2021-7-10 20:00 |

Bitcoin price predictions have been a hot topic for a while now. Bloomberg Analyst, Mike McGlone believes that the price of BTC hitting $100,000 is tied to the asset following ethereum. This came in the monthly cryptocurrency newsletter sent out by Bloomberg Crypto Outlook. McGlone said this in the July version of the newsletter that was recently published.

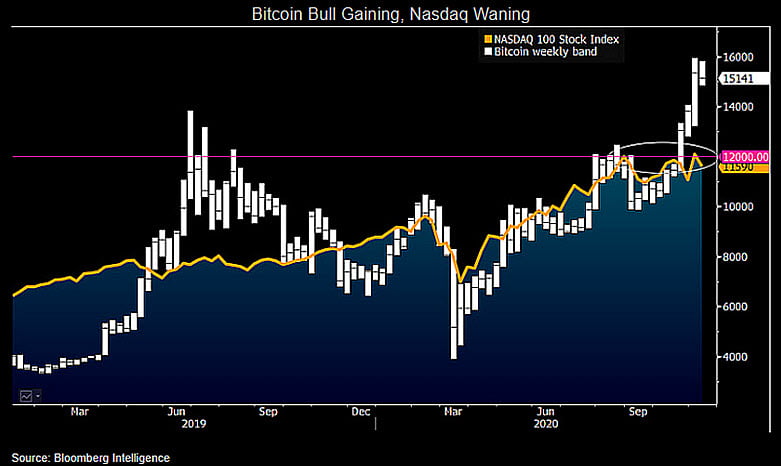

McGlone commented on the performance of ethereum, putting it as the top market leader so far since the bull market began. Ethereum has consistently outperformed BTC in the market in recent years. But even as the coin grows in popularity, BTC continues to take the lead. Bitcoin still boasts of a market cap twice that of ethereum and it does not seem to be stopping yet.

Related Reading | I Stand By My $100,000 Bitcoin Price Target, Anthony Scaramucci

Bitcoin comes with countless merit as a decentralized coin. These add up to the reasons why $100,000 might not be an outrageous prediction for the price. Given the massive run-up this year, there is no telling where the next run-up will end up.

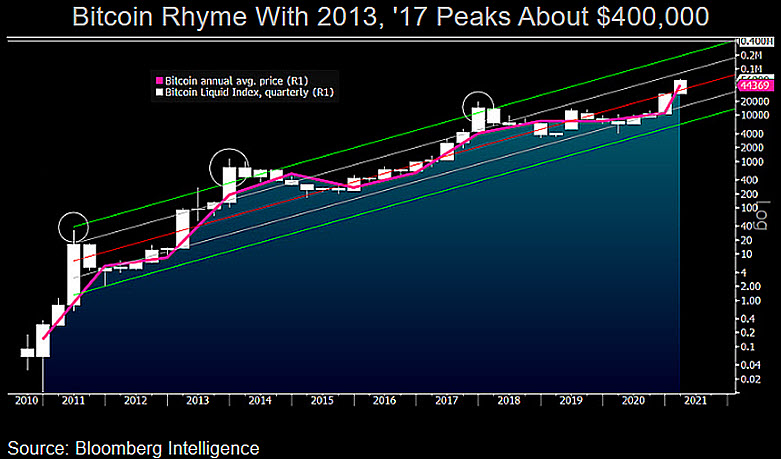

$100,000 Is Tame For BitcoinIn the newsletter, McGlone highlights the potential for bitcoin. Stating that the coin $100,000 mark is still pretty tame for the flagship cryptocurrency. “Based on its history, a bottom line for BTC in 2021 is that the price advance to May 24 is a round error,” McGlone said. “The 2020 halving came amid unprecedented global fiscal and monetary stimulus, along with institutions tilting toward Bitcoin allocations.”

Continuing on, he highlighted the possibilities of BTC becoming a major value reserve for financial markets at large. Bitcoin has no doubt shown tremendous promise in its ability to be a store of value for both individuals and institutions alike.

BTC price declines as bearish sentiment intensify | Source: BTCUSD on TradingView.comTalking on this, the Bloomberg analyst said; “ The chance that the crypto becomes the digital reserve asset and stays the course it’s charted over most of the past decade is increasingly outweighing the loss of a small portion of a portfolio.”

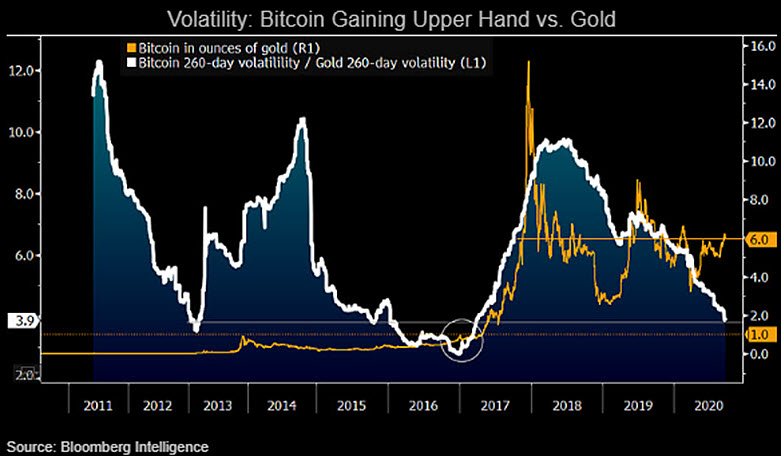

With BTC becoming stronger, greener (courtesy of the China mining crackdowns), and less extended, this proves to be a likely path towards $100,000. The newsletter cited that the asset’s correction in April was due to excessive energy use and this shows the strength of bitcoin, which is the world’s largest decentralized network. Confirming that the actions of China on crypto mining have only shown the benefits of BTC and now, miners have set their sights on using renewable energy for their mining operations.

Strong 2021 FoundationBitcoin has so far shown a strong and solid foundation in 2021. This is part of the reason why the coin price has held up so well despite losing over 50% of its value in a couple of months.

Using bitcoin’s history to date, McGlone said in the newsletter that this history points towards the digital asset moving higher in 2021 quite sharply. And the data on the charts seem to back this up.

Bitcoin’s declining supply is also a huge factor in this increase in price that looms on the charts. Bitcoin’s scarcity model makes sure that with each BTC mined, the coins are more valuable than ever. Capped at 21 million, there will be no more BTC once the last BTC is mined.

Related Reading | Bitcoin Drops 6% In 24 Hours, Why This Might Trigger A Bullish Rally

With institutional players coming into the market and buying up large numbers of coins at a time, the time where demand will be higher than supply is fast approaching. Coins being bought and taken to holding wallets means fewer coins available for buyers and traders.

Halvings happening every four years adds to this already boosted BTC train. Halvings are when the rewards for BTC mining are cut in half. The latest halving which happened in 2020 has left bitcoin mining rewards at 6.25 per block. By the next halving in 2024, the bitcoins reward per block will be 3.125.

A combination of these factors might just be the push that BTC needs to finally break $100,000.

Featured image from Inverse, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|