2024-7-30 12:07 |

BlackRock’s chief investment officer expects Bitcoin and Ethereum exchange-traded funds (ETFs) to be included in model portfolios by the end of 2024.

Speaking in an interview with Bloomberg, BlackRock exec Samara Cohen noted that major wirehouses are currently assessing the risks and utility of Bitcoin and Ethereum in their portfolios.

BlackRock CIO of ETF and Index Investments Samara Cohen discusses the iShares Ethereum Trust ETF (ETHA) and expects we'll see allocation of crypto ETFs in model portfolios by the end of this year and into 2025 https://t.co/5UOLwIRWHL pic.twitter.com/rYqpym7Wqg

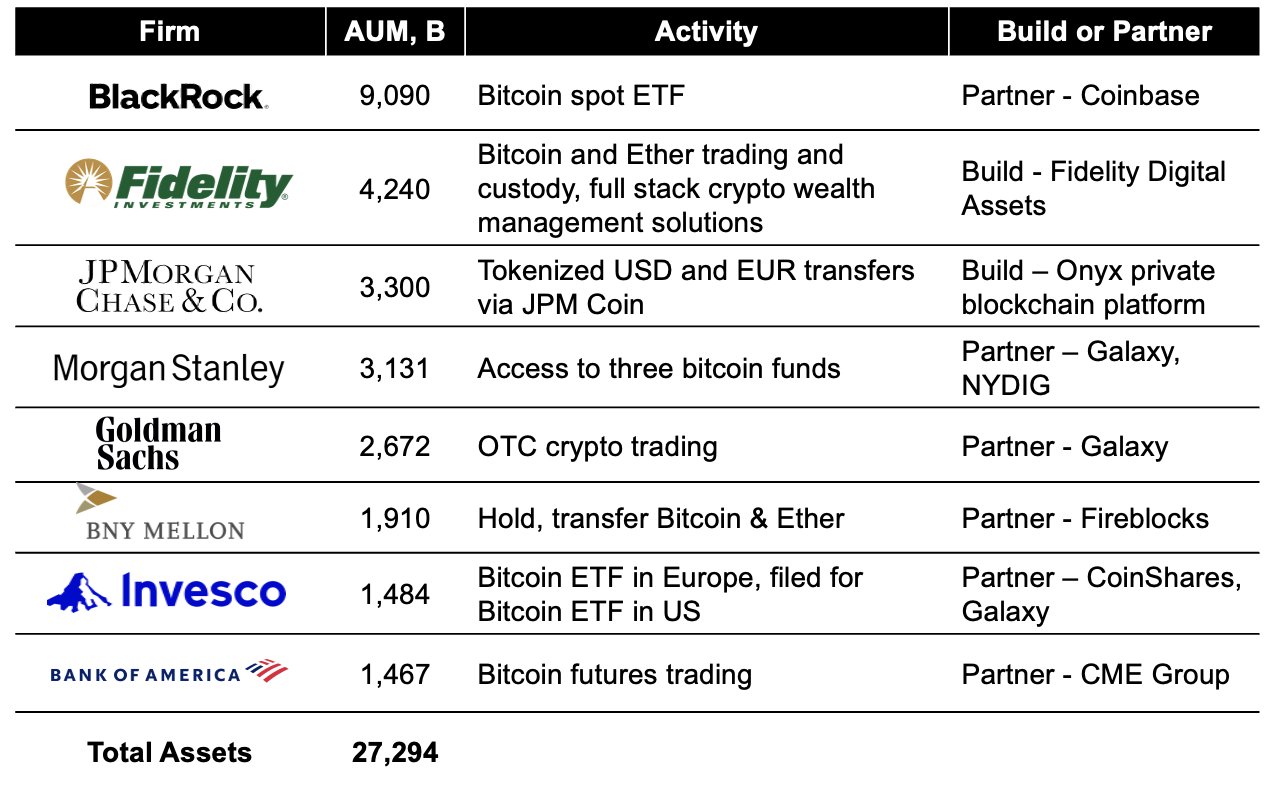

— Bloomberg Crypto (@crypto) July 29, 2024 Model portfolio market to surgeAccording to Cohen, firms like Morgan Stanley, Wells Fargo, and UBS might be looking to integrate cryptocurrencies in their ‘model portfolios’ by the end of 2024.

Model portfolios are investment portfolios that serve as templates or guidelines for managing clients’ investments. Based on varying risk levels, these are designed to target specific goals, such as growth, income, or capital preservation.

Salim Ramji, global head of iShares at BlackRock, claims the model portfolio market will reach $10 trillion within the next five years.

In an earlier report, Ramji said this market is “going to be massive”, adding that it is becoming the preferred method for fiduciary advisers to conduct their business. As such, BlackRock has been aligning its strategies to meet this growing demand.

Model portfolios benefit from including a variety of asset classes to enhance diversification and potentially improve the risk-return profile. Cohen added that while Bitcoin and Ether are different asset classes with different use cases, they are useful as “portfolio diversifiers.”

No Solana ETFCommenting on BlackRock’s intention to launch a Solana ETF, Cohen said the firm isn’t pursuing this offering at the moment. She added that Bitcoin and Ethereum meet the firm’s criteria for “instability and client interest,” and the firm is not expecting any other ETF products to be introduced for now.

BlackRock’s stance contrasts with that of other asset managers like VanEck, which has pushed for a Solana ETF. However, VanEck CEO Jan van Eck says it’s not likely to be approved anytime soon.

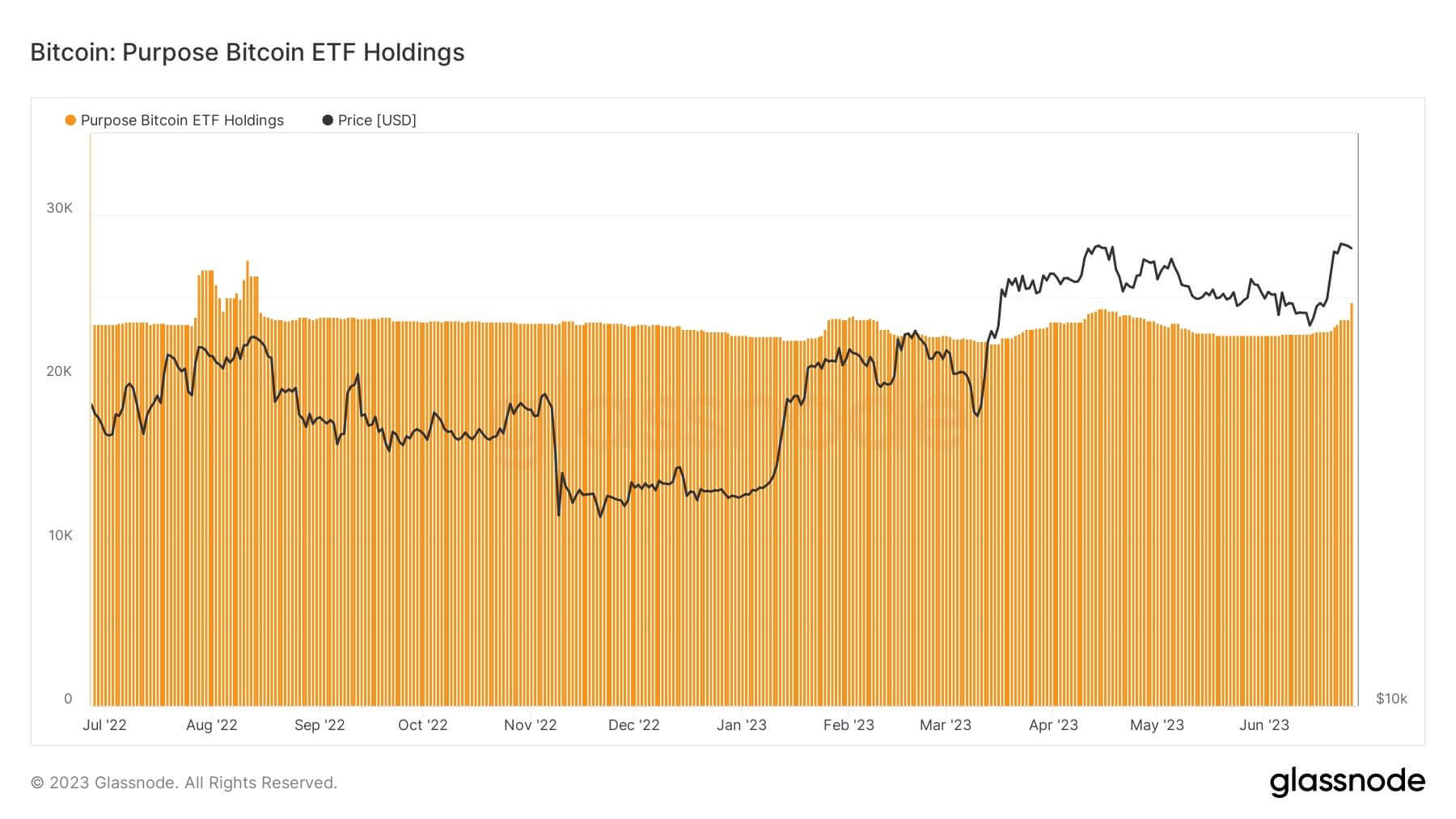

Cohen also discussed the $1.7 billion in net outflows for Ether ETFs since their launch. However, the BlackRock CIO isn’t concerned due to the investment vehicles’ strong launch.

According to her, a lot of the outflows came from higher-priced funds and proxy vehicles because investors “want to get their ETH exposure, especially if they’re going to use it in the context of an overall portfolio in an ecosystem they have confidence in.”

At the time of publication, spot Ether ETFs recorded four consecutive days of outflows, with only one day of inflow on July 23.

In contrast, Bitcoin ETFs have recorded a fourth positive day of net flows with only BlackRock’s IBIT seeing inflows on July 29.

The post BlackRock CIO expects crypto ETFs to be included in Model Portfolios soon appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|