2023-10-25 14:00 |

The potential approval of a Spot Bitcoin ETF by the US Securities and Exchange Commission (SEC) is expected to have significant effects on Bitcoin and the Spot Bitcoin ETF market. Addressing what investors can expect, the crypto research firm Galaxy Digital recently provided insights as to what could happen in the first three years upon the launch of this fund.

What To Expect In The First Three YearsIn a research paper released on October 24, Galaxy Digital’s research associate Charles Yu provided a vivid illustration of the heights a Spot Bitcoin ETF could attain in terms of market size and inflows in the first three years.

As to market size, Yu made his predictions on the addressable market size of a US Bitcoin ETF based on how they expect various wealth channels to adopt the fund. According to him, RIA (Registered Investment Advisor) will ramp up starting at 50% in the first year and increasing to 100% in the third year.

Meanwhile, broker-dealers and bank channels will ramp up at a slower pace, starting at 25% and increasing to 75% by the third year. If their assumption comes true, they estimate the market size to hit $14 trillion in the first year, $26 trillion in the second, and $39 trillion in the third year.

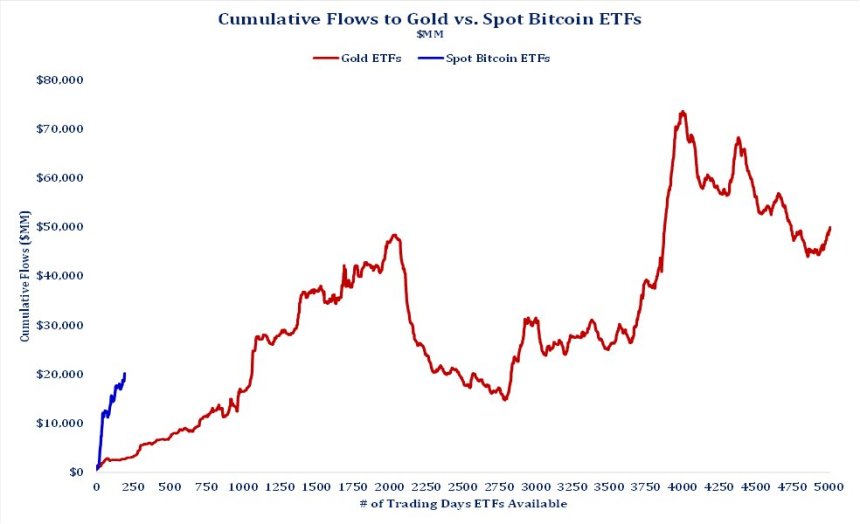

The firm’s estimates of inflows into the Bitcoin ETFs are based on their market size estimates. Going by this, they predict that these funds could see $14 billion of inflows in the first year, $27 billion by the second year, and up to $39 billion by the third year after launch.

Yu noted that factors such as a potential delay or denial of the pending Spot Bitcoin ETFs could affect their analysis. Other factors like poor price performance could also cause a low adoption rate, which they believe will potentially affect their estimates.

Potential Impact On Bitcoin’s PriceYu also provided insight into the effect that these Spot Bitcoin ETFs could have on BTC’s price. They predict that Bitcoin’s price could see a 74.1% increase in the first year of these funds launching. He made this estimate using the expected amount of inflows ($14 trillion), which is expected to come into these funds in the first year while making comparisons to Gold ETFs.

Source: Galaxy ResearchSpecifically, they project that Bitcoin’s price could see a 6.2% increase in the first month of these funds’ launch as they estimate an adjusted inflow of over $10 billion in the first month. This price increase in the first month is expected to keep ramping down to a 3.7% price impact in the last month of the first year of launch, all of which will cumulatively add up to the 74.1% increase.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|