2021-12-14 17:41 |

On-chain data shows that 90% of all Bitcoins to ever exist have now been mined. Bitcoin’s scarcity is bound to increase as the remaining 10% will be mined in about 119 years.Prices are expected to surge as Bitcoin becomes more scarce and in demand.

Bitcoin has been described as the most perfect human-created financial instrument due to its combination of economic incentives with cutting-edge mathematical certainty. One of the most important aspects of Bitcoin’s existence is its limited supply of 21 million coins which ensures that the pioneer digital asset remains deflationary.

The issuance of these Bitcoins is programmed into the code of the Bitcoin network. By the set standard, approximately every 10 minutes new Bitcoins are issued to miners for dedicating their resources to validate new blocks of transactions on the network.

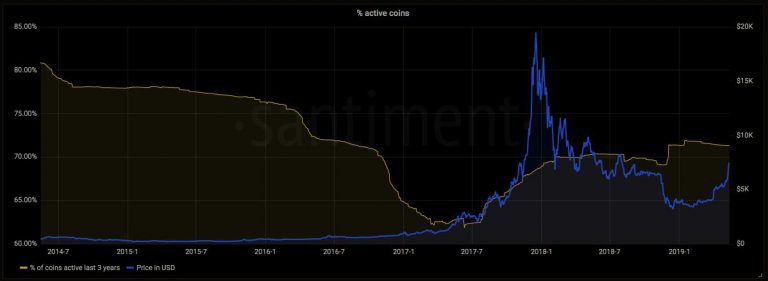

At this time, over 18 million Bitcoins, or about 90% of the 21 million Bitcoins that will ever exist have been mined. This means that only 10% of the 21 million Bitcoins are left to be mined by the network. While it has taken around 12 years to mine 90% of the Bitcoins, it is estimated that the remaining 10% will take another 119 years to mine because of the increasing difficulty of mining programmed into the code.

What does reducing issuance mean for Bitcoin?The current mining difficulty allows around 6.25 new Bitcoins to be distributed to miners every 10 minutes. This value falls at every halving cycle of Bitcoin. The next halving of Bitcoin issuance which is estimated to happen in May 2024 will see the issuance of new Bitcoin drop to 3.125. These halvings will continue until there are no more Bitcoins to be mined.

In an economic sense, when reducing/limited supply is combined with increasing demand, there is bound to be a positive supply shock. This is why Bitcoin proponents expect that as the Bitcoin monetary network advances in adoption globally to a point they expect that Bitcoin will become the primary unit of – hyperbitcoinization – a supply shock will become inevitable for Bitcoin.

An offshoot of a Bitcoin supply shock is that the price of Bitcoin is also expected to increase as more people realize how scarce and important the crypto asset is. The Bitcoin stock-to-flow model, which tries to predict the price of Bitcoin by analyzing the supply of Bitcoin and its scarcity enforced by the halving cycle, estimates that before this halving is over, the price of Bitcoin should reach over $200,000 by the end of the current halving cycle.

Bitcoin is currently trading at around $47,915, down 3.53% on the day and about 28.8% from its all-time high price of just under $69,000 set in November.

BTCUSD Chart by TradingViewThe current price of Bitcoin is still far off from this estimate, but investors remain confident that prices will catch up. This is mostly because, despite the volatility of the price of Bitcoin, it is still one of the best-performing assets in the last decade. Bitcoin has outperformed both gold and the S&P 500 index, having posted an over 1,000,000% increase in the last decade compared to 13% and 287% increases in the latter two assets.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|