2019-9-13 02:00 |

Bitcoin (BTC) has been facing a long bout of consolidation ever since it was rejected at its 2019 highs of $13,800 earlier this summer. Simultaneously, the equities markets have also faced a period of consolidation throughout 2019, after trade tensions and global political instability slowed the market’s meteoric ascent.

It is important to note that one analyst is now explaining that he believes the S&P 500’s performance on a yearly basis impacts Bitcoin, as BTC’s best years have been the ones where the S&P climbs over 15%.

Bitcoin Laying the Groundwork for Another UptrendAt the time of writing, Bitcoin is trading up over 2% at its current price of $10,315, which marks a decent surge from its recent lows of $10,000 that were set yesterday.

Bitcoin has been caught in a relatively wide trading range over the past several days and weeks, as it has been finding support in the lower-$9,000 region which facing strong resistance in the upper-$10,000 region.

BTC’s bullish reaction to each dip below the key five figure price region further bolsters its current bullishness, as it signals that this region is filled with buying pressure that may ultimately allow the crypto to begin another parabolic movement upwards.

In the near-term, how the crypto reacts to the upper-$10,000 region will be critical in understanding whether or not it currently has enough momentum to climb back towards its 2019 highs of just below $14,000.

Could S&P 500 Be a Primary BTC Influence?Thomas Lee, co-founder of Fundstrat Global Advisors and a prominent Bitcoin bull, explained in a recent tweet that he believes the S&P 500 could be a primary influence on the cryptocurrency’s price action.

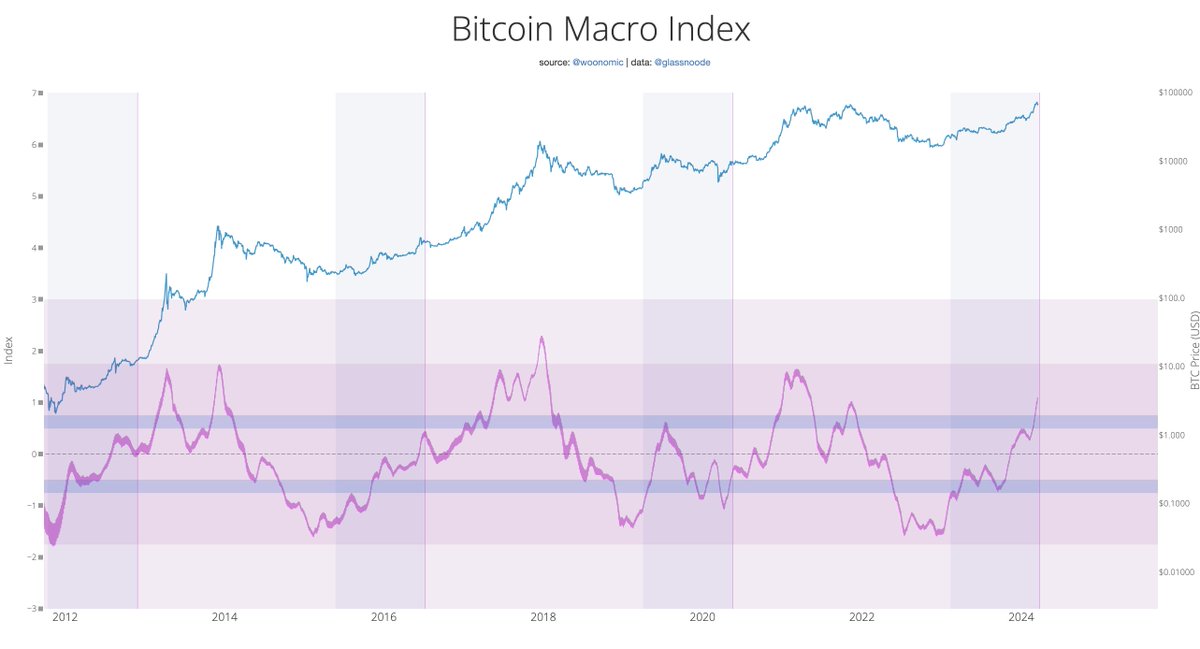

“Unpopular opinion, Bitcoin won’t make a new high until S&P 500 makes a new high. $BTC has been rangebound because macro trendless. Confirmed by our Bitcoin Misery Index falling from 66 (50 now). Since 2009, best years for Bitcoin is when S&P 500 >15%,” he noted.

Unpopular opinion, Bitcoin won’t make a new high until S&P 500 makes a new high.

– $BTC has been rangebound because macro trendless. Confirmed by our Bitcoin Misery Index falling from 66 (50 now)

– Since 2009, best years for Bitcoin is when S&P 500 >15% #Bitcoin#BTFD pic.twitter.com/1gWqZlnxfE

— Thomas Lee (@fundstrat) September 12, 2019

It remains unclear as to whether or not Bitcoin and the S&P 500’s macro-uptrends since 2009 are purely coincidental, or if their performance is truly correlated. Either way, watching to see how BTC fares in the next economic downtrend or recession will illuminate whether or not it is an uncorrelated asset.

Featured image from Shutterstock.The post Bitcoin’s Next Bull Run May Be Sparked By S&P 500 Uptrend, Claims Analyst appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|