2024-6-25 20:30 |

On-chain data shows the Bitcoin Supply in Profit has taken a significant hit following the crash the cryptocurrency has seen recently.

Bitcoin Supply In Profit Dropped To Around 81% During The CrashAs explained by an analyst in a CryptoQuant Quicktake post, the latest drawdown in the cryptocurrency has resulted in a portion of the supply going underwater.

The on-chain indicator of relevance here is the “Supply in Profit,” which, as its name suggests, measures the percentage of the total circulating Bitcoin supply currently carrying some unrealized profits.

This metric works by going through the transaction history of each coin in circulation to find what price it was last moved at. Assuming that this last transaction of the coin was the last time it changed hands, the price at the time would denote its current cost basis.

As such, if the current spot price of the cryptocurrency is higher than this cost basis, the coin could be considered to be to holding some profits right now. The Supply in Profit adds up all coins fulfilling this condition and calculates what percentage of the supply they make up for.

Naturally, an opposite metric called the “Supply in Loss” keeps track of the rest of the coins. Since the total supply must add up to 100%, this latter indicator’s value can also simply be found by subtracting the Supply in Profit from 100.

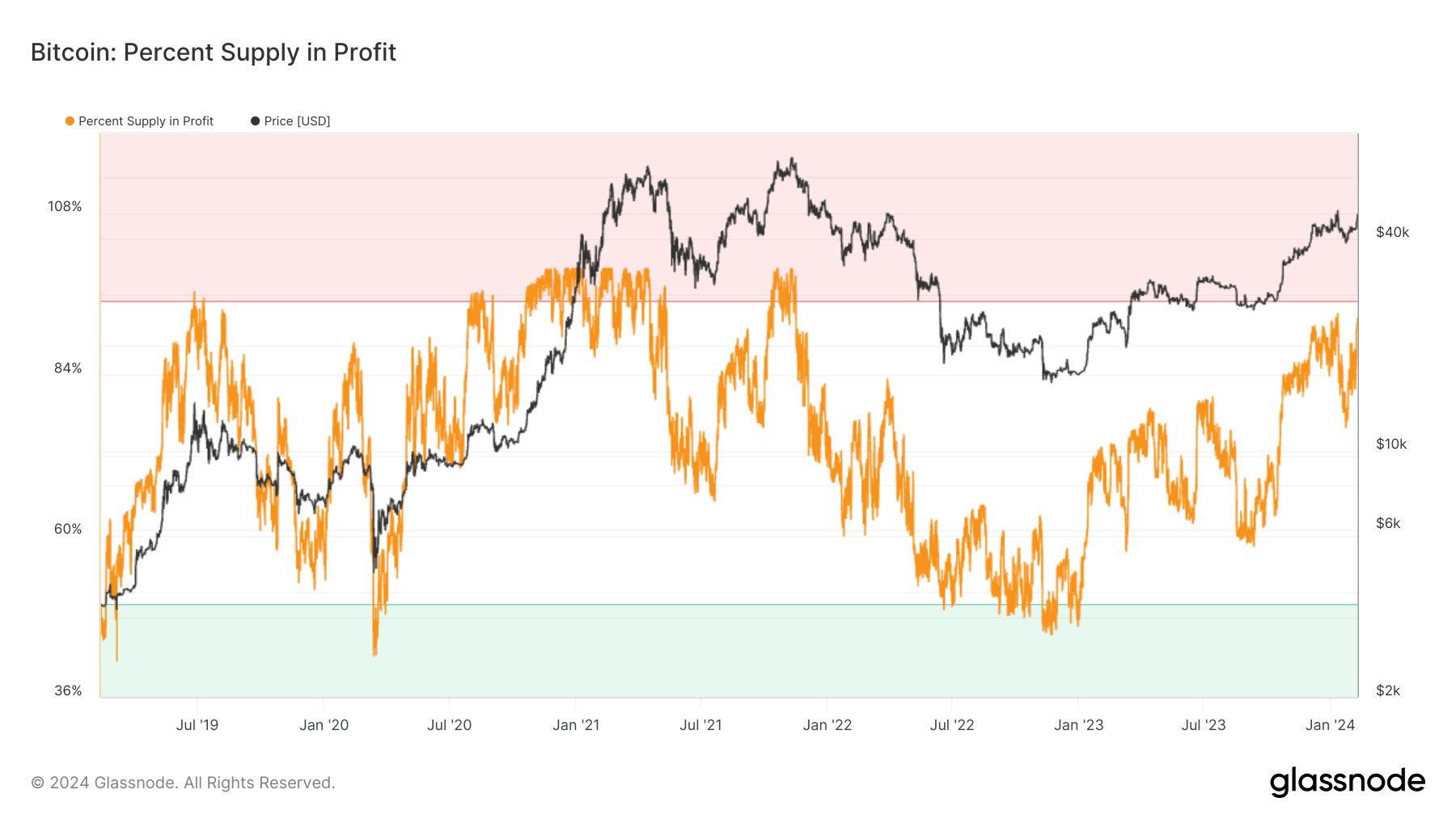

Now, here is a chart that shows the trend in both of these indicators for Bitcoin over the last few years:

As displayed in the above graph, the Bitcoin Supply in Profit has observed a sharp plunge alongside the latest drawdown that the asset’s price has gone through.

At the lowest point of this crash, Bitcoin had briefly slipped under $60,000, which had sent the Supply in Profit down to around 81%. Naturally, the Supply in Loss had simultaneously seen a rise to 19%.

“Currently, everything seems to be progressing normally, with the retracement following a usual pattern,” notes the quant. “If the price drops a bit more, we anticipate that the profit percentage will fall to the 70-76 range.”

Now, what’s the relevance of this indicator to the cryptocurrency’s price? Statistically, the investors in profit are more likely to sell than those carrying loss, so a large amount of holders being in the green could raise the possibility of a mass selloff taking place in the market.

Due to this reason, a cooldown in the Supply in Profit can actually be a positive development for the cryptocurrency, as it suggests there are fewer potential sellers left.

At present, the indicator’s value is still relatively high for Bitcoin, but it should be noted that during bullish periods, the metric usually tends to stay near high levels, so a decline of the current degree could be enough for the asset to reach a bottom.

The low back in May, for example, also occurred alongside similar levels of Supply in Profit. It now remains to be seen whether the latest values of the indicator will also lead to another bottom for the cryptocurrency.

BTC PriceBitcoin has seen a minor rebound since its plunge under $60,000 as the coin’s price is now back above $61,000.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|