2024-3-26 18:00 |

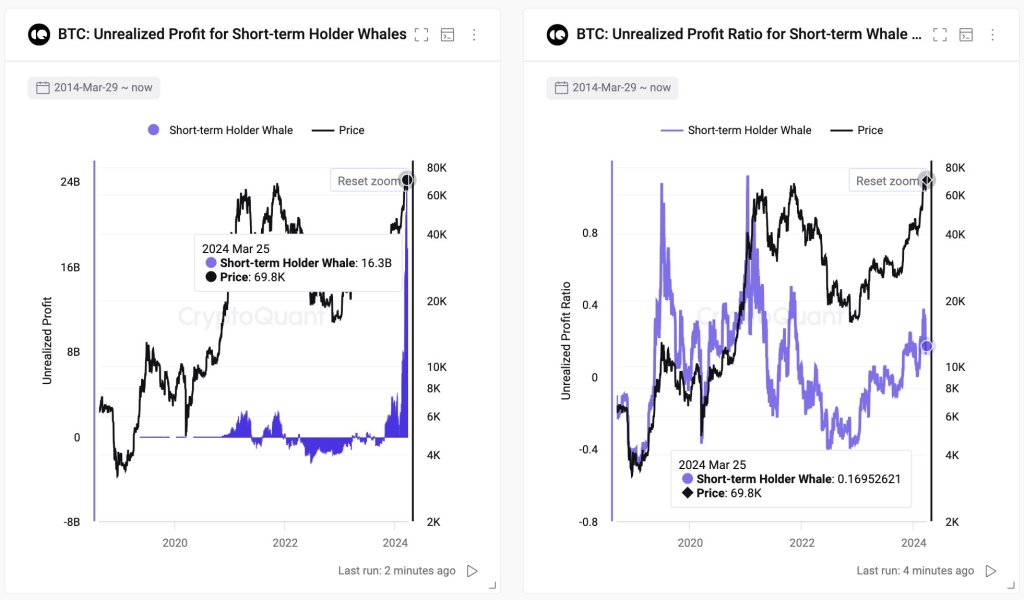

Ki Young Ju, the founder of CryptoQuant, a crypto analytics platform, now says historic inflow into Bitcoin is the key driver of profitability among short-term whales, including spot Bitcoin exchange-traded fund (ETF) buyers.

Referencing on-chain data, the founder notes that these investors have amassed roughly $16.3 billion in unrealized profit, translating to a gain of about 16%.

BTC Snaps Back Bullish After Correcting LowerThe revelation comes roughly a day after the world’s most valuable coin broke back above $70,000, extending gains over the weekend. After a series of lower lows threatened to wipe out gains, the coin rose sharply over the weekend, breaking above the $69,000 resistance level.

When writing on March 16, BTC is trading above the middle BB, a dynamic price level chartists use to mark out resistance or support, depending on the trend. The extension on March 25 might also spur more demand, lifting the coin above $73,800 and to new territory.

Spot Bitcoin ETFs continue to shape the coin’s price action. Even before approval in mid-January 2024, rumors of its green lighting by the strict United States Securities and Exchange Commission (SEC) lifted prices.

The coin rallied above $40,000, reaching highs of around $47,200 on January 8. After the approval, prices briefly contracted before rocketing higher, registering new all-time highs in early March 2024.

Interest in spot Bitcoin ETFs has seen its total assets under management (AUM) surge to $60 billion in around ten weeks. It took Gold ETFs approximately 15 years to reach the same milestone. This uptick points to the upswing in demand, possibly from other players and institutions seeking exposure to the asset.

Eyes On Inflows Into Spot Bitcoin ETFsStill, while spot Bitcoin ETFs shape price action, cracks are beginning to emerge. The past week marked the second time in the coin’s history to record five consecutive days of outflows. Increased outflow coincided with Bitcoin prices edging lower, dropping to as low as $63,500. However, this trend ended on March 25, with Fidelity’s FBTC leading the rebound.

For now, it remains to be seen whether inflow will pick up pace in the sessions ahead. If more capital flows to spot Bitcoin ETF issuers, reversing last week’s impact, it is highly likely that prices will also recover. Even so, whether the coin will break above $74,000 ahead of Bitcoin halving is unclear.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|