2024-3-9 19:00 |

Bitcoin price has fallen by over 10% after briefly touching its all-time high of $69,000, propelled by investors’ flood of money into BTC Spot Exchange-Traded Funds (ETFs).

However, intense volatility surrounding the crypto asset’s price has triggered a rebound to the $68,000 mark, which highlights the return of positive enthusiasm, prompting predictions of a significant rally to an unprecedented height.

Key Narrative That Could Send Bitcoin To $240,000Cryptocurrency analyst and trader Matthew Hyland has shared an optimistic forecast for Bitcoin with the community on the social media platform X. The analyst has identified a key trend that could trigger a bullish rally for BTC to the $240,000 threshold.

At first, Hyland noted that over the past two years, Bitcoin has “destroyed several narratives, both positive and negative.” These include one of the ideas that BTC will “never fall below the previous cycle low or reach its peak until after the halving event.”

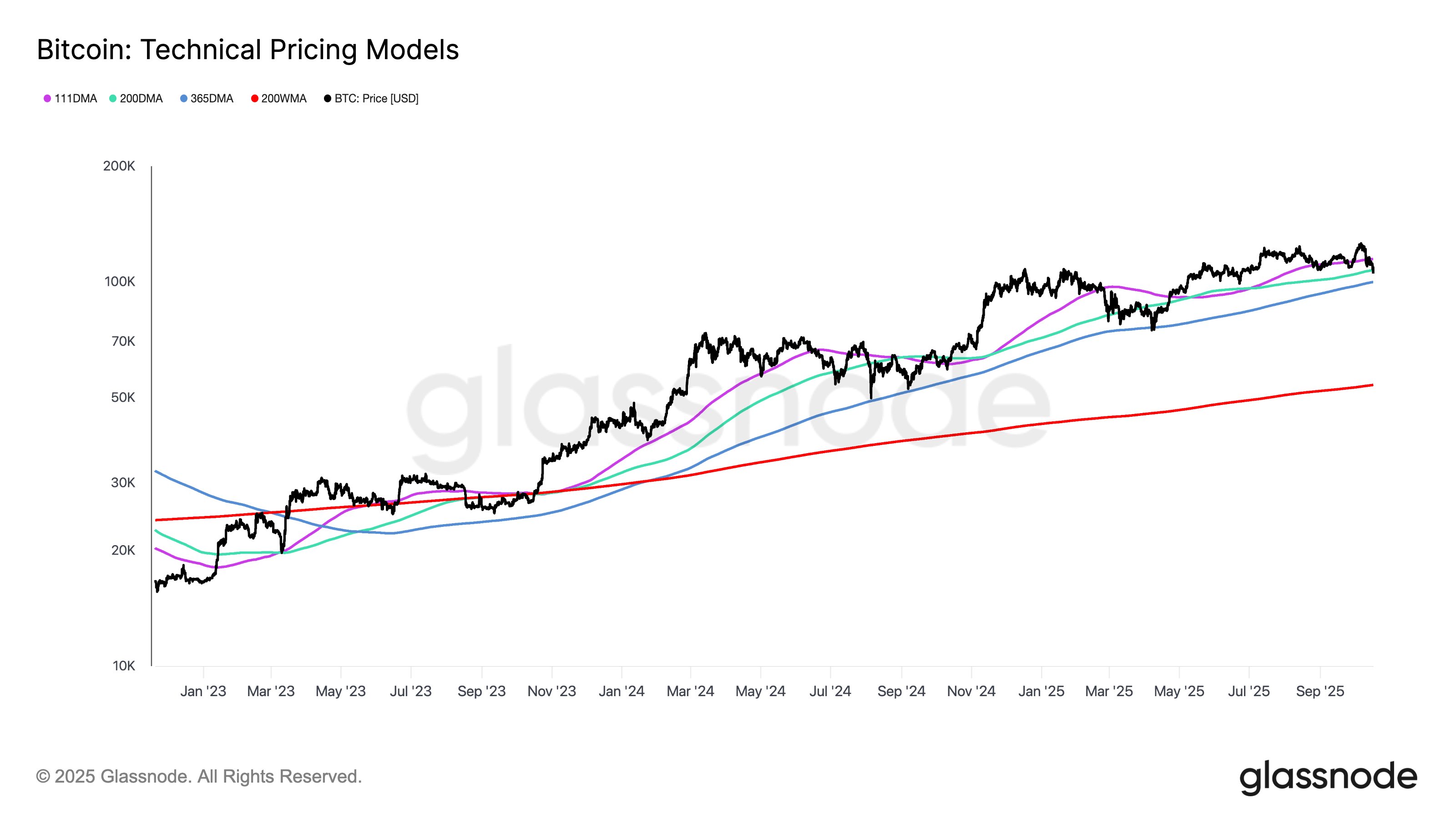

However, Hyland claims that the only narrative left that BTC has not destroyed is the “Diminishing Returns,” as it is still almost 100% effective. Hyland is uncertain of the narrative’s effect but believes that it is the “final boss” since it is the only one still standing.

As a result of the trend, the crypto expert has set his price target at $240,000 in the upcoming months. This simply means BTC needs to surpass the aforementioned price in order to be able to demolish the diminishing returns narrative.

Hyland claims it makes no difference to him if Bitcoin “reaches the level or not.” Nonetheless, it will be “intriguing” to observe whether it can smash the one trend that remains intact.

Another expert known as Crypto Signals seems to agree with Hyland, expressing his pleasure in the analysis. According to Crypto Signals, in the context of Bitcoin, “the idea of diminishing returns is a fascinating one.”

Crypto Signals claims that every cycle tends to “produce a declining percentage gain as the market matures.” Due to this, there is a more profound development and broader adoption in the market. Thus, in the constantly changing world of cryptocurrencies, the narrative is worth looking into.

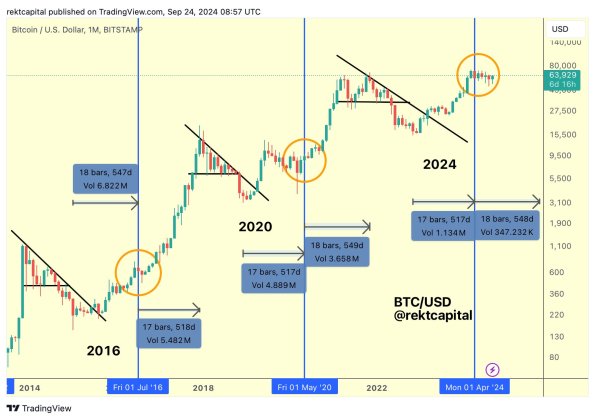

Strategic Timeframe For BTC Pre-Halving RallyRekt Capital, a well-known crypto expert, has pinpointed a timeframe for when and where the Bitcoin Pre-Halving rally will end. According to Rekt Capital, the “pre-halving rally is gradually approaching its end.”

Related Reading: Bitcoin Halving Prep: Analyst Outlines Key Points Ahead Of Event

Drawing a comparison to 2020’s pre-halving rise, the analyst stated that it occurred two weeks before the event. After that, BTC witnessed a “pre-halving retrace” of about 20%, which was the last it saw before the halving.

He further drew a comparison to 2016’s pre-halving surge, which he noted took place “28 days prior to the halving.” Nevertheless, it also experienced “a conservative correction” of over 29% after the rally topped.

Rekt Capital has marked the point as the “historic danger zone” that could potentially conclude the pre-halving rally this year, before witnessing a pullback ahead of the event.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|