2026-1-24 23:35 |

Bitcoin’s advance toward $90,000 stalled as a wave of coins flowed to exchanges, while on-chain data showed holders slipping into net realized losses for the first time since October 2023.

At the same time, spot market signals have brightened, creating a mixed setup in which rising supply meets tentative demand, according to multiple analytics firms.

Between Jan. 20 and 21, more than 17,000 BTC moved to exchanges, while key profitability metrics dipped below break-even.

Yet spot buying strength on major venues has picked up, hinting at stabilization even as rallies face resistance.

Exchange inflows test $89,000–$90,000 resistanceBitcoin researcher Axel Adler Jr. noted that exchange inflows totaled over 17,000 BTC across Jan. 20–21, including 9,867 BTC on Jan. 20 and 6,786 BTC on Jan. 21.

That contrasts sharply with January’s average daily netflow range of –2,000 to +2,000 BTC.

Though netflows have since normalized to +296 BTC, the accumulated inflows create a supply overhang near current levels, making the $89,000–$90,000 zone a key test of resistance.

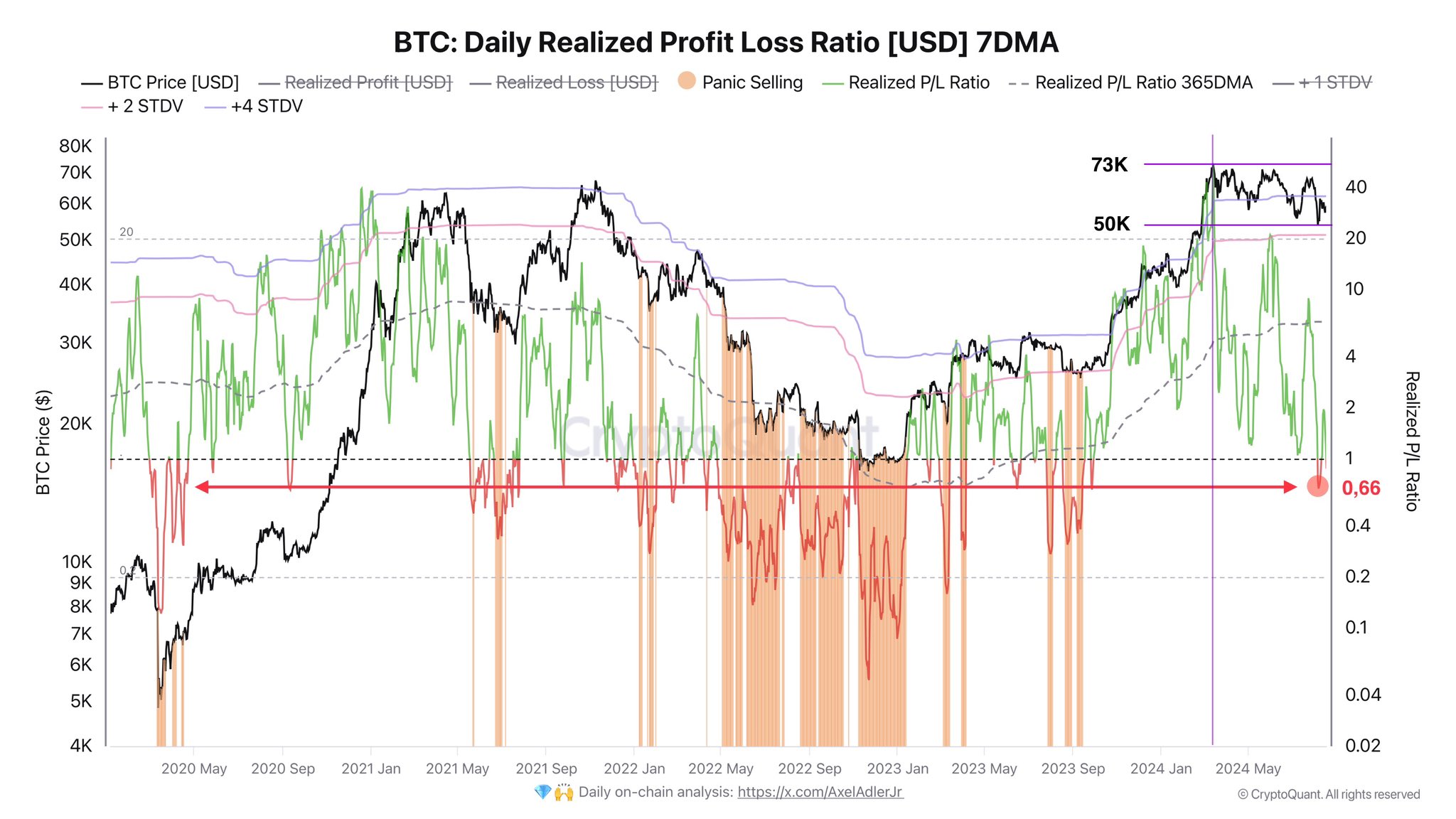

Profitability dips for recent buyersShort-term holder SOPR, which gauges whether recent buyers are selling at a profit or loss, slipped below the 1.0 break-even mark.

The seven-day SMA sits at 0.996, and at the recent price low near $87,500, SOPR fell to 0.965, implying an average 3.5% loss for short-term holders.

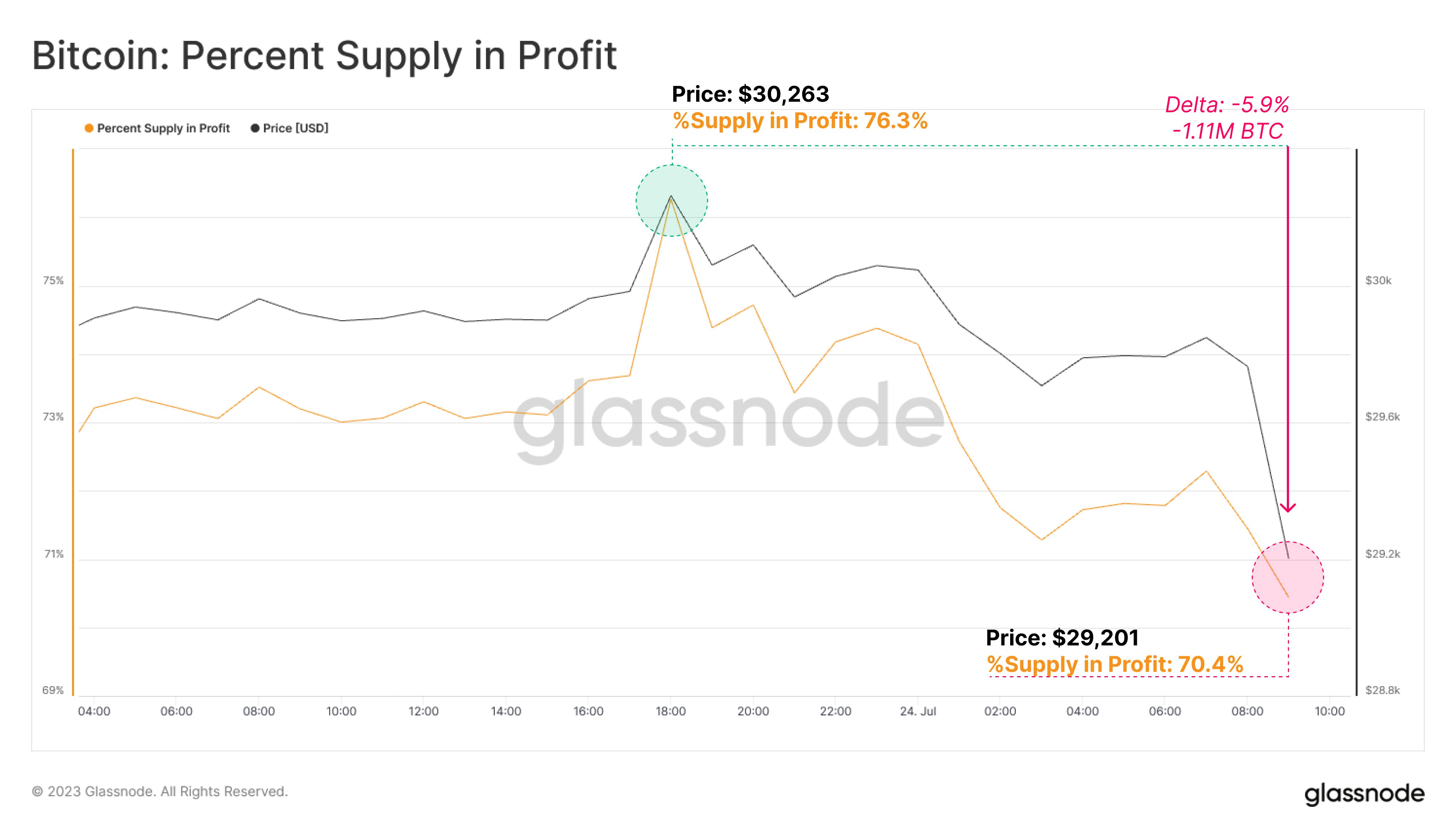

Spot demand improves, but remains lightGlassnode data points to an improving spot environment.

Binance and aggregate exchange cumulative volume delta (CVD) have turned buy-dominant, while selling pressure on Coinbase has eased.

However, the decline in overhead supply has yet to meet strong enough demand. Aggregate spot CVDs reached highs last seen in April 2025, a period that preceded range expansion, but current inflows remain insufficient to force a breakout.

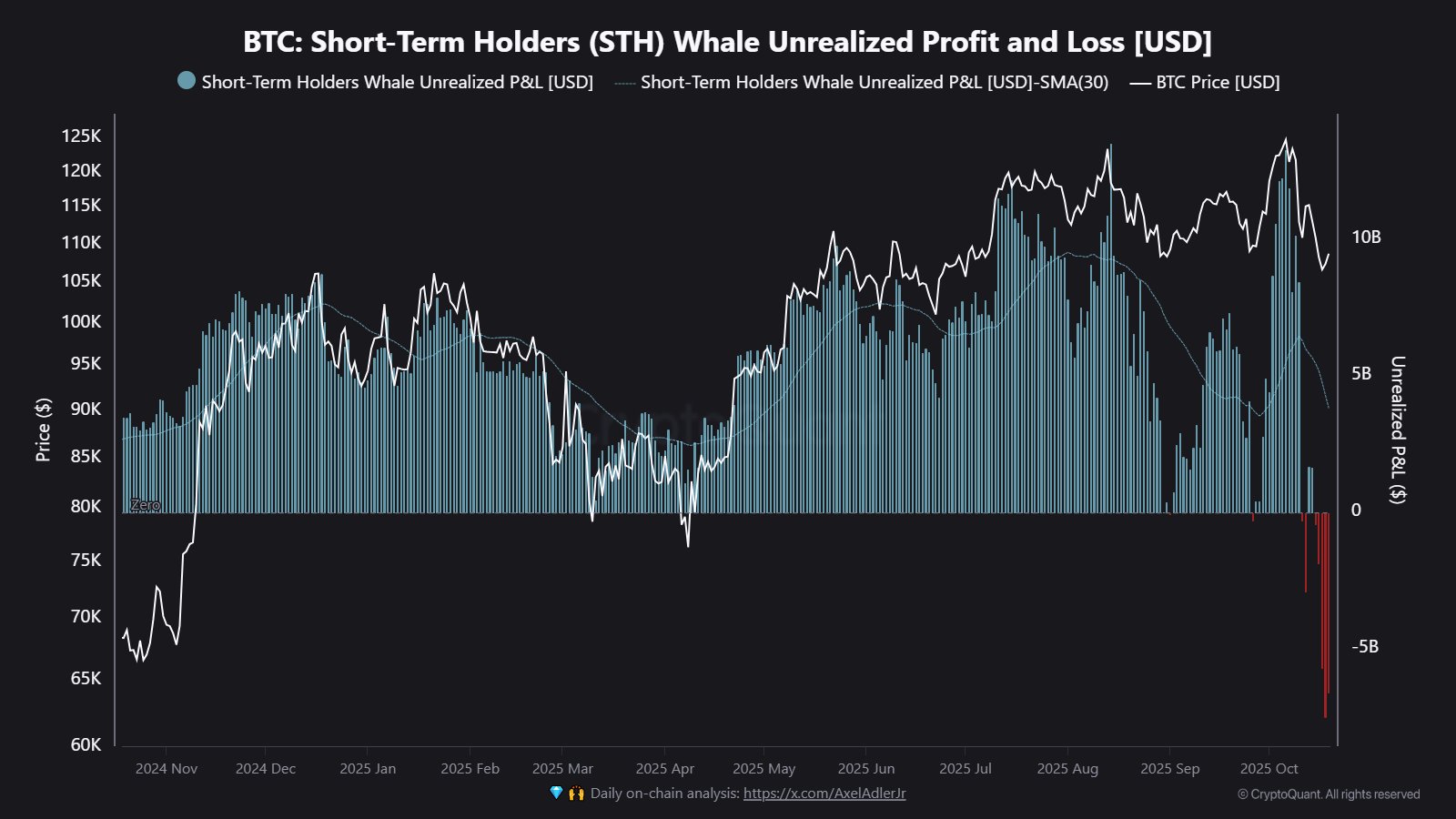

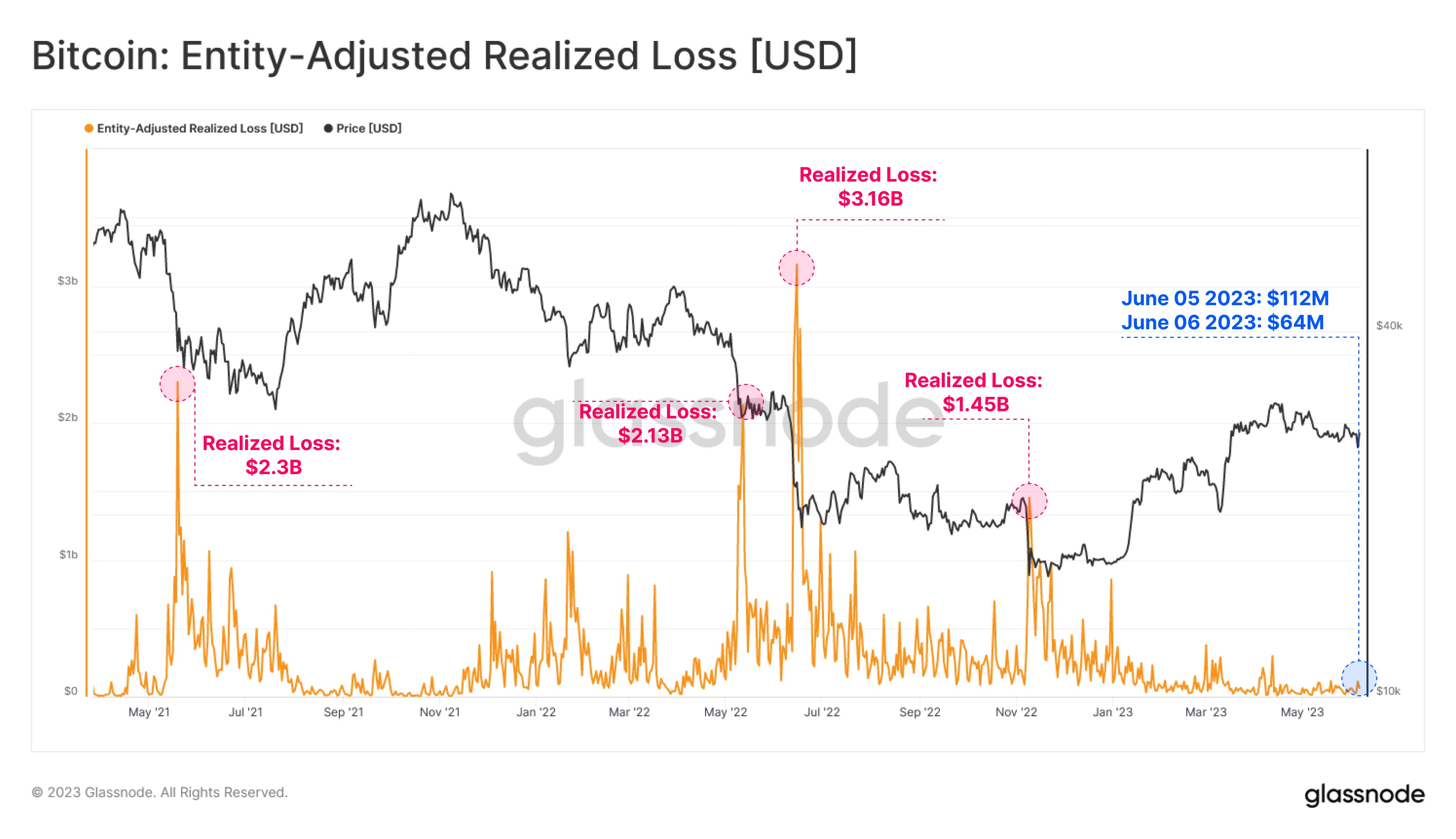

Holders flip to net lossesCryptoQuant data shows Bitcoin holders have entered a net realized loss phase for the first time since October 2023.

Since Dec. 23, investors have collectively realized around 69,000 BTC in losses, signaling a shift away from profit-taking conditions.

Realized profit momentum has weakened steadily since early 2024, posting lower peaks in Jan. 2024, Dec. 2024, July 2025, and Oct. 2025.

Annual realized profits have compressed to roughly 2.5 million BTC from about 4.4 million BTC in October, levels last seen in March 2022.

The firm draws parallels to the 2021–2022 transition, when profits peaked before flipping negative ahead of a bear cycle, describing the pattern as a cautionary sign rather than a forecast.

Underperformance versus goldCryptoQuant also notes Bitcoin remains in a steep bear trend against gold, with the BTC/XAU ratio extending months of decline.

Historically, such phases can take time to reverse, suggesting prolonged relative weakness may persist.

What to watch nextKey near-term markers include whether exchange inflows continue to ease, if SOPR can reclaim 1.0, and whether buy-dominant spot flows remain intact.

Stablecoin dynamics may also play a role: analyst Darkfost highlighted that the Stablecoin Supply Ratio saw its sharpest drop of the cycle following the recent correction, suggesting Bitcoin’s market cap fell faster than stablecoin liquidity.

Overall, the data points to a market balancing a supply overhang and weakening profit dynamics against early signs of spot stabilization.

Until buying conviction strengthens, rallies near $89,000–$90,000 may attract sellers, keeping volatility elevated.

The post Bitcoin stalls near $90K as exchange inflows jump and on-chain losses return appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|