2018-9-21 11:47 |

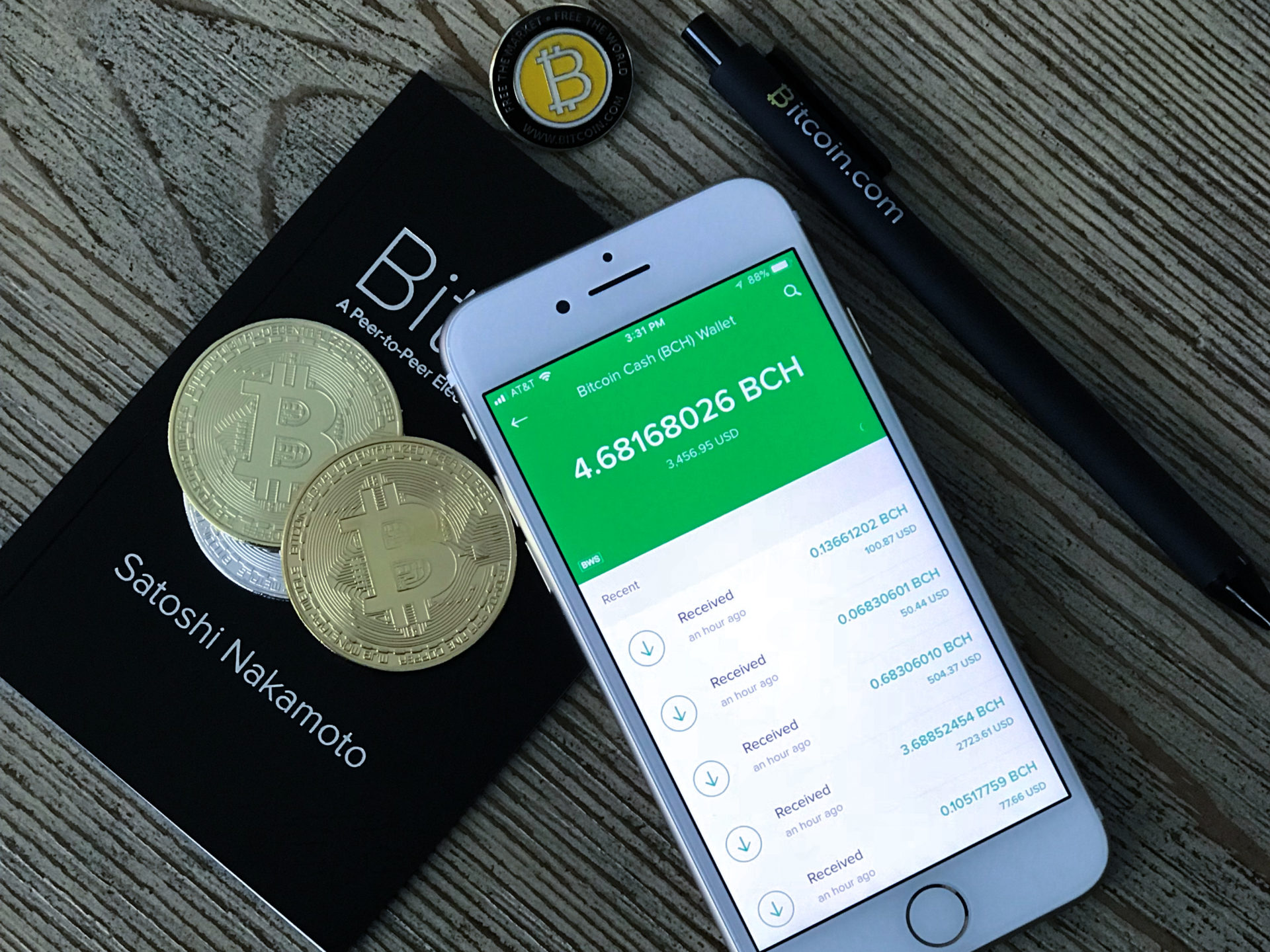

CEO of Bitcoin.com, Roger Ver spoke about the growth and adoption of Bitcoin Cash [BCH] in South Korea, during an interview with South Korea’s SBS CNBC this Tuesday.

He discussed the global concerns surrounding the cryptocurrency market as evidenced by the recent statement made by Jerome Powell, the Federal Reserve Board Chairman. Roger stated that cryptocurrencies do not have any intrinsic value.

He said:

“I heard him say that. And the fact that he would say something like that just shows that he hasn’t studied the concept at all. There is absolutely no such thing as intrinsic value. Gold has no intrinsic value either. The value is in the mind of the being beholding it.”

Gold and bitcoin have both been identified as safe-haven assets. While gold has long been identified in this way, bitcoin has more recently become something that investors flock to in times of distress.

Bitcoin and gold are also both speculative investments. Unlike stocks and bonds, they are not based on factors like earnings and interest payments. As for what drives their price movements, the answer is complicated, and not everyone agrees. For example, gold has acted as a safe-haven asset in many cases but risen alongside riskier assets at other times.

In Ver’s own words if there were no humans on the earth to look at gold and value and like it, gold would have no value. He added that the same concept applies to Bitcoin, if there weren’t any human beings to appreciate Bitcoin [BTC], then it would have no value.

He further stated that most people working at the Federal Reserve don’t understand this key concept which is why they are accustomed to saying “such foolish things”.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|