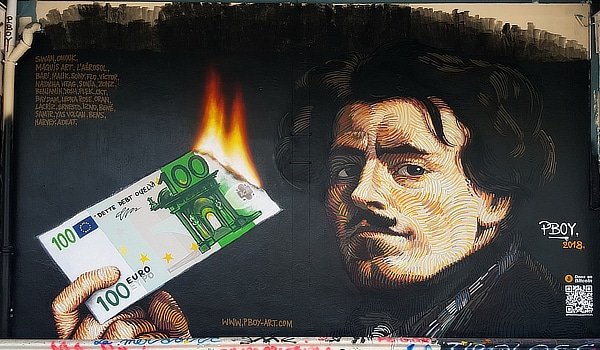

Featured image from Ethereum World News, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|