2024-10-5 20:30 |

Ki Young Ju, the founder of the on-chain analytics platform CryptoQuant, revealed that Bitcoin whales are currently moving out of character in terms of profit-taking. These whales likely believe that the bull is far from over, which is why they haven’t secured as much profit as they have done in previous bull runs.

Bitcoin Whales Have Taken Lesser Profits In This Market Cycle Than Past OnesKi Young Ju mentioned in an X post that if the Bitcoin bull cycle were to end here, it would mean that Bitcoin whales have just set the record for the least profit-taking across all cycles ever. Crypto analyst Ali Martinez tried to counter Ki Young Ju’s point by highlighting how these whales have been distributing their BTC across different addresses, leading to a drop in the number of addresses holding between 1,000 and 10,000 BTC.

However, the CryptoQuant founder claimed that this is still the lowest return rate across all cycles, no matter how much these whales sold through those different wallets. He also revealed that the whales that are selling now are doing so with little profit, suggesting that they are likely new whales with weak hands.

Meanwhile, Ki Young Ju noted that the type of transactions that Martinez alluded to cannot always be considered as sales. He remarked that one must look at more macro-level aggregated data, such as historical realized profit, rather than just transactions to get the bigger picture.

These whales are believed to be holding back on taking profits just yet, considering that the bull run looks to be far from over. The CryptoQuant CEO also mentioned earlier that Bitcoin was still in the middle of a bull run based on the market cap to realized cap metric.

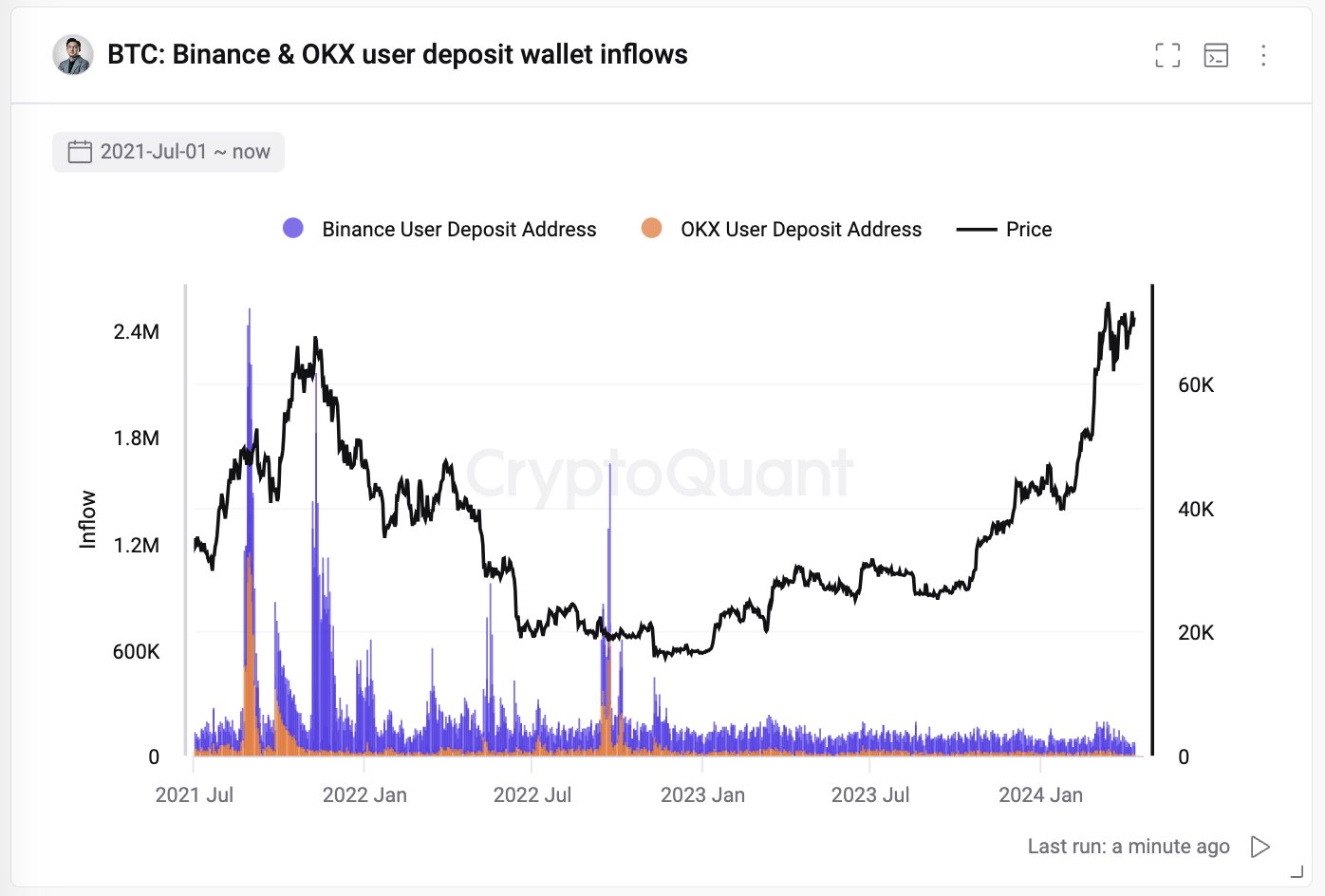

Instead of taking profits, these Bitcoin whales are still accumulating more BTC ahead of the next leg of the bull run. CryptoQuant recently revealed that there has been a surge in the outflows from exchanges, the largest since November 2022. Meanwhile, Ki Young Ju also noted that new whales are accumulating at a rate the market has never witnessed before.

When Is This Market Cycle Expected To Peak?Crypto analysts like Rekt Capital have predicted that the Bitcoin market top could occur sometime in mid-September or mid-October 2025. However, in a recent report, CoinMarketCap offered a different opinion, predicting that the cycle top could potentially be between mid-May and mid-June 2025.

The platform noted that Bitcoin is currently ahead of historical trends, especially considering that it hit a new all-time high (ATH) before the Halving event. CoinMarketCap pointed out that this market cycle is accelerating by approximately 100 days, which indicates that the next peak could arrive sooner than expected.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|