2018-8-26 21:07 |

Those that are intrigued in the world of cryptocurrency as a prospective investor will never cease to be surprised by the diversity of ways in which they can create a unique portfolio of various crypto assets.

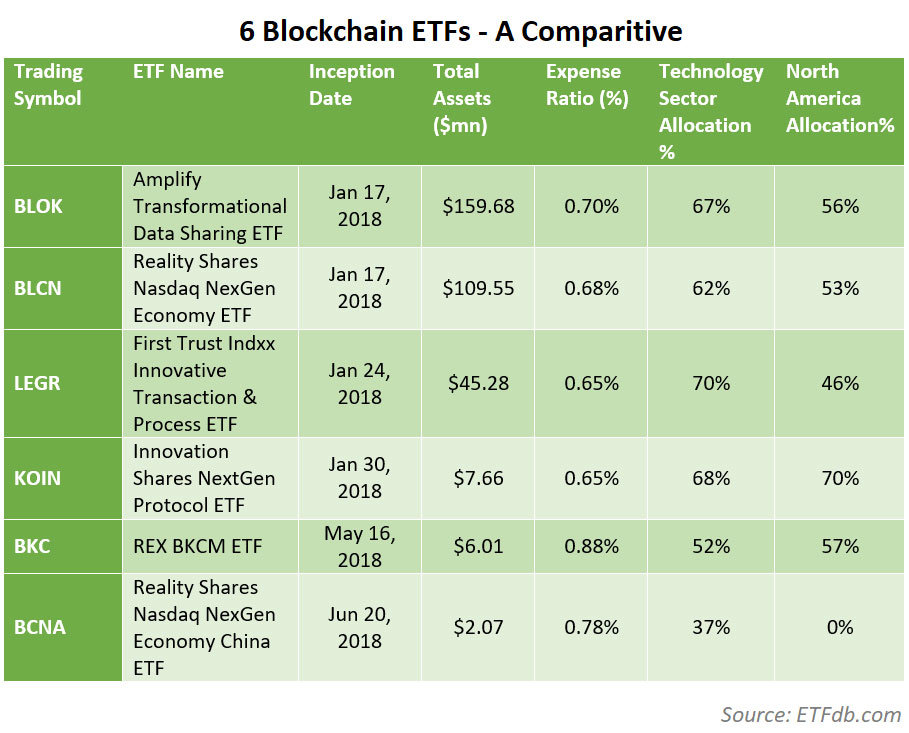

It's become an even more exciting space for investors based in the US, because there are now 6 Exchange Traded Funds (ETFs) which offer very unique exposure to a range of companies and their stocks that have otherwise strong connections to the world of blockchain in some capacity. With all the fuss about Bitcoin ETFs and what their impact would be on the industry (especially given the fact the SEC is re-reviewing its latest denials), Blockchain ETFs are still in the picture and carry significant importance as well.

While these ETFs are incredibly varied for a range of factors, such as inception, returns, fees, and holdings, among the many other aspects, they're all created with a single objective they each seek to fulfill: to provide technology and blockchain enthusiasts and investors with exposure to blockchain stocks.

At the moment, these ETFs are: The Amplify Transformational Data Sharing ETF (BLOK), the Reality Share NASDAQ NexGen Economy ETF (BLCN), the First Trust Indxx Innovative Transaction and Process ETF (LEGR), the Innovation Shares NextGen Protocol ETF (KOIN), the REX BKCM ETF (BKC), and the Reality Shares Nasdaq NexGen Economy China ETF (BCNA).

Upon a closer observation of each of the six ETFs, about 60 to 70% of fund holdings demonstrate that they're dominated by the technology sector, and have roughly a 50% allocation on average in stocks based in North America. We take an even closer look at the unique characteristics of these various Exchange Traded Funds to see how they match up.

BLOK: Amplify Transformational Data Sharing ETF: Inception date: January 17th, 2018 Total Assets: $159.68 Million Total Expense Ratio: 0.7% Technology Sector Allocation: 67% North America Allocation: 56% BLCN: Reality Shares NASDAQ NexGen Economy ETF Inception Date: January 17th, 2018 Total Assets: $109.55 Million Expense Ratio: 0.68% Technology Sector Allocation: 62% North America Allocation: 53% LEGR: First Trust Indxx Innovative Transaction and Process ETF Inception Date: January 24th, 2018 Total Assets: $45.28 Million Expense Ratio: 0.65% Technology Sector Allocation: 70% North America Allocation: 46% KOIN: Innovation Shares NextGen Protocol ETF Inception Date: January 30th, 2018 Total Assets: $7.66 Million Expense Ratio: 0.65% Technology Sector Allocation: 68% North America Allocation: 70% BKC: REX BKCM ETF Inception Date: May 16th, 2018 Total Assets: $6.01 Million Expense Ratio: 0.88% Technology Sector Allocation: 52% North America Allocation: 57% BCNA: Reality Shares NASDAQ NexGen Economy China ETF Inception Date: June 20th, 2018 Total Assets: $2.07 Million Expense Ratio: 0.78% Technology Sector Allocation: 37% North America Allocation: 0% Average Return Over Six Months? 7.6%Along with researching some of the details that separate these various Exchange Traded Funds, we looked into the average returns that each of these ETFs have managed to deliver in the recent past. When it comes to typical returns, the leading ETF in this area would be Innovation Shares NexGen Protocol ETF (KOIN), which provided positive returns of 0.8%, 3.9%, and 7.6% over the past 1 month, 3 months, and six-month spans respectively. For the last six months, KOIN's typical returns have been far ahead of LEGR, which delivered 2.6%.

Overall, KOIN has managed to consecutively outperform its major competitors within the Blockchain ETF space by a significant margin. The out-performance warrants a little more detail on KOIN – see below graph.

The Innovation Shares NextGen Protocol ETF (KOIN)All in all, KOIN has the intention of providing investors with unique access to companies that will, or currently do, benefit from blockchain technology. Some of the major names linked to the KOIN ETF include Taiwan Semiconductor Manufacturing (TSM), Amazon (AMZN), Cisco Systems (CSCO), Microsoft (MSFT), and Oracle (ORCL).

There are a number of other stocks within the KOIN portfolio that belong to any of the four custom stakeholder categories, these include:

Cryptocurrency as payment Mining enablers Solution providers Adopters origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|