2020-6-29 21:08 |

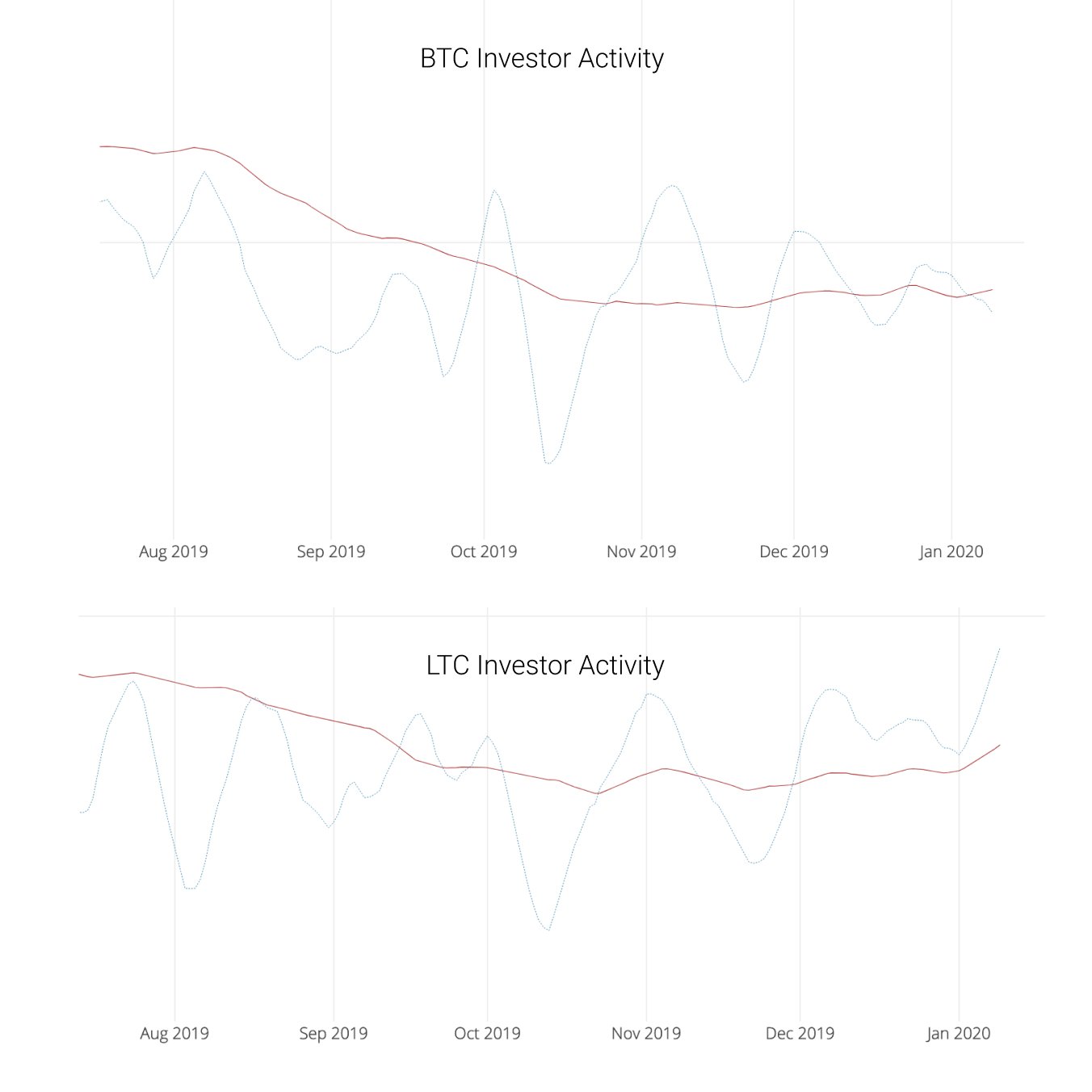

According to a new model that on-chain analyst Willy Woo is working on, bitcoin was setting up for a bull run when coronavirus pandemic – the white swan “killed the party.”

The model picks the start of exponential bull runs and it suggests that we are close to yet another bull run and it could take yet another month to go.

But the time taken by the bitcoin to start this bull run is actually a good thing because “the longer this bull market takes to wind up, the higher the peak price,” he said.

The market is currently in an accumulation mode with holders taking this time to stack the sats, and “a long sideways accumulation band is ultimately a good thing.”

”Very clearly shows how COVID was a model breaking outlier” – On-chain analyst Willy Woo

As we reported, there are several indicators pointing out that the accumulation is going on in the market and investor confidence is growing.

Bitcoin daily active addresses are approaching levels not seen since 2018 but at the same time, active supply has been falling. Active supply is a measurement of the amount of supply moved on-chain within the last x days or years and while short-term supply surged in early 2020, longer-term active supply has dropped.

The fact that 1 year and 2 years active supply has dropped to two-year lows implies that “supply is increasingly being held for periods longer than one year, which supports the narrative that BTC is used as a store of value,” said Nate Maddrey, Research Analyst at Coin Metrics.

About 10.35 million BTC has moved on-chain within the last two years and about 7.4 million within the last year. Also, only 38.93% of bitcoin supply was active within the last year, the last time it was under 40% was in May 2016.

At the same time bitcoin balance on exchanges has been dropping since March sell-off.

Source: Glassnode Bitcoin Exchange BalanceCurrently, 14.3% of bitcoin’s circulating supply, 2.6 million BTC is in centralized exchange wallets, as per Glassnode.

The largest bitcoin holder is Coinbase at 954k BTC. At 2nd spot is Huobi but with not even half of Coinbase’s balance at 364k BTC, followed by Binance’s 267k BTC.

Coin Metrics also notes that Gemini which has been a relatively small exchange compared to its competitors at the beginning of 2017 now holds more bitcoin than Bitfinex, Bitstamp, Bittrex, Kraken, and Poloniex.

Amidst this, bitcoin realized capitalization has recovered and reached a new all-time high of $106.97 billion. In contrast to traditional market capitalization which values each unit of BTC supply uniformly at current market price, realized cap is calculated by valuing each unit at the price it was last moved on-chain or transacted.

Meanwhile, bitcoin continues to rebound three months after the March crash, currently trading under $9,100 in red while managing a mere $767 million in ‘real’ trading volume.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,141.4101 change ~ 1.89%Coin Market Cap

$168.36 Billion24 Hour Volume

$2.84 Billion24 Hour VWAP

$9.09 K24 Hour Change

$172.7244 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|