2020-3-13 16:39 |

Bitcoin price crashed to $3,850 on spot exchanges yesterday but on crypto derivatives exchange BitMEX, it went even lower to $3,600.

As the price went down to an early February 2019 level, the platform halted trading on account of “system instability.”

Traders reported experiencing a system crash around following a massive market-wide sell-off that had the leading digital currency losing 40% of its value in a single 1-day candle.

A few hours later, BitMEX released a statement on Twitter describing the outage as a “hardware issue.”

“Between 02:16 and 02:40 UTC 3 March 2020 we became aware of a hardware issue with our cloud service provider causing BitMEX requests to be delayed. Normal service resumed at 03:00 UTC.”

The halt of trading services came on the Seychelles-based derivatives exchange after the exchange saw one of the largest bloodbaths ever resulting in a sudden drop in its funding as well.

The price drop triggered $4 million worth of buy liquidations and $698 million worth of sell liquidations. Both the long and short positions were liquidated however, 90% were of long positions indicating the leverage was on the bullish side.

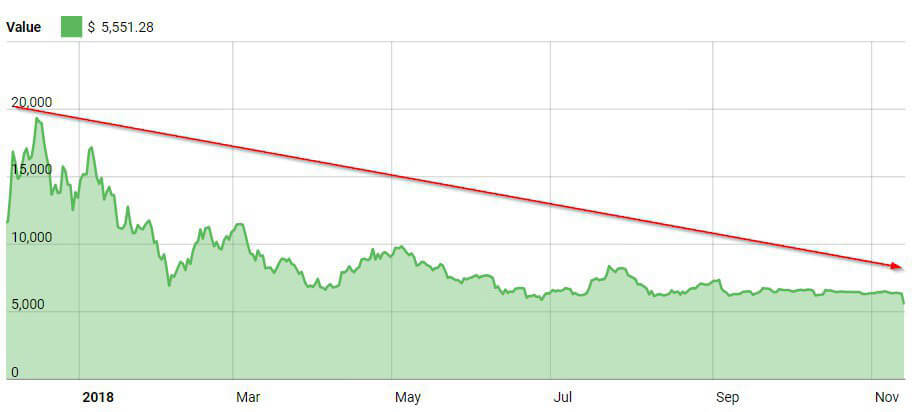

Only half day and already nearly at the record daily liquidation level of the great capitulation in November 2018 pic.twitter.com/9ebo6S9uKu

— skew (@skewdotcom) March 12, 2020

The aggregate volume for bitcoin futures broke records while BitMEX insurance fund lost 1627 BTC that could be further extended given Friday’s carnage. The funding rate, that is designed to encourage the future price to stay close to the spot price, dropped to -0.3750.

An Insane/Conspiracy TheoryBitMEX now reports the database to be recovered, however, it continues to receive criticism for being the one behind bitcoin’s massive drop. Sam Bankman-Fried, CEO of research firm Alameda and competitor derivatives exchange FTX, took to Twitter to share a theory that accuses BitMEX of doing it on purpose.

1) Insane theory of the day: there was no BitMEX hardware issue.

— SBF (@SBF_Alameda) March 13, 2020

Bankman-Fried argues that the minute BitMEX went down crypto recovered as noted by trader Joe Moe as well, “Literally -to the minute- of BitMEXdotcom going down, BTC immediately began its recovery. What a coincidence.”

The second evidence to this insane theory he says is that their liquidation engine was lethargic because BitMEX liquidates the orderbook down to 0 but it didn’t.

And Bitcoin didn’t go to zero because BitMEX stopped grinding down their liquidations slowly in the hopes that it would just go away.

“That's NOT how a liquidation engine works. A liquidation engine's primary job is to save the insurance fund and other customers, even if that has significant market impact,” said FTX CEO.

When the things were “teetering on the edge,” BitMEX went down for maintenance and Bitcoin rallied “without the gigantic sell wall of the BitMEX liq.” Bankman Fried said, “Deribit was playing a similar role, and went down at the same time.”

BitMEX refuted any such activity with a harsh statement, “Insane” is right. Sam, you know better than to deal in this type of conspiracy theory, especially since you operate a platform in space and under,” to which SBF said he believes BitMEX and replied with “Sorry for suggesting it!”

summary of exchange issues i saw in the last 24hrs:

– binance futs disconnected spot market pricing, orders entry seemed delayed.

– bitmex while holding up trading wise and matching wise, it is not handling these outsized liquidations well.

– deribit shut down multiple times

/1

— I am Nomad (@IamNomad) March 13, 2020

Bitcoin (BTC) Live Price 1 BTC/USD =$5,798.1496 change ~ -6.25%Coin Market Cap

$105.92 Billion24 Hour Volume

$24.13 Billion24 Hour VWAP

$5.43 K24 Hour Change

$-362.2676 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Safe Exchange Coin (SAFEX) на Currencies.ru

|

|