2024-7-3 06:00 |

Bitcoin remains within an uptrend from a top-down preview, looking at the performance in the daily chart, especially in Q1 2024. Bulls appear to be taking over, with the coin floating above $60,000.

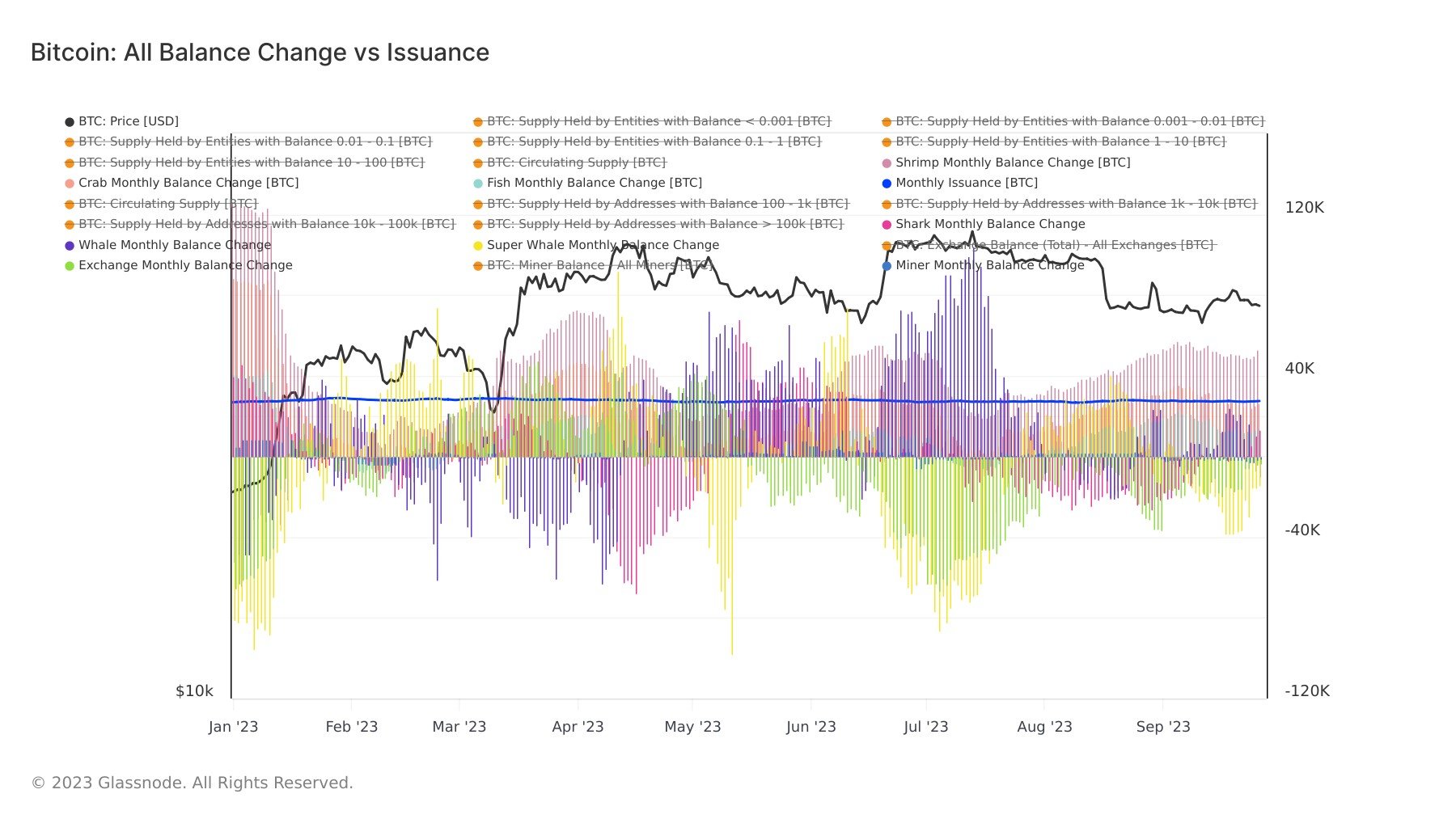

There Is Oversupply In Bitcoin: Will Prices Fall?Not everyone is convinced that the uptrend will last, at least based on on-chain activities. Taking to X, one analyst pointed to developments in the Bitcoin spent volume lifespan chart. There, the analyst noted a 10X increase in BTC movements compared to previous highs.

The massive influx, amounting to a staggering $9 billion, coincides with Mt. Gox’s planned user compensation in July, initially slated for October. The analyst says the concern with this deluge is that it could trigger a sell-off, further driving prices down.

The impact of Mt. Gox accelerated release of BTC to victims from October to July sparked a sell-off in late June. Though prices recovered over the weekend, there must be a convincing close above $63,000, marking June 24. If buyers press on, with $60,000 acting as a foundation, any breach of $66,000 would be ideal and might pave the way for even more gains in the short to medium term.

Technically, even with gains, bears are still in control. As it is, the coin is within a bear breakout formation following on June 11 when prices slide, setting the motion for the dip below $66,000.

Analysts Remain Upbeat: Expect BTC To Shake Off WeaknessThough there are concerns about the current recovery, some think the selling pressure associated with Mt. Gox could be exaggerated. Responding to the analyst’s assessment, one user said Mt. Gox users were likely tech-savvy early adopters with a clear understanding of what Bitcoin offers.

Therefore, even with the defunct exchange distributing coins, they won’t be incentivized to sell on the fly. Also, the anticipated selling pressure has likely been factored in, muting attempts to lower prices.

Another analyst, replying to the fears of increasing BTC supply, said. However, the Bitcoin spent volume lifespan chart paints a picture of a potential deluge; the entity-adjusted version, which discards internal transactions, reveals a more muted picture.

Based on this assessment, the analyst is convinced that the influx of BTC supply from Mt. Gox creditors will likely be less dramatic than initially feared.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|