2019-12-12 21:17 |

BitMEX, one of the largest crypto derivatives exchanges in the world, announced that it has added support for Bitcoin Bech32 addresses. According to the company’s announcement, users will now be able to withdraw to their SegWit addresses with lower fees and contribute to the reduction of block weight usage on the platform.

BitMEX enables withdrawals to all three types of Bitcoin addressesCrypto derivatives exchange BitMEX has expanded its service and currently offers its users the ability to withdraw funds to all three types of Bitcoin addresses. According to the company’s official announcement, all BitMEX users will now be able to withdraw BTC from their accounts to Bech32 addresses.

The Bech32 address format, also known as SegWit, will allow users to take advantage of the perks offered by the native address format, including higher efficiency, lower fees, and segregated witness scalability:

“The key advantage of Bech32 addresses is that transaction fees can be saved when spending bitcoin, which was already sent to a Bech32 address.”

However, the company noted that this upgrade will not directly reduce fees when withdrawing funds from BitMEX, but rather in the following transaction made by the user. In a blog post, the company explained that the absence of overhead when sending a transaction will reduce the fees in every transaction the user makes.

What is SegWit and will it benefit users?For users to understand the scope of BitMEX’s latest update, the company explained the history behind Bitcoin addresses. The Bitcoin network currently supports three different types of addresses—P2PKH, P2SH, and Bech 32. The first one, pay to public key hash, is the original address format that starts with the number 1.

Bitcoin’s second address format, the pay to script hash, is the most widely used one on BitMEX. The format, which begins with the number 3, allows users to send BTC to script-secured addresses such as a multi-signature wallet. The third and newest Bitcoin address format, Bech32, is also referred to as the native SegWit format and takes full advantage over the improvements brought on by the soft-fork.

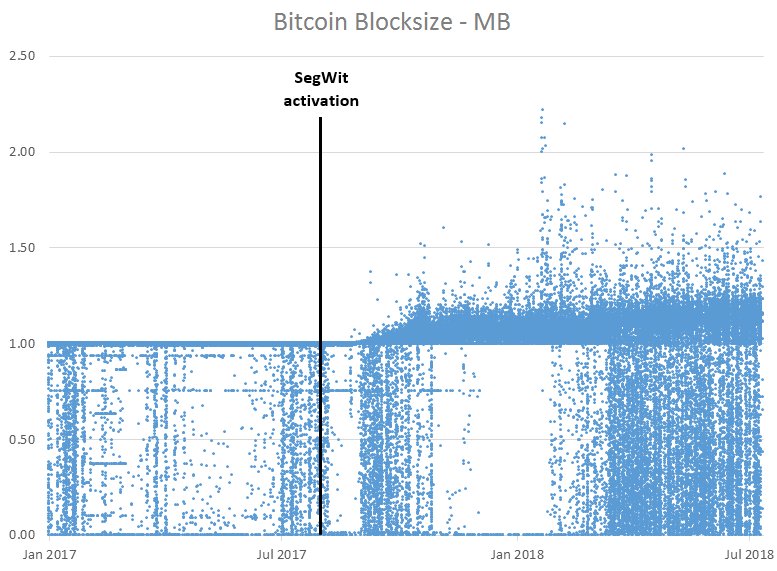

A solution to Bitcoin’s scalability problem implemented in 2017, SegWit splits a transaction into two segments—appending signature, or “witness” data from the original transaction. Removing the signature data allows the protocol to free up around 65 percent of the space in a given transaction, which allows more of them to fit into a single Bitcoin block.

With more transactions flowing through the network, the fees decrease over time and create a faster and more efficient system. According to data from TransactionFee.Info, SegWit transactions represent 56 percent of all the activity on the Bitcoin network.

However, despite the major impact that its implementation has had on transaction fees, BitMEX was one of the last major crypto exchanges that have integrated it. Back in 2018, the release of the Bitcoin 0.16.0 software-led many platforms to adopt the format, including Coinbase, Bitfinex, Binance, and Kraken.

The post BitMEX enables lower withdrawal fees with native SegWit support appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Lendroid Support Token (LST) на Currencies.ru

|

|