2024-9-18 03:28 |

According to Farside, this development comes as spot Bitcoin ETFs collectively drew in $12.8 million on September 16, 2024, signaling a potential shift in investor sentiment.

The crypto market has been closely watching the performance of spot Bitcoin ETFs since their inception in January 2024. IBIT’s recent inflow of $15.8 million marks the end of a 21-day streak without positive flows, which included 11 trading days of zero movements and two days of net outflows on August 29 and September 9, 2024.

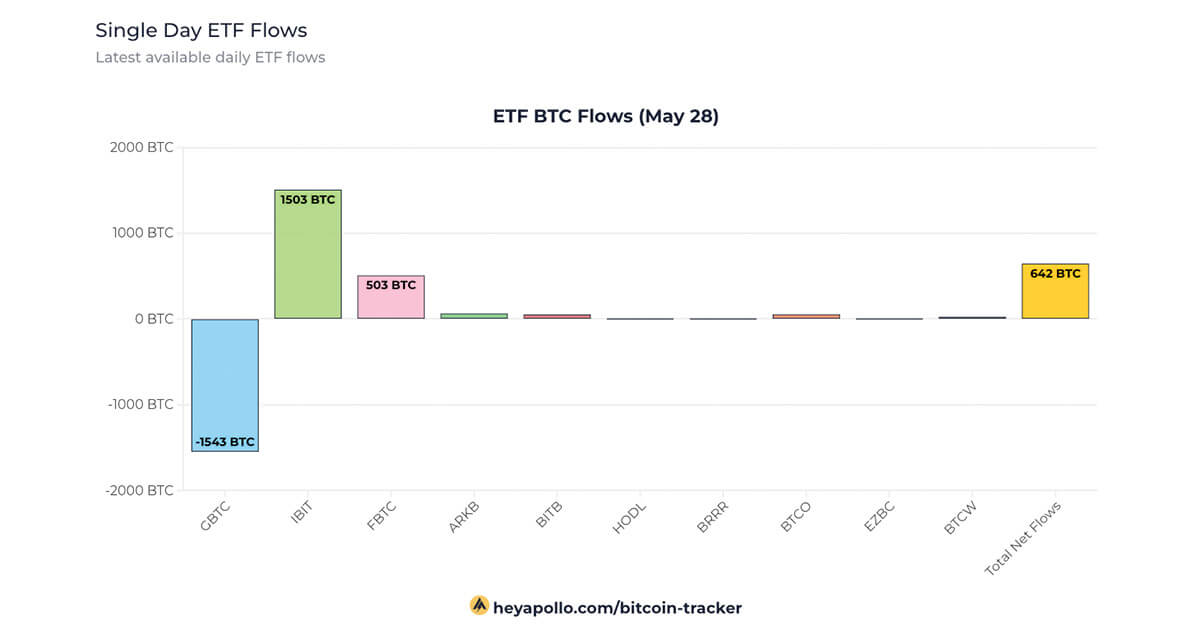

While IBIT’s resurgence is noteworthy, it wasn’t alone in attracting investor interest. According to data from CoinGlass, other major players in the spot Bitcoin ETF arena also saw positive flows on September 16. Fidelity’s FBTC added $5.1 million, Franklin Templeton’s EZBC gained $5 million, and VanEck’s HODL secured $4.9 million in net inflows.

Grayscale’s GBTC Defies The Positive TrendHowever, not all funds experienced the same upward trajectory. Grayscale’s GBTC, known for its higher fees, reverted to net outflows of $20.8 million on September 16, following a brief respite with $6.7 million in net inflows on September 13. This outflow was partially offset by $2.8 million worth of net inflows into Grayscale’s mini-product, BTC.

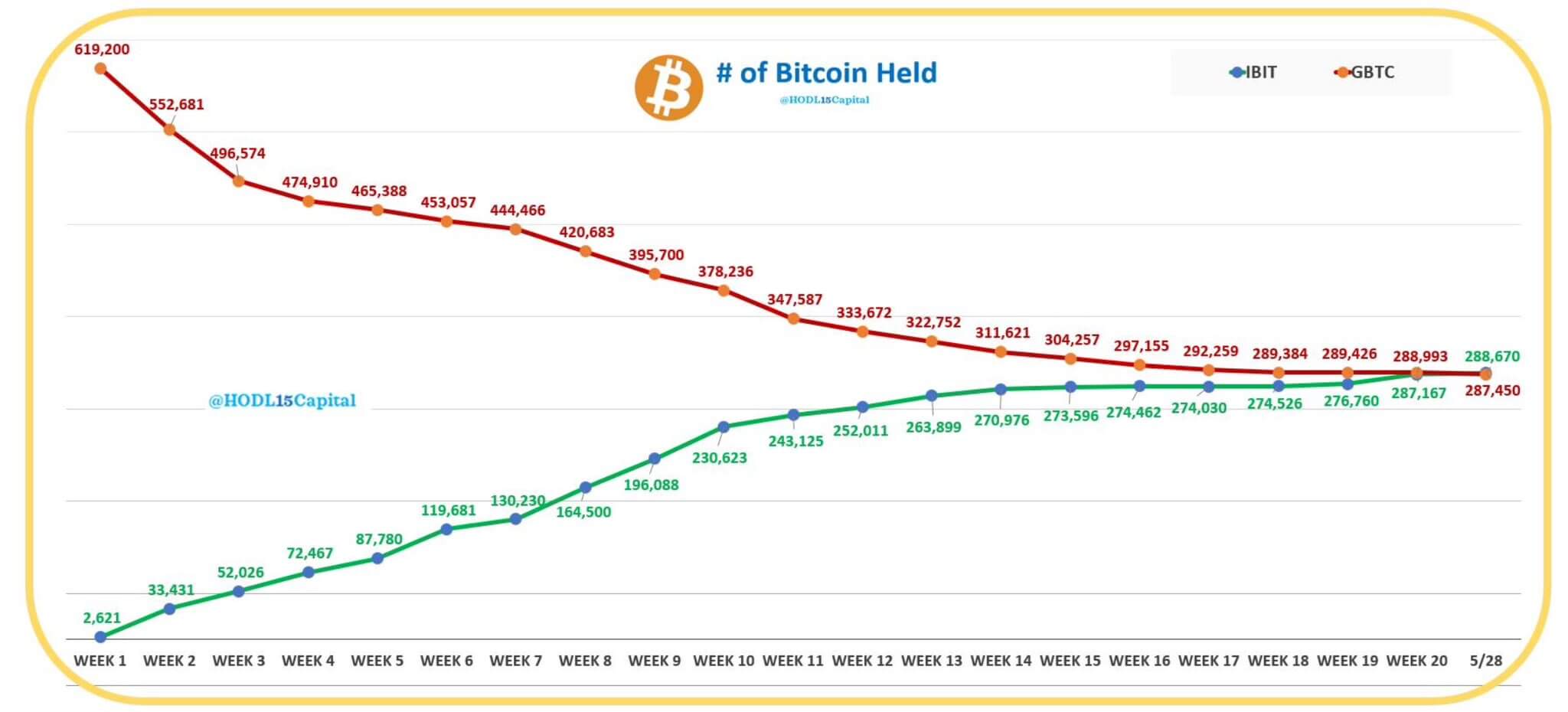

Despite the recent dry spell, BlackRock’s IBIT continues to dominate the spot Bitcoin ETF landscape. Since its launch in January 2024, IBIT has generated an impressive $20.9 billion in net inflows. Fidelity’s FBTC holds the second position with $9.6 billion in net inflows, while Grayscale’s GBTC has experienced over $20 billion in net outflows during the same period.

The overall picture for spot Bitcoin ETFs remains positive, with a combined total net inflow of $17.3 billion since their introduction, according to data by The Block. However, it’s worth noting that the September 16 inflow of $12.8 million pales in comparison to the $263.2 million generated just three days earlier on September 13. Trading volume also experienced a significant drop, falling from $1.8 billion to $1.1 billion over the same period.

Ethereum ETFs Face HeadwindsWhile Bitcoin ETFs show signs of recovery, their Ethereum counterparts are facing challenges. Spot Ethereum ETFs recorded total net outflows of $9.4 million on September 16, reversing the modest gains of $1.5 million in net inflows seen on September 13.

BlackRock’s Ethereum product, ETHA, managed to buck the trend with a $4.2 million net inflow. Grayscale’s mini Ethereum ETF was the only other fund to attract positive flows, bringing in $2.3 million. However, these gains were overshadowed by significant outflows from other funds, including $13.8 million from Grayscale’s main ETHE converted fund and $2.1 million from Bitwise’s ETHW.

The contrast between Bitcoin and Ethereum ETFs is stark. Since their July 2024 launch, spot Ethereum ETFs have witnessed $590.8 million in total net outflows. This figure is heavily influenced by the $2.7 billion in net outflows from Grayscale’s converted ETHE product. Excluding ETHE, all other spot Ethereum ETFs have generated a combined $2.1 billion in net inflows.

Trading activity for spot Ethereum ETFs also declined on September 16, with volume dropping to $128 million from $149 million on September 13, according to The Block.

Bitcoin Selloff Sparks ETF Conspiracy TheoriesRecent weeks have seen the emergence of conspiracy theories regarding the backing of spot Bitcoin ETFs, particularly focusing on BlackRock’s offerings and their primary custodian, Coinbase. Bloomberg ETF analyst Eric Balchunas weighed in on the matter, suggesting that some Bitcoin enthusiasts may be seeking a “scapegoat” to explain recent selling pressure.

Balchunas stated on September 16, “[BlackRock] would flip out if [Coinbase] was screwing around with their bitcoin, plus it would violate the ’33 Act. People who invest in bitcoin are generally skeptical of government and institutions (which I get), [but] the same thing happened with gold bugs and GLD, which they called ‘paper gold,’ and said the vault was empty. It wasn’t true. This is like deja vu all over again.”

He further elaborated, “I get why these theories exist and people want to scapegoat the ETFs because it is too unthinkable that the native HODLers could be the sellers. But they are. The call is coming from inside the house. All the ETFs and BlackRock have done is save bitcoin’s price from the abyss repeatedly.”

origin »

Bitcoin price in Telegram @btc_price_every_hour

TrustPlus (TRUST) на Currencies.ru

|

|