2019-5-12 21:30 |

The controversy-riddled cryptocurrency exchange Bitfinex is veering towards ceding its effect on the price of Bitcoin [BTC] relative to other top exchanges. At press time, the difference between the price of the top cryptocurrency on Bitfinex and other exchanges was less than 2 percent.

Bitcoin price on Bitfinex dropped to 1.2 percent in comparison to other exchanges, and the premium of the iFinex-operated top stablecoin Tether [USDT] is 0.4 percent, as attested by Larry Cermak, an analyst at TheBlock. Cermak added that this is an indication of “less risk” percolating in Bitfinex. He tweeted:

“Bitfinex premium decreased drastically in the last 24 hours signaling that traders think there is way less risk now.

Tether premium: 0.4%

Bitfinex premium: 1.2%”

Source: Trading View

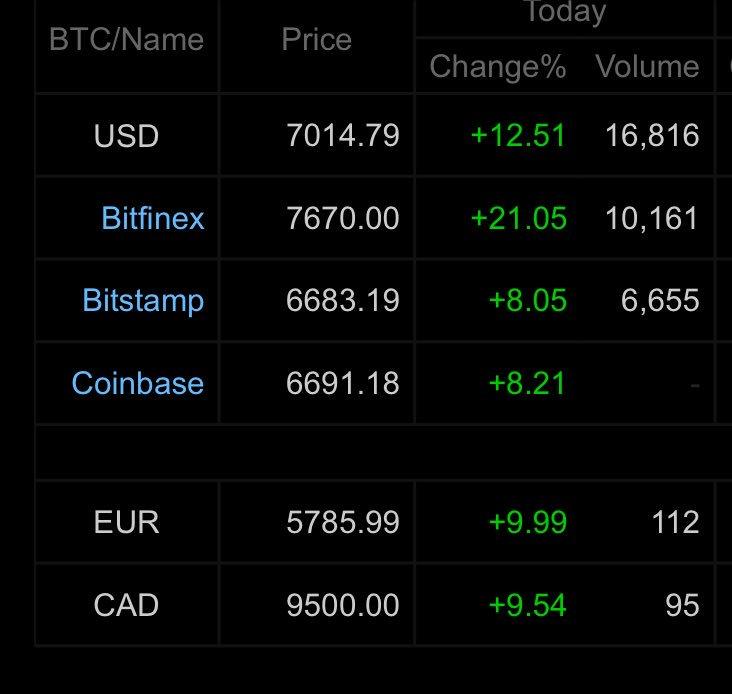

As can be seen from the BTC price on Coinbase, Bitstamp, Bittrex, Gemini as opposed to Bitfinex, the price listed on the first four exchanges is around $6,840, with a deviation as low as $3, while Bitcoin is traded on Bitfinex at $6,809, a reverse movement, but still closing the gap between its contemporaries.

Following the release of a report by the New York Attorney General citing the cover-up of undisclosed losses amounting to $850 million, the price of Bitcoin was inflated on the exchange, resulting in several arbitrage opportunities for traders. The report added that Bitfinex used its Tether [USDT] reserves to hide the losses, leading to the stablecoin’s premium also rising.

Days after the NYAG report surfaced, the disparity in BTC price on Bitfinex compared to other exchanges was as high as $350. On April 30, the BTC price on Bitfinex was just under $5,500 while exchanges like Bitstamp, Bittrex, Coinbase, and Gemini recorded the price at under $5,150, exhibited a price deviation of less than $2 between the exchange.

Furthermore, on May 3, Bitcoin breached $6,000 on Bitfinex, whereas on other exchanges this significant milestone was passed almost a week later. It should be noted that on May 3, Bitcoin rallied from $5,500 to $5,800, failing to breach $6,000 on other exchanges, but pointing to a decreasing spread between other exchanges and Bitfinex.

Since the debacle surfaced, the exchange hit back at the NYAG questioning the body’s jurisdiction, legal standards and authority over the matter, but, more importantly, to remedy to the fiasco, Bitfinex launched their own native tokens, LEO. The first positive sign for the exchange in weeks was that the tokens were “oversubscribed”, according to Fundstrat’s Tom Lee, indicating a decline in the spread and a return of investor confidence.

In light of this Bitfinex return, Mati Greenspan, a senior market analyst at eToro, stated on May 9:

“Bitfinex premium is finally eroding. Now just $75 higher than the rest of the market.”

The post Bitfinex: Bitcoin [BTC] premium on exchange diminishing; possible sign of risk settlement? appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

BitFinex Tokens (BFX) на Currencies.ru

|

|