2021-1-24 03:30 |

While the price of bitcoin has been consolidating just above the $30k handle, onchain data shows that when the price dropped to $28,800, bitcoin whales bought the dip. Statics from Glassnode’s web portal shows the number of addresses with more than 1,000 bitcoin has spiked after hitting the price bottom.

The Number of Addresses Holding 1,000 Bitcoin SpikesAccording to onchain statistics, bitcoin whales with a balance of more than 1,000 bitcoin are growing and the recent BTC price drop helped bolster the metric. A few days before the drop to the $28k zone, BTC prices were coasting along between $35k to 38k in USD value. The drop to $28,800 per bitcoin on Thursday, was the lowest price drop so far this year. But the dip did not last very long and Glassnode stats show that the number of addresses with more than 1,000 bitcoin has increased significantly.

#Bitcoin whales bought the dip. pic.twitter.com/sviiiQyNSV

— Documenting Bitcoin 📄 (@DocumentBitcoin) January 16, 2021

A number of analysts on social media platforms spoke about the whales (1,000+ BTC holders) growing after the price drop allowed them to scoop as many units as they could.

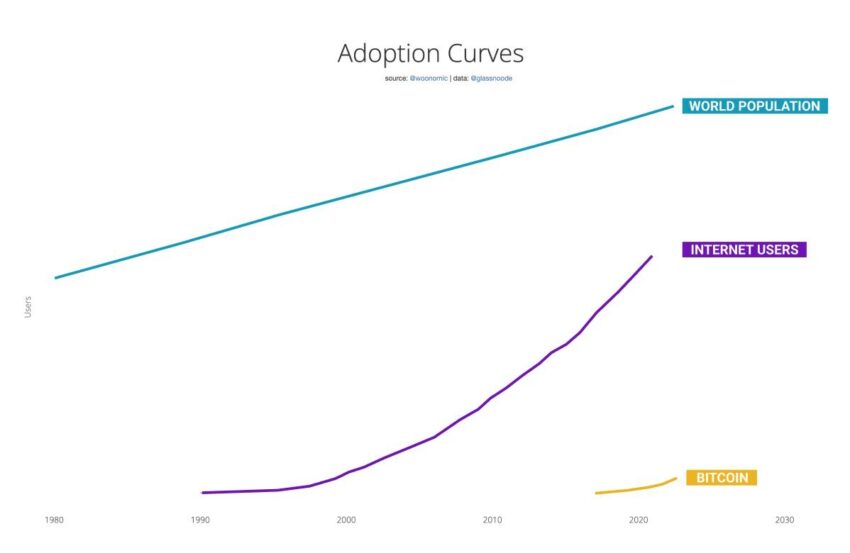

Glassnode data shared by the researcher Willy Woo, which shows bitcoins may be moving off the market to stronger hands.“Oh look,” the researcher Willy Woo tweeted. “Suddenly there’s a whole bunch of newly minted whales…. holders of 1000BTC / $32m of BTC. I’m seeing more whales coming in on this dip,” Woo added.

The bitcoin proponent further wrote:

Coins are moving off the market to very strong holders, the ones that keep accumulating without selling.

if (!window.GrowJs) { (function () { var s = document.createElement('script'); s.async = true; s.type = 'text/javascript'; s.src = 'https://bitcoinads.growadvertising.com/adserve/app'; var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } }); Double-Dipping and the Bitcoin Rich ListThe metric of 1,000+ BTC whales dropped some at the end of 2020, but has been rising ever since the two most recent price drops. For instance, on January 10, 2021, crypto markets suffered heavy losses and the price of bitcoin dropped more than 25% in 24 hours’ time. Similar to the last price drop on Thursday, at that time, bitcoin whales with addresses with more than 1,000 bitcoin had jumped in number.

Glassnode stats that show the number of addresses with a balance of 1k BTC or more.The most recent drop and whales scooping up bitcoins from weak hands also follows the BTC reserve purchase announced by Microstrategy. The company revealed this week it had bought the dip, by buying 314 more bitcoins for $10 million in cash.

Stats from the ‘Bitcoin Rich List’ or bitinfocharts.com’s 100 richest addresses shows that there was some deep accumulation on Thursday. Data currently indicates that there are 13,780 addresses that hold anywhere between 100 to 1,000 BTC in a single address.

Further, there are 2,345 unique bitcoin addresses holding 1,000 to 10,000 coins at the time of publication. There are only 100 colossal sized whales (10k to 1 million BTC) in the crypto economy and only one address with 100,000 – 1,000,000 BTC today.

What do you think about bitcoin whales accumulating more coins during the last two price dips? Let us know what you think about this subject in the comments section below.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|