2024-7-25 01:32 |

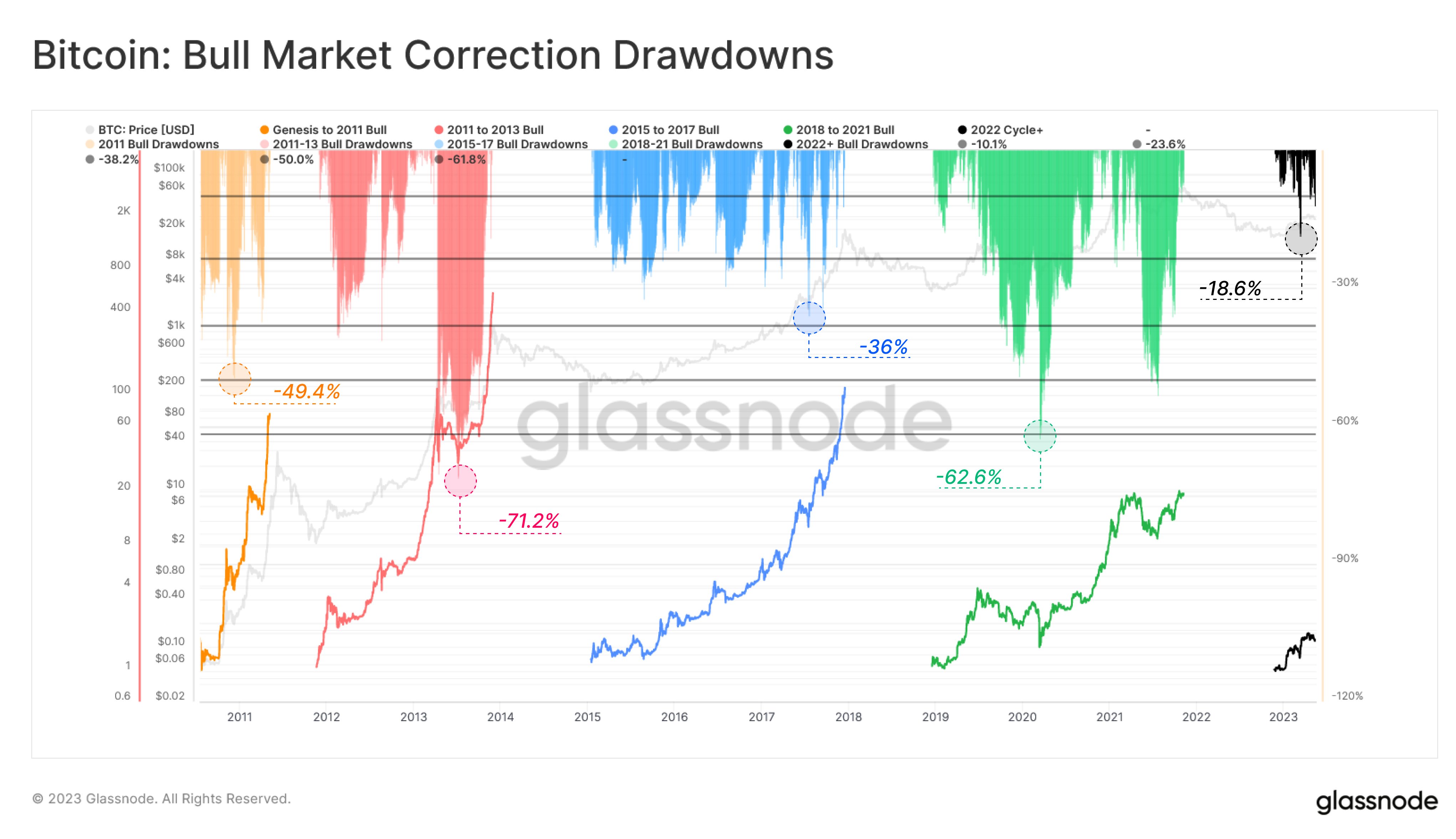

The Bitcoin price has experienced a notable rally, climbing more than 23% over the past two weeks to reach a two-month high of $68,583 on July 22, before falling back to $65,500 on Wednesday. This rally was particularly significant for short-term holders of Bitcoin. According to Glassnode, the recent price increase has allowed over 75% of STH holdings to return to unrealized profit, as the price has risen above the short-term holder cost basis of $65,329.

Much of the rally was driven by President Trump’s perceived support for Bitcoin, and while Trump looked like an easy winner over President Biden, with Vice President Kamala Harris now the new democrat nominee the odds are much closer.

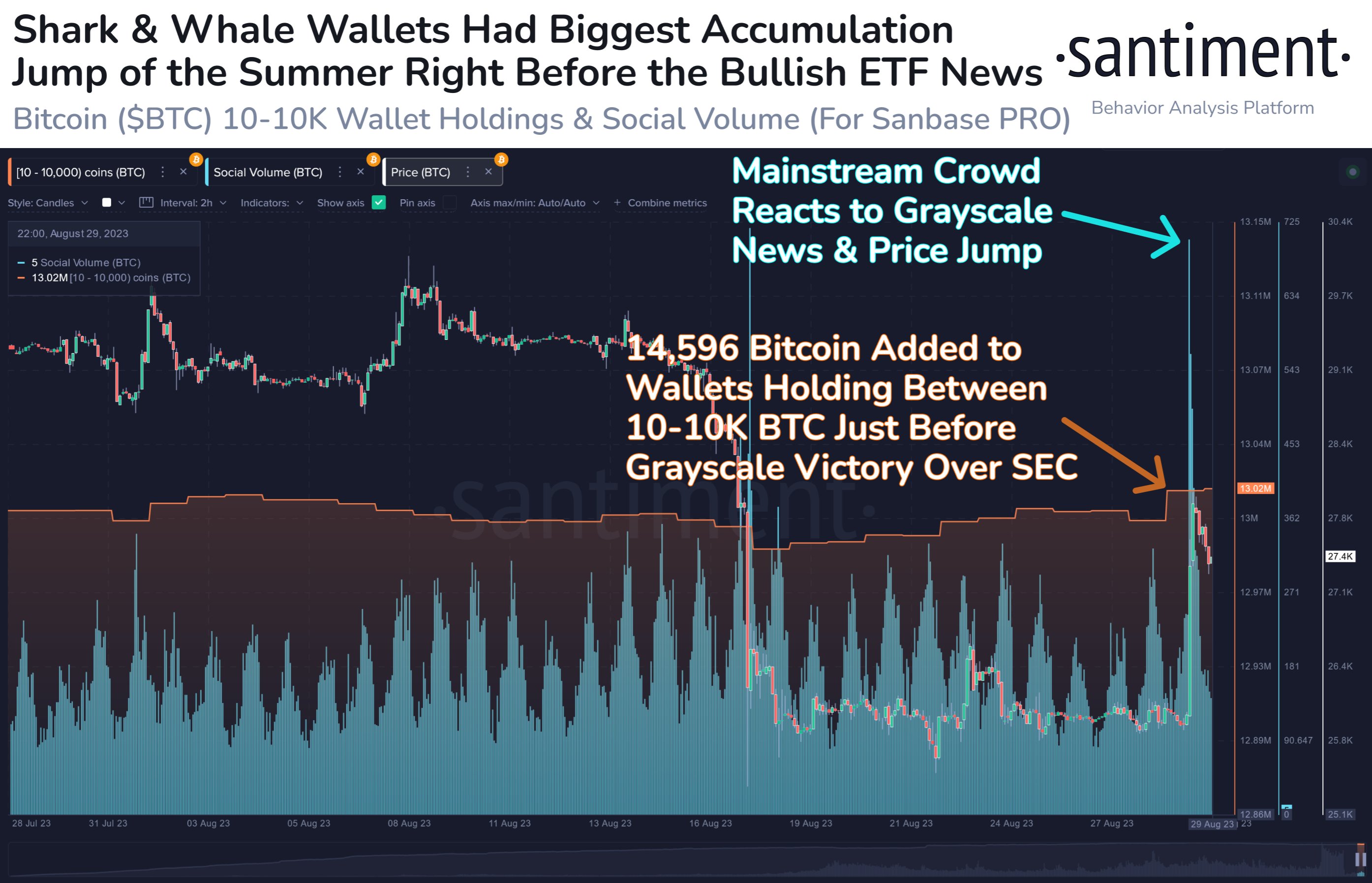

ETF Inflows end 12 Day StreakThe bullish trend was reflected in Bitcoin ETF flows which saw a twelve-day inflow streak. On July 23, U.S.-based spot Bitcoin ETFs saw net outflows totaling $77.92 million, ending the inflow streak. The Bitwise ETF (BIBT) led the outflows with $70.3 million, followed by the 21Shares Bitcoin ETF (ARKB) with $52.3 million, and Grayscale’s GBTC with $27.3 million. Conversely, BlackRock’s ETF (IBIT) saw a net inflow of $71.9 million.

Since the start of the year, the ten spot Bitcoin funds that began trading on January 11 have accumulated $17.5 billion in net inflows, with over $59.97 billion in assets under management. The recent ETF inflows, although positive, have been less pronounced compared to the substantial inflows seen earlier in the year, which peaked at over $4 billion between May 13 and June 7.

Source: X, BTC ETF flows since inception

The outflows came amid the launch of ether (ETH) ETFs, which attracted $107 million in net inflows and saw trading volumes exceed $1 billion. The debut of spot Ether (ETH) exchange-traded funds (ETFs) on July 23 was robust, with these funds pulling in over $100 million in net inflows on their first day of trading. However, this performance, while strong, is significantly less than the record-breaking inflows seen by Bitcoin (BTC) ETFs in January.

Too Soon to know the Harris Crypto ViewDespite the withdrawals from Bitcoin ETFs, BTC prices remained relatively stable, holding above $66,000 with a slight decline of just over 0.5% in the past 24 hours. Traders are now waiting for a new catalyst to emerge, such as the content of Trump’s speech at the Nashville Bitcoin Conference on Saturday. Conference organisers did ask Democrat nominee Kamala Harris to speak at the conference, but after discussions, Harris declined.

For the crypto industry, the key question is how a Harris administration would differ from Biden’s in terms of its crypto policy – and how that would contrast with former President Donald Trump. Harris has only been the presumptive nominee for a short time, and her campaign has just begun. There is potential for a reset, with entrepreneur Mark Cuban noting Harris’s campaign has shown interest in crypto.

While it’s too early to determine Harris’s stance on crypto, her new role suggests a potential shift in how the crypto industry engages with the 2024 election. Sheila Warren, CEO of the Crypto Council for Innovation, indicated that the change presents an opportunity for a new approach, although it’s unlikely Harris will immediately pivot the campaign to focus on crypto.

A Congressional staffer suggested that Harris’s campaign offers a chance to reset relations with the industry, and there are indications that her campaign may be more receptive to these issues. Harris’s background from California might make her more familiar with technology and related matters.

The choice of Harris’s vice presidential pick will also be significant. Many potential candidates, such as Pennsylvania Governor Josh Shapiro, North Carolina Governor Roy Cooper, Arizona Senator Mark Kelly, or Transportation Secretary Pete Buttigieg, are generally pro-business, which could be a positive signal for the crypto industry.

Industry groups and individuals have already reached out to Harris’s campaign and the Democratic Party, advocating for less hostility towards the crypto sector and encouraging open dialogue to support and nurture digital asset technologies while ensuring consumer protection and financial stability.

MT Gox Payouts Via BitstampStarting Thursday, customers of the defunct Mt. Gox crypto exchange will begin receiving payouts via Bitstamp, nearly a decade after the exchange’s collapse due to a hack. Bitstamp announced on its website that it has received funds in bitcoin (BTC), ether (ETH), and bitcoin cash (BCH) from the Mt. Gox trustees. However, U.K. customers will not be included in this initial distribution. This follows reports of assets being distributed through Kraken earlier this month. The Mt. Gox trust began transferring assets to various crypto exchanges, allowing users to reclaim their funds in the coming weeks. Once the world’s largest crypto exchange, Mt. Gox handled over 70% of global bitcoin transactions in its early years.

The upcoming distribution of nearly $9 billion in assets, primarily BTC and BCH, has raised concerns about market impact. Investors fear that creditors may sell the reclaimed assets, potentially flooding the market. In response, the bitcoin price fell slightly to $65,900.

Despite the Mt. Gox-related selling pressure, Bitcoin has performed surprisingly well in July. Traditionally, Bitcoin has shown a strong correlation with tech stocks, leading some to view it as a tech asset rather than a unique macro asset. Currently, Bitcoin’s market movements seem to be influenced by a unique narrative that tech stocks lack: the support of Donald Trump, who is scheduled to speak at the Nashville Bitcoin Conference this weekend.

Bitcoin supporters are eagerly awaiting his speech, with rumors suggesting he might even announce a US Bitcoin strategic reserve. Trump’s conference speech appears to be providing Bitcoin with insulation from further price falls. However, analysts predict that Trump’s speech could lead to a “sell the event” reaction, but whatever happens, his comments are expected to impact the Bitcoin market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|