2021-8-7 20:54 |

Bitcoin offers the chance for us to truly learn and understand money on a level that people have not yet experienced.

Bitcoin will bring about an explosion of financial literacy in the same way that the printing press brought about an explosion of reading literacy in the 1400’s. While it's impossible to calculate the literacy rate before the invention of the movable type printing press, we know today's literacy rates are over 95% in many countries.

I’m confident that the same thing can happen with financial literacy because of bitcoin. Best-selling author and educator Robert Kiyosaki is the first person I know who explained that most of us are “financially illiterate” and he has been advocating financial literacy since he published his best-seller Rich Dad Poor Dad in 1997. One of my favorite quotes about money and our banking system is by Henry Ford who said, “It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning.”

After studying money, the US banking system and bitcoin for the past several years I’ve reached the startling and mind blowing conclusion that even though we’re two decades into the 21st century, almost no one understands money, finance, currency or our banking system! This is true of captains of finance, kingpins on Wall Street and nearly every elected official. Nearly every critique of bitcoin is based on ignorance about money, what it is or its purpose. Or those critiques are based on a deeply flawed understanding of our banking system. This ignorance extends to our understanding of digital scarcity, cryptography, Austrian economics, game theory and how the old rails of the US banking system compare to the new rails of the bitcoin protocol.

It’s fair to say that I too didn’t fully understand money or the banking system until I began studying bitcoin. Bitcoin is like learning about a fourth or fifth dimension for money. Even the most seasoned “experts” in money today might know three dimensions of money but not a “fourth or fifth”.The three dimensions of money are time, space and scale or mass. There was no fourth or fifth dimension of money until bitcoin was invented. While this is a topic for another article, consider that until bitcoin there was no such thing as money with zero mass or weight that could be sent over the internet or held in your mind.

As you start to do your homework on bitcoin you must examine your assumptions about money. There is an ancient proverb that applies: “fish discover water last.” Well, the same is true of a financial person and money. Those in finance discover money last precisely because they believe they understand it,and they’ve been professionally trained by people who possess the same blindspots about money and our banking system.

Let’s look at a few widely shared myths or assumptions about money that are tragically false:

“The Federal Reserve has constitutional authority to issue US dollars.”

False. Our governing documents don’t give Congress let alone a private corporation wholly owned by a small group of banks the right to print money. In fact, many of our founders were very negative about printing money and credit.

“The government has always issued our currency.”

That is completely false but that doesn’t mean it isn’t widely shared, repeated and believed. There was a period during the 1800s when banks issued their own notes. In other words, there was competition rather than monopoly money. This was also during a time when we rarely saw booms and busts in our economy. See George A. Selgin’s 1998 book “The Theory of Free Banking: Money Supply Under Competitive Note Issue.” It is only since the creation of the Fed in 1913 that we’ve seen booms and busts and rampant inflation in our economy.

“The Fed is a quasi-governmental entity.”

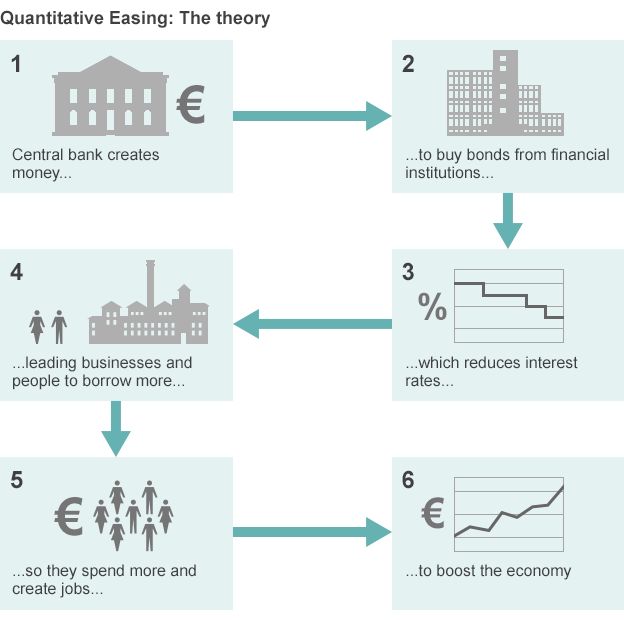

False, it is a private corporation owned by a small number of banks and accountable to no one. They make decisions in secret, behind closed doors, and only tell you what they want you to know. Moreover, when they crank up the printing press, they receive seigniorage which is a concealed way of saying they get a certain percentage of every dollar printed! This fact alone should make you shudder.

“Cash is king.”

In the age of unchecked money printing; cash is trash. Every dollar the Fed puts into circulation (or worse; provides it to the bank in hopes that they will lend it) reduces the value of the dollar in every person’s pocket or bank account. And the small handful of banks get rich at the expense of the citizens. It’s not unfair to say that the Fed takes from the poor and gives to the rich. 1/infinity = zero.

“The Fed’s target Inflation rate of 2% is to our benefit.”

False. Again inflation is a hidden form of taxation or theft. Don’t believe me? Since 1913 the US dollar has lost 98% of its purchasing power and is dropping faster by the minute! And the smart money in the corporate world and on Wall Street say our government’s monetary response to COVID 19 in 2020 means the inflation rate is closer to 15-20%. A better name for inflation is “theft.”

“Deflation is bad.”

Wrong again. Deflation is an incredible positive in our economy although you’ll never hear anyone in government admit that. See this article by Jeff Booth called “The Greatest Game.” Deflation means that we all get more for less. Given the impact of technology on almost every industry including money we now have a computer we hold in our hands that has the ability to send money across the world for almost nothing.

“The US banking system is based on free markets.”

Again this is 100% wrong. The US dollar is monopoly money of the worst kind. The US banking system is fundamentally flawed because it’s based on socialism. We allow private gains and socialized losses. See article by Robert Breedlove “Masters and Slaves of Money.” The Fed does central planning and sets interest rates and has done so since Alan Greenspan in the 1980’s. We all learned very quickly in 2008 that the U.S. banking system permits “private gain” to banks and socializes the losses. Heck, we now even have the most socialist policy of all as the predominant narrative of our day, we now have banks that are “too big to fail.” Karl Marx would be proud.

The good news is those willing to do their homework can level the playing field. It doesn’t matter if you’re poor, of modest means or otherwise disadvantaged because anyone can understand money if they are open minded and willing to learn. That means that people can have an understanding of money that exceeds those in the billionaire class simply by doing their research. The best time to begin educating yourself about money and bitcoin was 10 years ago. The next best time is now. And don’t stop until you have 1000 hours invested in it.

This is a guest post by Mark Maraia. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|