2024-5-15 17:25 |

Quick Take

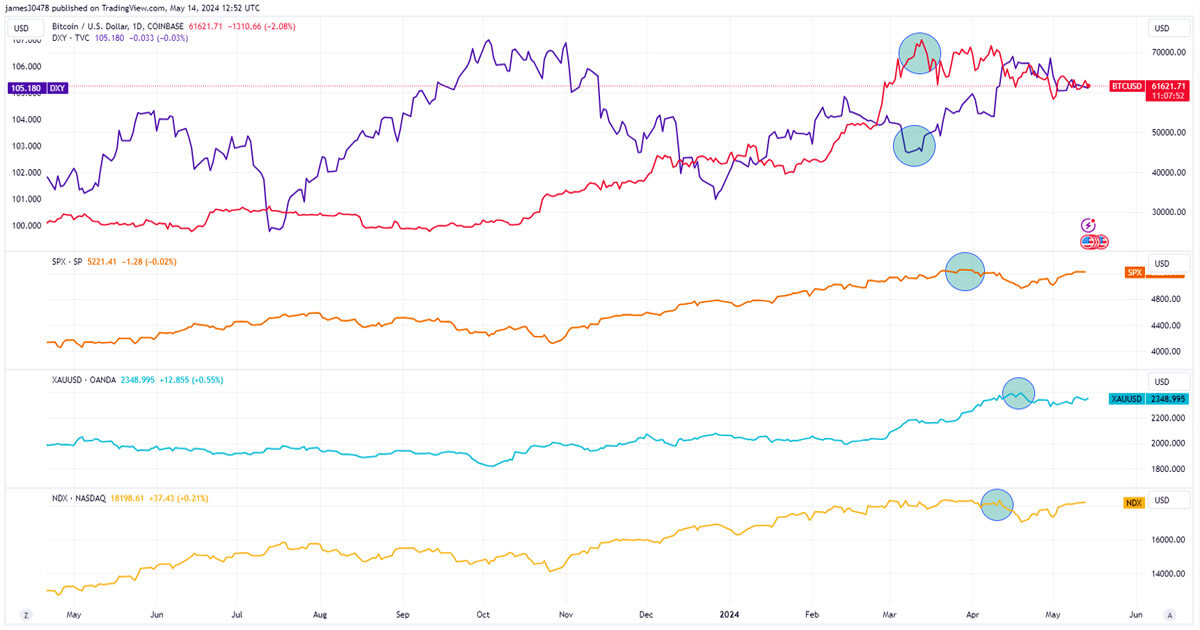

Bitcoin remains the primary indicator of global liquidity, with its price movements often preceding those of other risk-on assets. This dynamic was evident in the recent market cycle, as Bitcoin hit an all-time high on March 13, coinciding with the biggest ETF inflow since launch on March 12, over $1 billion, and the bottoming of the US Dollar Index (DXY), which typically has an inverse correlation with risk-on assets.

Since then, the DXY has strengthened from 102 to 105, exerting downward pressure on Bitcoin, dropping roughly 20%. Subsequently, the most liquid risk-on assets, such as the Nasdaq and S&P 500, peaked after Bitcoin, followed by gold. This sequence reinforces Bitcoin’s role as a leading liquidity barometer.

May 2023 – May 2024: BTCUSD, DXY, SPX, Nasdaq, Gold: (Source: TradingView)Bitcoin’s current correlation with US equities, represented by the S&P 500 and Nasdaq, currently stands at around 0.7 over the past 30-day moving average, indicating a strong tie to risk-on assets. Conversely, its correlation with gold has dropped to one of the lowest levels this year at -0.33.

With the upcoming release of US CPI inflation data on May 15, a hot inflation print could potentially dampen Bitcoin’s price, as it might delay or eliminate the possibility of interest rate cuts in 2024.

BTC Pearson Correlation: (Source: The Block)The post Bitcoin’s tight correlation with US equities highlights market anticipation of CPI data release appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|