2022-5-24 22:00 |

On-chain data shows the Bitcoin taker buy/sell ratio is now approaching a crossover with the “1” level, a sign that could be bullish for the crypto’s price.

Bitcoin Taker Buy/Sell Ratio Observes Rise, Almost Reaches A Value Of 1As explained by an analyst in a CryptoQuant post, signs may suggest that a local top could soon be coming for the crypto.

The “taker buy/sell ratio” is an indicator that measures the ratio between the Bitcoin long volume and the short volume.

When the value of the metric is greater than one, it means the taker buy volume is higher than the sell volume right now. This trend indicates that a bullish sentiment is dominant in the market at the moment.

Related Reading | Bitcoin NUPL Touches Lows Not Seen Since COVID Crash, Rebound Soon?

On the other hand, the ratio being below one implies the majority sentiment is bearish currently as taker sell volume is more than the long volume.

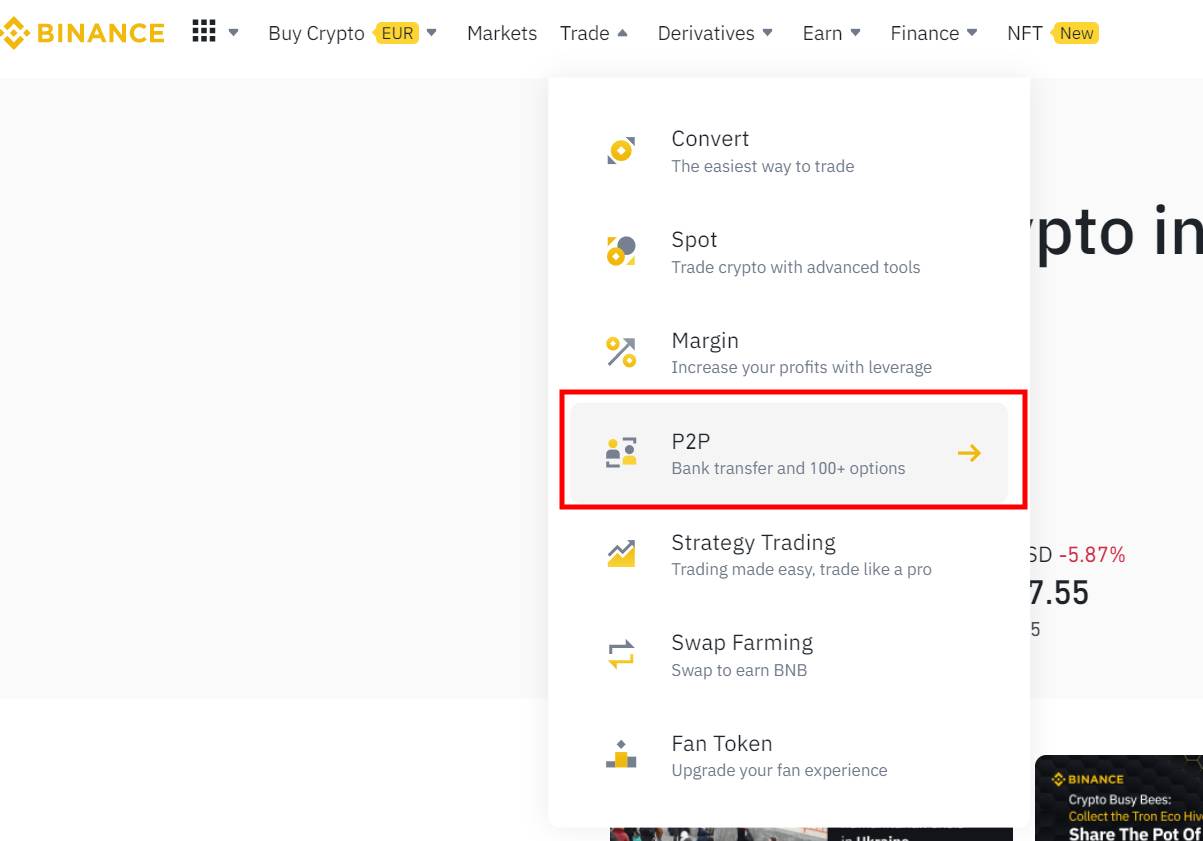

Now, here is a chart that shows the trend in the Bitcoin taker buy/sell ratio over the last few months:

The value of the indicator seems to have observed a surge recently | Source: CryptoQuantAs you can see in the above graph, the Bitcoin taker buy/sell ratio has been rising over the past month and is now approaching a crossover with the “1” level.

In the past, an increase in the indicator’s value above this line has usually been a bullish signal for the crypto’s price.

Related Reading | Long Liquidations Continue To Rock Market As Bitcoin Struggles To Settle Above $30,000

The quant also points out that the volume has been going up and is about to cross above a positive value. The below chart shows this trend.

Looks like the BTC volume has been going up in recent weeks | Source: CryptoQuantThe analyst believes that these two trends together (if they continue on and the respective crosses take place) may indicate that the price of Bitcoin could see an increase soon and form a local top.

BTC PriceAt the time of writing, Bitcoin’s price floats around $30.3k, up 2% in the last seven days. Over the past month, the crypto has lost 24% in value.

The below chart shows the trend in the price of the coin over the last five days.

The price of the crypto looks to have observed a rise over the last couple of days | Source: BTCUSD on TradingViewBitcoin seems to have gained some footing above the $30k level in the past two days, but the coin has still been stuck in an overall trend of consolidation for a couple of weeks now.

At the moment, it’s unclear when the coin may escape this rangebound market and show some real price movement.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|