2021-1-4 13:58 |

2021 is starting off great for Bitcoin as it continues to break new all time high prices.

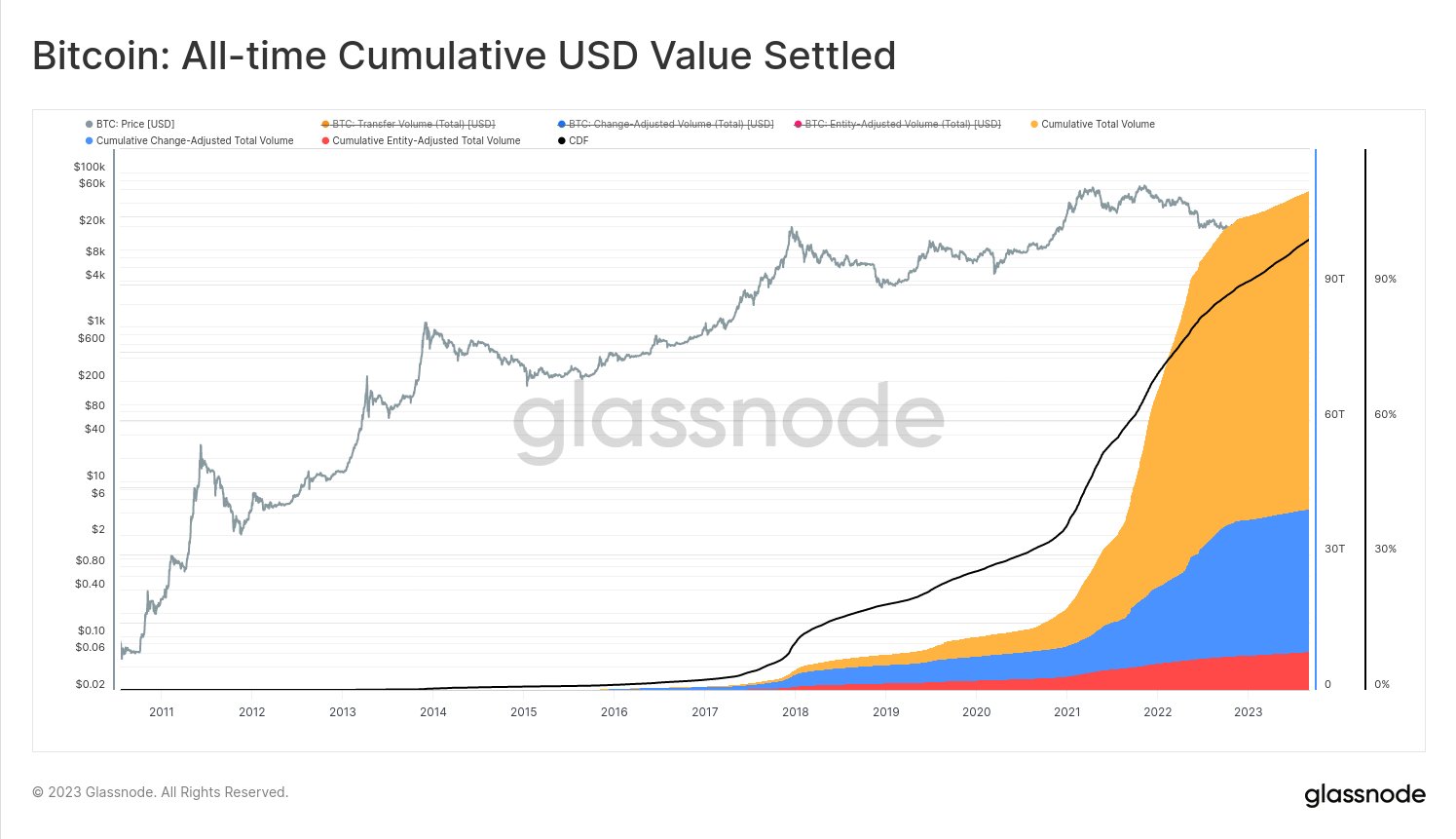

Now, as the price of Bitcoin closes in on $35,000, we are reaching massive volume levels that have barely been seen before. In the past 24 hours, Bitcoin is up about 15 percent. However, it is the increase in volume that is shocking. According to CoinMarketCap, the largest online cryptocurrency market capitalization aggregator, Bitcoin volume has increased by almost 104% in the last 24 hours. This is momentous, as this increase in volume on top of major price growth is an extremely bullish sign for the world’s largest cryptocurrency.

What is causing this massive volume spike?One of the most interesting factors to this sharp increase is that there is no immediately identifiable catalyst. Since the beginning of the new year, Bitcoin is already up over 20 percent. However, Bitcoin was already seeing daily/weekly all time high prices before 2021 even started.

One possible reason for this price increase is FOMO, or fear of missing out. Since the rise of Bitcoin is becoming mainstream news globally, investors and speculators may feel that if they do not purchase Bitcoin now, they will continue to miss out on massive price gains.

One point to consider is that this overnight volume increase took place from a Saturday to a Sunday. Thus, it is possible that institutional investors and their employees were not working. That leaves this volume increase up to retail investors.

Institutional interest supportThis Bitcoin bull run is fundamentally different than the previous all time price run in 2017 in almost every way. In 2017, retail investors drove the market. When the price peaked around $20,000, it quickly dropped and was not able to maintain support. This bull run is different because institutional and enterprise investors are driving it, overall.

Take for example MicroStategy, one of the biggest publicly traded business intelligence firms in the world. Michael Saylor, the CEO of MicroStrategy, was extremely skeptical of Bitcoin, but in August 2020, became one of Bitcoin’s biggest proponents. Due to economic uncertainty, dollar devaluation, inflation, hedging, and other factors, Saylor made the executive decision to use MicroStrategy’s reserve treasury to purchase Bitcoin. These purchase grew incrementally, with MicroStrategy raising $650 million via a debt offering to purchase Bitcoin.

There are a lot of other companies either integrating or investing in Bitcoin, sometimes to the tune of tens if not hundreds of millions of dollars. PayPal, Square, and Mass Mutual have also started getting involved with Bitcoin and cryptocurrencies. This could set the pace for the rest of the financial industry.

All this may speak to why Bitcoin has seen all time high prices and regular price increases. However, it doesn’t exactly explain the overnight growth in volume. There may not be an obvious factor that caused this explosion in volume. The factors leading up to it are undeniable, though.

The post Bitcoin Volume Explodes as BTC Targets $35,000 appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|