2018-11-12 22:51 |

Divorces and breakups are always hard, they are hard for the parties directly involved and can be equally so for those not directly involved. Finance and business is no exception to this rule. As the hard fork date, November 15 approaches for Bitcoin Cash (BCH) many cryptocurrency enthusiasts waiting with bated breath.

The anxious anticipation is built up from the suspense of how the crypto exchanges will support the event and which of the newborns will garner more widespread acclaim. We have recently had a slew of exchanges, including, Binance, Coinbase, Independent reserve, and Ledger announce their plan of action for this eventuality. Now, BitMEX has joined in as the latest platform to delineate its intent and notified its plan for the upcoming hard-fork on the 15th of this month.

Following the precedent set by other exchanges, BitMEX has announced that it shall settle contracts using Bitcoin Cash ABC price. This was announced in a blog post that was subsequently emailed to all its users. The main excerpt from the email notification read the following:

“Bitcoin Cash is expected to conduct a hardfork upgrade on 15 November 2018. There are two competing incompatible hardfork upgrade proposals. Bitcoin ABC and Bitcoin SV. Therefore, there could be a chainsplit; users holding BCH prior to the hardfork could end up with coins on both sides of the split. On settlement, the BCHZ18 contract will settle at a price on the Bitcoin ABC side of any split and will NOT include the value of Bitcoin SV. This is consistent with the approach BitMEX took when Bitcoin Cash initially split off from Bitcoin in August 2017.”

Market Reactions Ahead of the Hard ForkIt is not lost on anyone that, Bitcoin Cash is now approaching its second hard fork in about 6 months. The previous fork was fairly straightforward, adding opcodes and a block size increase. This time around, though, the community has been visibly split. The Bitcoin ABC client development team had announced their changes, which many did not agree with and consequently, nChain (Craig Wright) announced their own new client called Bitcoin SV.

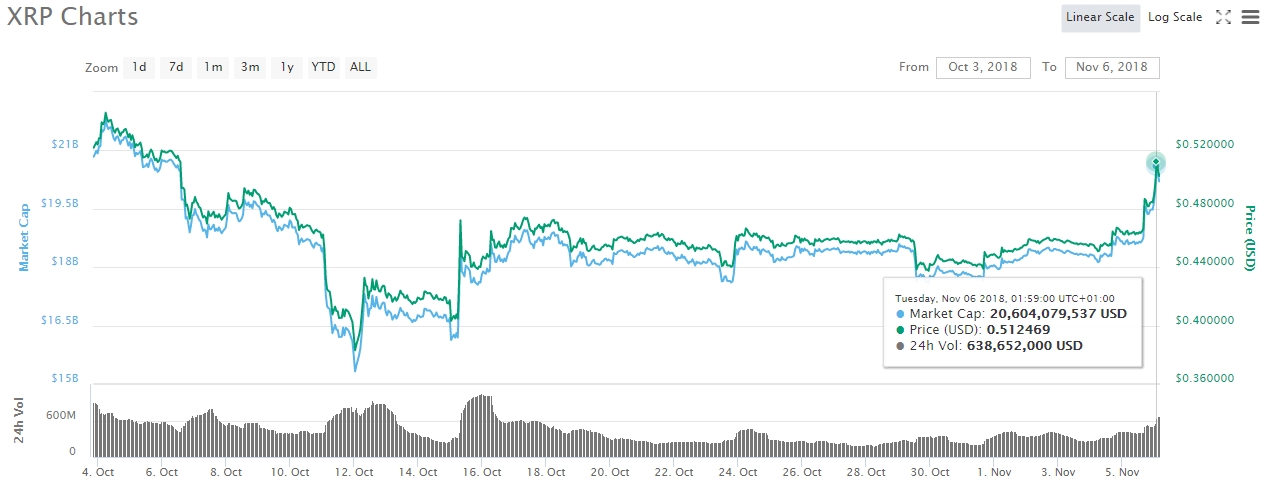

Such infighting leads to instability and is roundly hated by markets. With the hard-fork event less than a week away, it shows. BCH was trading at $530 on the 9th before rallying back today morning to a smidge over $551. This is far from the promising peaks of $644 that the asset was trading at, a few days ago. In fact, many traders were hoping for a further spike in the value in anticipation of the hard-fork. It now seems the converse, where just a stable and clean fork is being hoped for.

All this has not left Bitcoin (BTC) untouched, either. As is the case with most crypto swings, the price trends have affected the prices from the recovering $6503 to a more somber $6347 today, during the same time frame. With this decline in value, the entire market has dipped a slight bit. It is hoped that post 15th November, there will be a quick recovery.

What is more important is the lessons to draw from these market observations and ensure that the individuals behind such decisions understand the strain such ripples cause on the fabric of an infant industry.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cashcoin (CASH) на Currencies.ru

|

|