2024-4-14 01:25 |

Spot Bitcoin exchange-traded funds (ETFs) surpassed several predictions about their assets as their collective assets under management (AUM) hit $59.1 billion within the first three months of the year, Bitwise revealed in a research report on April 11.

JP Morgan and Bitcoin investment management firm NYDIG anticipated that spot Bitcoin ETFs could achieve an AUM of $36 billion and $30 billion by the year’s end. Meanwhile, Matrixport predicted the ETF would garner an AUM between $24 billion and $50 billion by Dec. 31, 2024.

The actual AUM is nearly twice as high as each company’s earlier prediction, and spot Bitcoin ETFs are on the way to meet the more optimistic predictions made by CryptoQuant, Standard Chartered, and Bloomberg Intelligence.

Bloomberg and Standard Chartered project an end-of-year AUM of roughly $100 billion for the ETFs, while CryptoQuant believes they will reach $150 billion.

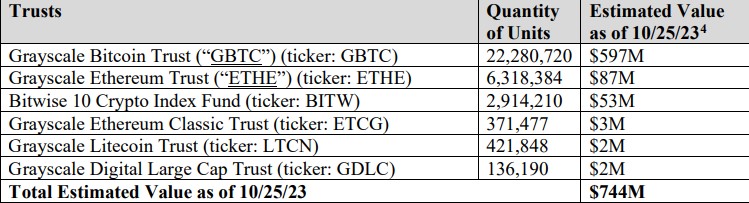

The data includes Grayscale’s GBTC, which accounts for $22.26 billion of the collective AUM and has mostly seen outflows since its launch.

Other key ETF dataBitwise’s report also revealed that spot Bitcoin ETF demand far exceeded new BTC production during the first quarter of 2024. Miners produced 74,756 BTC during the first quarter, while the ETFs collectively took in 212,852 BTC — 2.8x higher than the amount produced.

The report said that the reduction in mining output caused by Bitcoin’s upcoming halving — expected roughly around April 20 — could affect the supply-demand ratio.

Bitcoin ETFs also demonstrated strong performance against the two largest US gold ETFs. During the first quarter, spot Bitcoin ETFs saw $12 billion in inflows against $3 billion in gold ETF outflows.

Despite their broader success, Bitcoin ETFs represent only a minority of Bitcoin ownership. Bitcoin ETFs hold 800,000 BTC, amounting to 3.9% of all Bitcoin ownership. Individuals (57%), inactive accounts (17.6%), and several other small categories hold the remainder of Bitcoin.

Bitcoin findingsThe Bitwise report also noted that Bitcoin had demonstrated high performance year-to-date, with its value rising 66.99% year-to-date — outperforming growth in almost every market, including the US equities (10.56%), gold (8.09%), DM equities (5.81%), and other markets.

Bitwise CIO Matt Hougan also noted “low correlations between Bitcoin and the S&P 500,” represented in the report by a 0.11 correlation between Bitcoin and the US equities market.

The correlation is critical, as the degree to which Bitcoin correlates with traditional markets determines whether Bitcoin is a risk-on asset or a hedge against conventional markets.

Hougan said Bitwise’s report should provoke a “staggeringly bullish” attitude toward the crypto market. He noted crypto has been in the bull market phase for the past 1.25 years and that bull markets typically last three years, meaning strong performance may persist.

The post Bitwise reveals spot Bitcoin ETFs outperformed pre-release predictions by a significant margin appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|