2023-7-25 12:33 |

Coinspeaker

BlackRock Expands Presence in Asia amid Its Bitcoin ETF Approval

Investment management corporation BlackRock Inc (NYSE: BLK) has made two important appointments within its expansion in Asia. In particular, the company has hired Mandy Lui as head of Greater China Wealth and Dennis Quah as head of Singapore Wealth.

Mandy Lui will be in charge of relationships with distributors throughout Hong Kong, Taiwan, and offshore China. Starting from the middle of August, former Baring Asset Management’s head of wealth and retail distribution will build strategic relationships with key distributors and ensure that BlackRock’s clients in the regions mentioned have access to the full range of investment capabilities.

As for Dennis Quah, he will be responsible for building relationships with consumer banks, private banks, and insurers, as well as helping in building client portfolios together with relevant specialists throughout the firm. Notably, Dennis Quah has twenty years of experience in asset management distribution. Previously, he worked for Columbia Threadneedle, Amundi, OCBC Bank, and Schroders.

James Raby, BlackRock’s Apac head of wealth, commented:

“We are delighted to welcome leaders like Mandy and Dennis to the firm. Their deep local market understanding and expertise in helping clients build whole portfolios are highly valuable as we serve the new and evolving needs of our investors in this current market environment.”

Speaking further of the two appointments, it is also worth mentioning another shift in BlackRock’s Asia-Pacific team. Earlier this year, Nicholas Chiu left the company. He was the co-manager of the BlackRock GF China Fund, the BlackRock GF Asian Dragon Fund, the BlackRock GF China Flexible Equity Fund, and the BlackRock Asia Fund.

With headquarters in New York, BlackRock has as many as 78 offices in 36 countries. The firm had approximately $8.59 trillion in assets in management as of December 31, 2022. In the first quarter of 2023, this number soared to $9.09 trillion. Within the next five years, BlackRock’s assets under management are set to exceed $15 trillion. With expansion into Asian markets, this is a milestone possible to achieve.

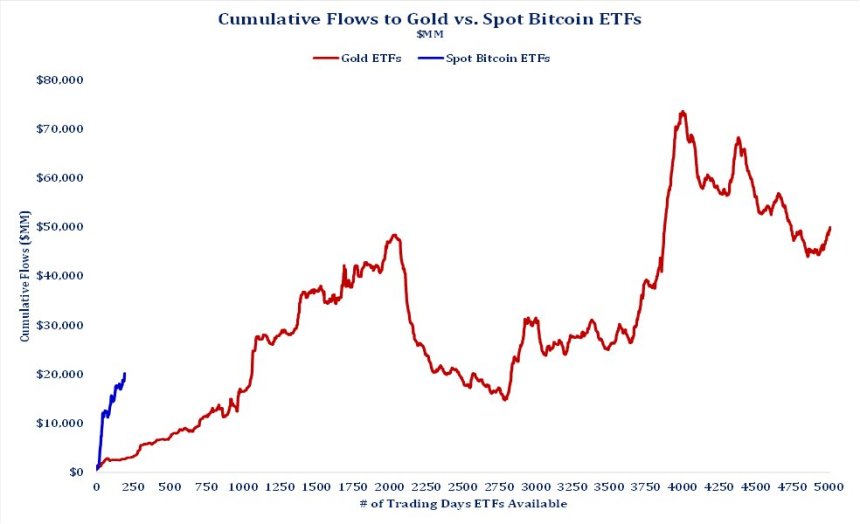

BlackRock Waiting for Bitcoin ETF ApprovalThe changes in BlackRock’s Asia-Pacific team come amid the SEC‘s decision on the future of the company’s spot Bitcoin (BTC) ETF. Over the past decade, the SEC has rejected as many as 30 spot Bitcoin ETF applications from big-name companies, but many anticipate the approval of BlackRock’s application. If approved, it will be the first Bitcoin ETF in the United States. And if it happens, as much as $30 trillion worth of capital could be made available to the Bitcoin market.

Joshua Chu, group chief risk officer at blockchain technology group XBE, Coinllectibles and Marvion, said:

“The fact that BlackRock, a well-respected and established asset management company, has filed for a Bitcoin ETF could be seen as a positive development in the quest for regulatory approval. It also shows resilience of the public’s interest in crypto.”

If approved, the new iShares Bitcoin Trust will be listed on the Nasdaq exchange. The pricing will be based on the CF CME Bitcoin Reference Rate. All shares in the ETF will be fully backed by BTC, and no new shares can be issued without delivery of the corresponding value of tokens.

next

BlackRock Expands Presence in Asia amid Its Bitcoin ETF Approval

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|