2024-10-15 19:42 |

The Bitcoin market is buzzing with optimism as the cryptocurrency hits a high of $66,265, marking a notable comeback.

The rally is being fueled by whale buying pressure, historical patterns suggesting a strong October performance, and growing speculation around the upcoming US presidential election.

Analysts are closely monitoring the relationship between Bitcoin’s price movements and political developments, hinting at a promising finish to 2024.

Whale activity sparks market momentumBitcoin’s recent surge was driven largely by significant buying activity from market whales, who have been scooping up the digital asset at key support levels.

Data from trading resource Material Indicators pointed out the influence of these large holders, especially around the $65,500 price range, where strong buy orders helped to push Bitcoin past crucial trend lines.

Material Indicators@MI_Algos·FollowFireCharts Binned CVD shows purple whales are buying Bitcoin again. Watching to see if brown Mega Whales show up with another big market order to eat through this sell wall at $65.5k

5:05 PM · Oct 14, 202432ReplyCopy linkRead more on TwitterThe cryptocurrency managed to reclaim its 200-day moving average, a critical metric often considered a bullish signal by traders.

On-Chain College@OnChainCollege·FollowBitcoin has now cleared the 200DMA and the STHCB, levels we’ve been tracking for quite some time. Has Uptober begun?!

5:17 PM · Oct 14, 202492ReplyCopy linkRead 4 repliesThis increased buying pressure has reignited “Uptober” optimism—referring to October’s historical trend of strong market performance. Notably, average October gains for Bitcoin have reached around 23% since 2013.

Analysts at QCP Capital are hopeful for a repeat performance in 2024, drawing parallels to 2016 and 2020 when Bitcoin’s price surged just weeks before US presidential elections.

Both instances saw the asset breaking out of long-term consolidation to post significant gains in the months leading up to January.

This year’s rally appears to follow a similar trajectory, with current trends sparking fresh optimism.

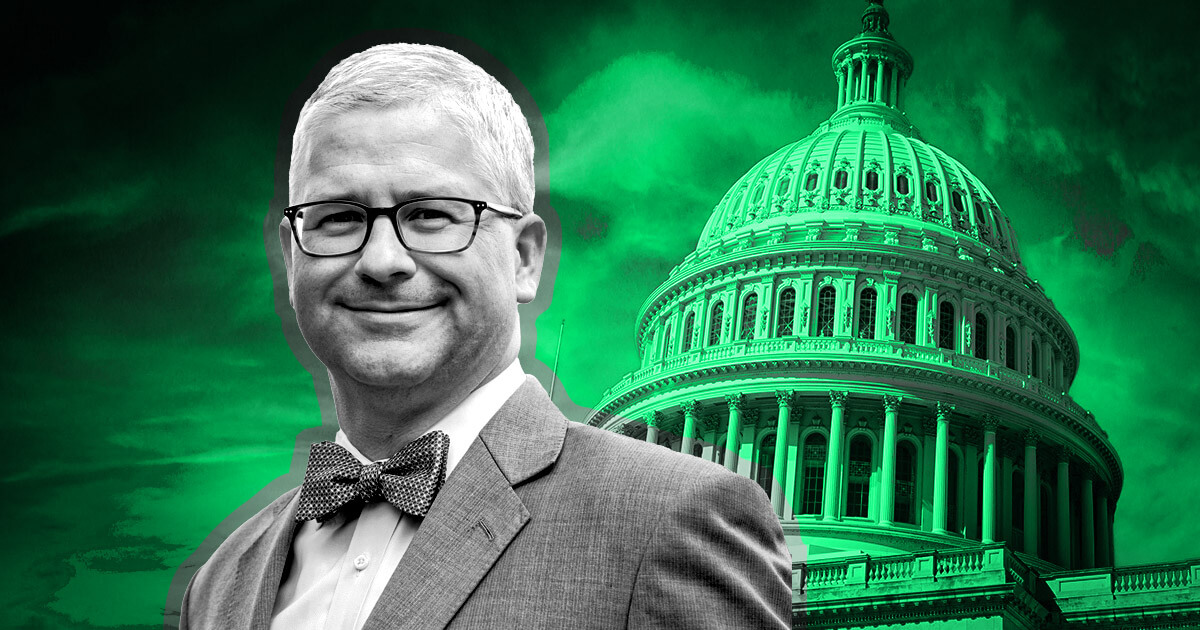

Trump’s pro-Bitcoin stance influences the marketThe link between Bitcoin’s recent price increase and political sentiment surrounding the 2024 US presidential election is becoming increasingly evident.

As Donald Trump’s odds of winning have risen—from 50% on October 10 to 54% on October 14—Bitcoin has concurrently climbed from $60,300 to $66,000.

Trump’s well-known support for cryptocurrency has played a role in this trend, as he continues to advocate for a deregulated crypto industry and even accepts Bitcoin for campaign donations.

Conversely, Vice President Kamala Harris, a key rival in the election, has been viewed with some skepticism by the crypto community.

Her recent efforts to garner support for digital assets have not been as influential in shaping market sentiment.

Analysts at Bernstein predict that if Trump secures the White House, Bitcoin could surge to between $80,000 and $90,000.

Standard Chartered’s forecast is even more ambitious, with an all-time high of $125,000 projected by the end of 2024 if Trump wins, compared to $75,000 if Harris clinches victory.

Google’s chart removal raises questionsAmid the market rally, a curious development has emerged: Google’s unexpected removal of live price charts for Bitcoin, Ethereum, and other cryptocurrencies from search results.

The charts for some altcoins remain accessible, and while cryptocurrency data is still available via Google Finance, the last update was on October 7.

The removal has led to speculation within the crypto community about the reasons behind it, with some wondering if the move indicates broader changes in how mainstream platforms present cryptocurrency data.

As Bitcoin continues its “Uptober” rally, the combination of whale activity, election speculation, and unexpected shifts in market tools like Google’s charts suggest an exciting—and unpredictable—road ahead for the cryptocurrency.

The post Bitcoin’s 'Uptober' rally kicks off, driven by market optimism and election bets appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) íà Currencies.ru

|

|