2023-7-16 14:01 |

The United States Securities and Exchange Commission (SEC) has officially acknowledged receiving spot Bitcoin exchange-traded fund (ETF) applications from traditional financial institutions, including BlackRock and Fidelity.

While the acknowledgment itself does not indicate the regulator’s approval or denial of the pending applications, it represents a significant milestone within the application process.

BlackRock’s CEO Discusses Firm’s Approach to CryptoLarry Fink, BlackRock’s CEO, said the asset manager must democratize access to investments while comparing Bitcoin ETFs to the advent of gold ETFs. According to Fink, BlackRock’s foray into crypto aligns with its goal of developing user-friendly and cost-effective investment products.

Fink noted that investments in cryptocurrencies could diversify an investor’s portfolio, adding that the asset class has seen increased demand from its global clients.

“[Cryptocurrency] has a differentiating value versus other asset classes, but more importantly, because it is so international it is going to transcend any one currency.”

Fink used to be a prominent critic of the cryptocurrency industry. However, his views of the space appear to have evolved.

BlackRock spearheaded a flurry of traditional institutional firms that submitted Bitcoin ETF applications to the SEC in June.

Will the SEC Finally Approve a Spot Bitcoin ETF?Over the past years, the SEC has hesitated to approve a spot Bitcoin ETF. The regulator attributes its decision to their inability to prevent fraudulent and manipulative practices.

However, market observers have suggested that BlackRock’s exceptional track record with ETF applications makes it the frontrunner to overcome the historical hurdles presented by the SEC.

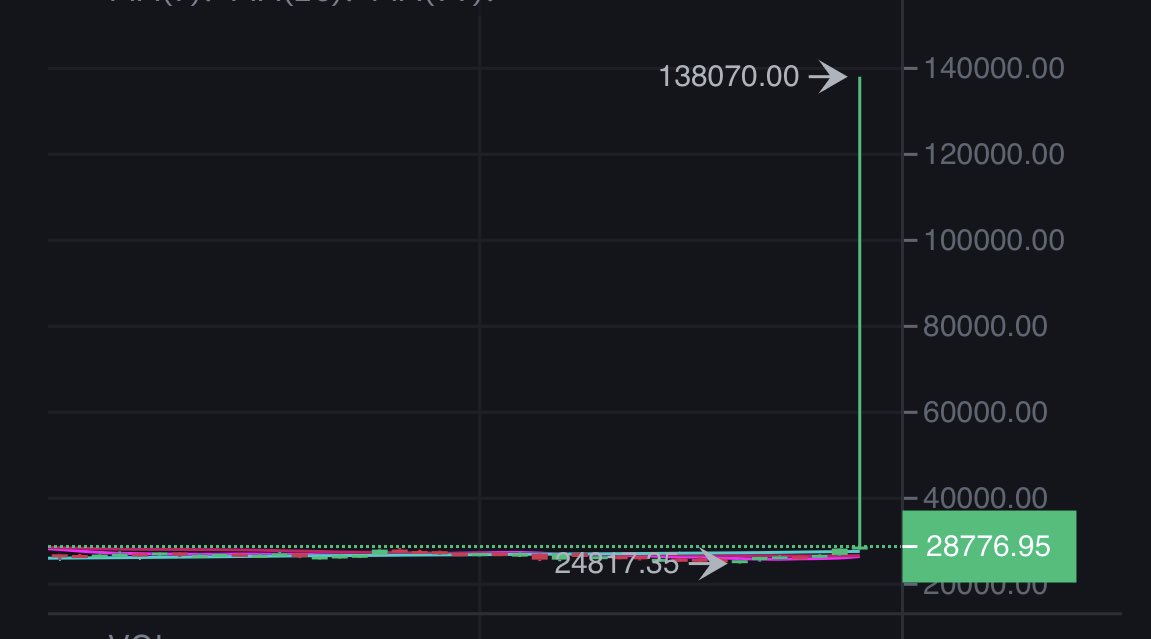

SEC Bitcoin ETF Rejections. Source: CCDataBut the regulator soon threw a spanner into the hopes as it deemed the recent applications inadequate. The SEC said the applications failed to name the cryptocurrency exchange the firms had signed a “surveillance-sharing agreement (SSA)” with.

The asset managers have since addressed the SEC’s concern by refiling their applications, naming Coinbase as their SSA partner.

Meanwhile, recent events in the space have further bolstered hopes that the regulator could finally approve a BTC ETF. Cryptocurrency asset manager Grayscale stated that investors are eager for BTC exposure with the protections of the ETF wrapper.

The post BlackRock’s Bitcoin ETF: SEC Begins Official Review of Application appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|