2024-10-3 20:05 |

The past few days have been turbulent for Bitcoin (BTC), with the leading cryptocurrency experiencing a decline of roughly 8% since September 29.

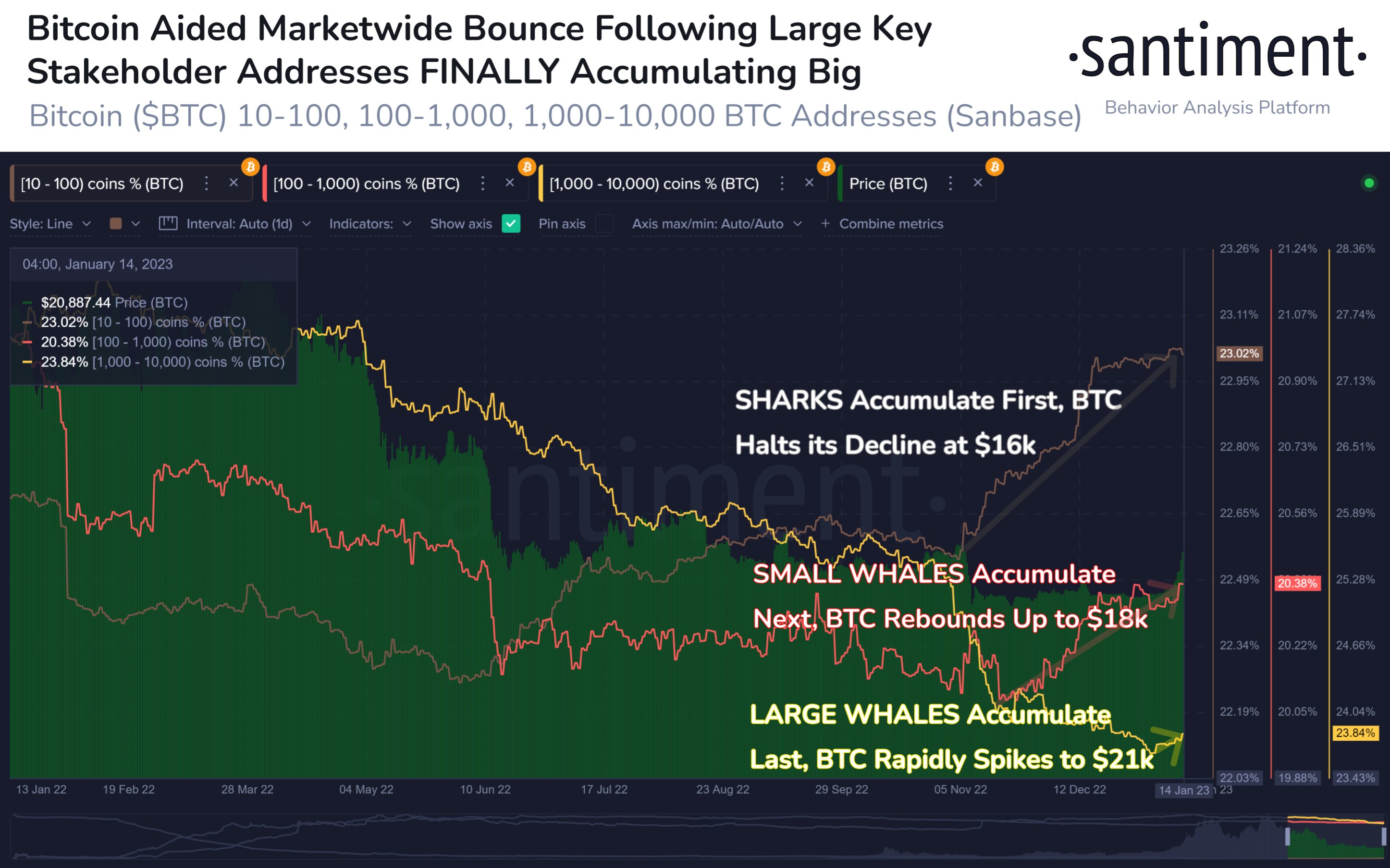

By Wednesday noon, it was trading at $61,856, marking a 3.16% drop in just 24 hours. However, this downturn has not deterred whales, who are capitalizing on the dip to accumulate more Bitcoin.

On Wednesday, popular crypto analyst Ali Martinez noted that this group has scooped over 50,000 BTC, valued at approximately $3.15 billion, in just ten days.

This notable buying spree coincides with a recent price correction following Bitcoin’s peak at $66,200 on September 27, indicating strong confidence from major investors even amid market fluctuations.

Notably, analysts from 10x Research suggested that this recent pullback was a natural correction after Bitcoin was deemed overbought. In a tweet on Tuesday, they acknowledged short-term concerns but emphasized that larger trends could soon emerge.

“The crypto market is undergoing some significant shifts. While short-term concerns have been evident, larger trends may soon overshadow them.” The analysts wrote.

“We’ve held a bullish view for the past three weeks, capturing the rally from $54,000. Although Bitcoin has yet to break through the downtrend, we believe it’s only a matter of time before it does.”

Other analysts also maintain a bullish outlook for Bitcoin as it heads into the year’s final quarter. Some, like Swyftx analyst Pav Hundal, believe that a return to an all-time high (ATH) of around $100,000 is feasible but hinges on favorable market conditions. Hundal noted that a more realistic target could be within the $75,000-$80,000 range by Christmas, especially if BTC breaks above the $70,000 mark.

Historical data further supports this optimism, indicating that October is typically a strong month for Bitcoin, with an average historical increase of around 23%. Martinez emphasized that the positive trends in September, where Bitcoin rose about 10%, could set the stage for continued growth.

“Historically, Bitcoin kicks off a parabolic bull run every October following the halving,” he tweeted on Tuesday.

Meanwhile, veteran analyst Peter Brandt cautioned that the recent rally has not disrupted Bitcoin’s ongoing pattern of lower highs and lower lows. He further asserted that a close above $71,000, confirmed by a new all-time high, is necessary to maintain the upward trend since November 2022.

“The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows. BTC Only a close above 71,000 confirmed by a new ATH will indicate that the trend from the Nov 2022 low remains in force,” he tweeted.

Additionally, pseudonymous analyst Marty Party shared insights on the Bitcoin market, referencing an updated Wyckoff accumulation pattern. He suggested that if Bitcoin can break through the $71,480 to $66,554 supply zone, it could surge to around $85,000 in the upcoming phases of the pattern.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|