2021-11-11 22:00 |

As prices for goods and services went up 6.2% compared to October last year, many see bitcoin as the preserve of value, despite its volatility.

Inflationary fears have sent Bitcoin skyrocketing to more than $69K in early trading on Wednesday morning, surpassing highs seen on Nov. 8, 2021. Inflationary fears have been stoked by a monthly consumer price index report released by the U.S. Department of Labor, with bitcoin going up by $2500 within approximately 45 minutes, of the report’s release.

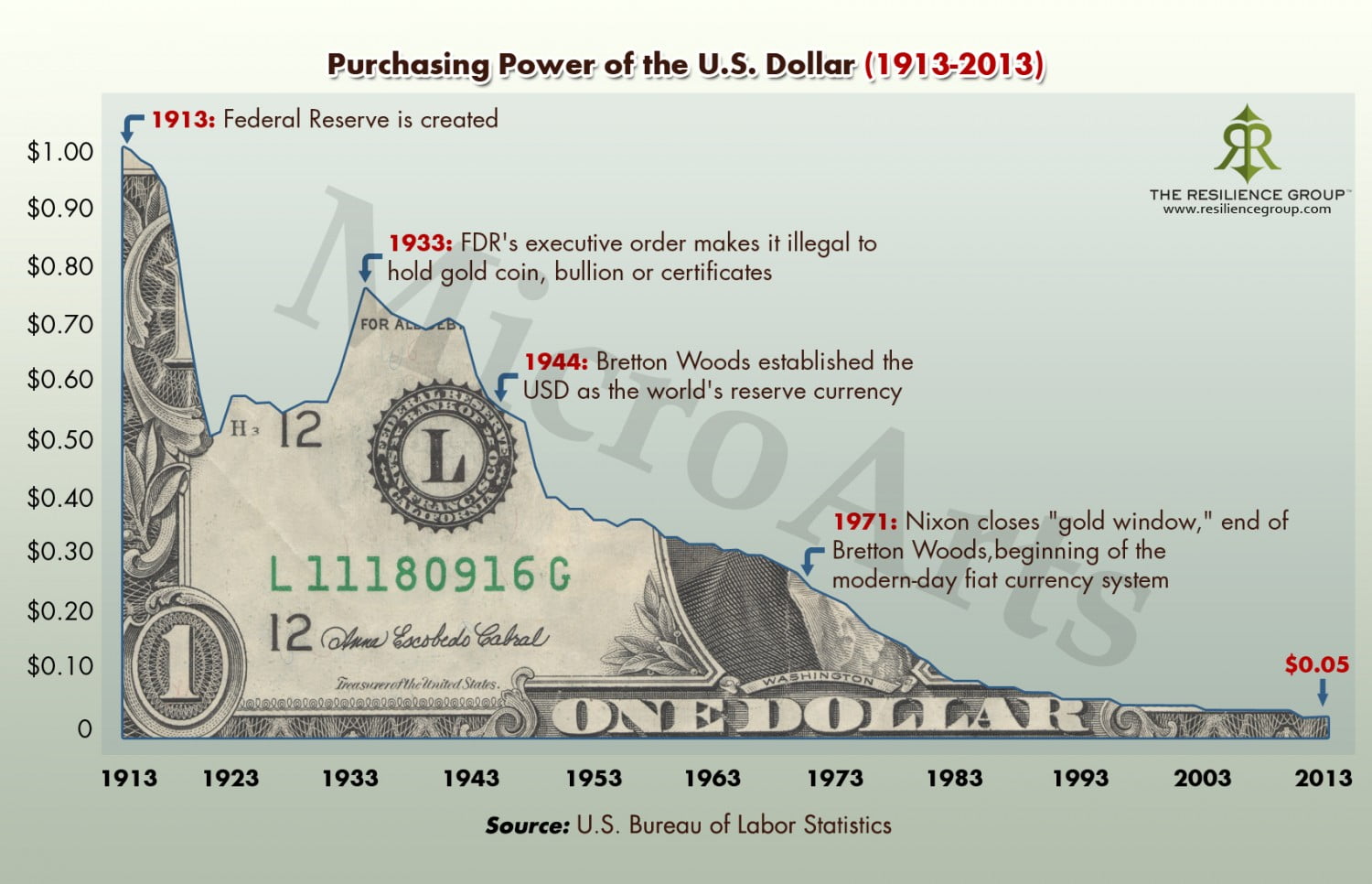

Inflation captures the increase in the price of a basket of goods and services. Increases in food, gas, and housing prices over the last few months have, amongst other items, outpaced economists’ predictions. Prices went up 6.2% compared to October last year, which is the largest annual increase since 1990. Stimulus checks and other money-printing activities reduce the value of the dollar, according to Nigel Green, the CEO of wealth advisory deVere Group. Bitcoin’s big advantage over fiat currency is that it has a limited supply of 21 million coins, which get progressively harder to mine, and can’t be devalued by over distribution by any government.

Hedge despite volatility?Both institutional and retail investors have taken to crypto during the pandemic as a hedge against inflation. Investors have previously used gold as an inflation hedge, which, according to Cam Harvey of Duke University, is prone to short-term volatility, despite its relatively stable value over many millennia. The chief purpose of an inflation hedge is to secure the purchasing power of money, but returns are generally expected from the hedging asset. The question is, are people buying bitcoin speculatively and driving up the price, and if so, are they really using it as an inflation hedge, or are they using it for short-term gains?

Bitcoin has appreciated in value immensely compared with gold, if one does a comparison from October 2009 to October 2021. Bitcoin has been rallying from August, right up until October, when the crypto community waited with bated breath for the launch of the first Bitcoin futures ETF. Bitcoin hit $66K following announcements by billionaire Paul Tudor Jones in late Oct 2021 that he views crypto as a better inflation hedge than gold.

The jury is still out on bitcoin vs gold as an inflation hedgeThere is a prevailing argument that gold’s scarcity and permanence, and ability to preserve value make it a better store of value than paper money, which can be printed at will and is dependent on governments. It is interesting to note, however, that only 15% of gold is held by individuals and ETFs, outside of jewelry.

Gold previously had a better reputation than crypto with investors, having been around for a long time. But this starting to change. Gold and bitcoin can coexist, according to George Milling-Stanley, chief gold strategist at State Street’s SPDR ETFs. It is interesting that it is not known how much gold remains to be mined from the earth, while the number of bitcoins that will exist in circulation is set to a maximum of 21 million, achieved by 2140.

What do you think about this subject? Write to us and tell us!

The post Bitcoin skyrockets to over $69K as inflationary fears confirmed appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|