2020-11-24 18:00 |

The Bitcoin as digital gold narrative is suddenly taking on such significance, hedge funds, corporations, and institutional investors have begun reallocating a portion of their gold holdings into the cryptocurrency, according to Bloomberg Intelligence.

A top senior commodities analyst for the financial forecasting giant believes that trend along with climbing Futures interest while gold declines, means that the cryptocurrency is beginning to gain the edge, price appreciation wise. Here’s why this trend will only continue well into the future.

Bitcoin Becomes Digital Gold In 2020 As Safe Haven Needs ChangeBitcoin price is trading at over $18,000 and a stone’s throw from its former peak and is up over 150% in 2020. Gold, which set a new all-time high earlier this year, has only 20% returns to show for it.

The widening gap between the performance of Bitcoin, and that of the precious metal historically used as a hedge against economic uncertainty, has begun to entice high wealth individuals and entities that seek to protect that wealth.

RELATED READING | BLOOMBERG ANALYST: BITCOIN IS “TINY” NOW, BUT “PRICE DISCOVERY STAGE” IS HERE

The dollar is in decline, and even stock market returns when adjusted for inflation aren’t compelling. Bitcoin, however, has the greatest ROI out of any asset since its inception, and it shows no signs of stopping.

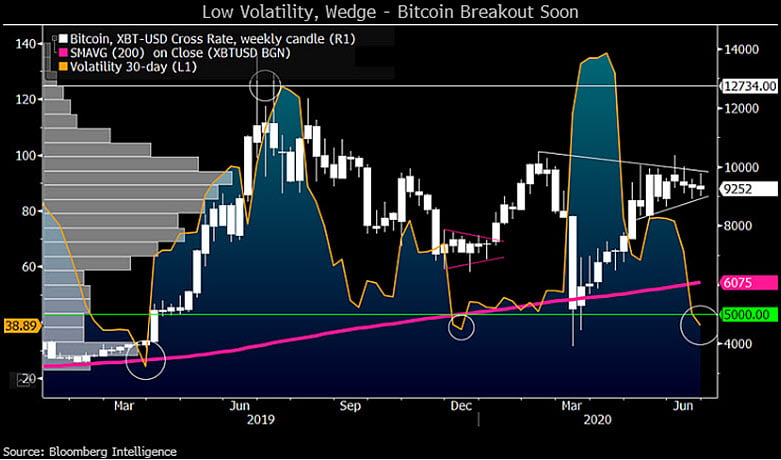

Bloomberg analyst Mike McGlone and his team agree. He claims that rising Futures “open interest and investor inflows” in Bitcoin versus gold declining during the same time highlights this trend unfolding.

This could give Bitcoin an added edge in price appreciation during the current cycle that wasn’t around during the last, and be the catalyst that takes the cryptocurrency if prices closer to $500,000 per coin.

Is #Bitcoin Replacing #Gold? #Futures and Fund Flows Are Saying Yes —

Rising futures open interest and investor inflows in Bitcoin vs. the same declining for gold indicate the #cryptocurrency gaining an edge for price appreciation, in our view. pic.twitter.com/Y0wJ6nzxPc

— Mike McGlone (@mikemcglone11) November 23, 2020

Why The Cryptocurrency Will Outperform The Precious Metal Forever MorePerformance aside, Bitcoin is better than gold in every way. 2020 cleared the path for an all-digital world and proved that decentralization and scarcity are extremely powerful in this day and age.

In addition to the completely capped supply versus a finite, yet always flowing supply of precious metals the cryptocurrency is uniquely coded for price expansion. The ideal example itself played out earlier this year when gold reached its all-time high. Demand was high, so mining kicked into high gear to compensate for the needed supply.

RELATED READING | FIVE REASONS WHY GOVERNMENTS WON’T BAN BITCOIN AND CAN’T STOP CRYPTO

Bringing supply to meet demand, caused the pullback. With Bitcoin, mining can never hasten and more coins can’t be extracted at a faster pace, and the built-in code even slashes the supply in half when demand started to pick up.

Price appreciation follows, and Bitcoin goes parabolic. Capital pouring out of gold and into BTC could do the trick. Gold’s market cap is roughly $10 trillion, and if Bitcoin can absorb that much money from the world, prices of $500,000 per BTC are just around the corner.

Gold is about to break down against Bitcoin | Source: XAUBTC on TradingView.com Featured image from Deposit Photos, Chart from TradingView.com origin »Golos Gold (GBG) на Currencies.ru

|

|