2024-12-2 17:30 |

Bitcoin has entered a consolidation phase just below the $100,000 level, following an impressive rally that saw the price hitting all-time highs nearly every day for almost three weeks. While the market has quieted down recently, Bitcoin’s bullish momentum remains strong, and many analysts believe the pause is merely temporary before another upward push.

Top analyst Axel Adler shared data revealing that this week saw a record in realized profits for BTC, indicating that investors are locking in profits while still maintaining confidence in BTC’s long-term potential. This is an important signal, as it suggests that even as BTC takes a breather, demand for the asset remains high and healthy.

With the price stabilizing below the $100,000 mark, many traders and analysts are waiting for the next key move. The coming weeks will be crucial to determine whether BTC can break through this psychological barrier and continue its upward trajectory. As the market digests the recent gains, all eyes are on Bitcoin to see if it can sustain its bullish structure or if a deeper correction is on the horizon.

Bitcoin Demand Pushing The PriceBitcoin has experienced unprecedented demand over the past few weeks, as the price made a historic move from $67,000 to $99,000 in less than 20 days. This surge represents one of the most rapid price advancements in Bitcoin’s history, highlighting the strength of market optimism and growing institutional interest. Following this meteoric rise, BTC finally retraced from its all-time high (ATH), but the pullback was short-lived. The price quickly recovered and has been consolidating just below the key $100,000 level, signaling that bullish momentum remains intact.

Axel Adler shared insightful data revealing that BTC saw a record in realized profits this week, which underscores the market’s robust health. Realized profits occur when long-term holders lock in gains, indicating confidence in the asset’s future potential.

In addition to this, Bitcoin’s price has nearly returned to the November 22 peak, showing the resilience of the current rally despite the brief retracement.

Current demand for BTC is absorbing all available sell-side supply, suggesting that eager buyers outmatch sellers. This is a key indicator of a very bullish market, as it shows that market participants are confident in Bitcoin’s long-term growth potential.

With strong fundamentals and sustained buying pressure, BTC appears poised for continued growth, with the psychological $100,000 level now acting as a pivotal support point. If BTC can maintain this consolidation, the next leg up could push the price to new all-time highs in the near future.

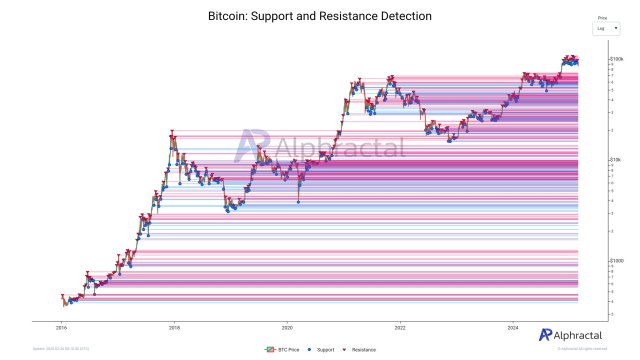

BTC Holding StrongBitcoin is currently trading at $96,500 after marking a new low of $90,700 and consolidating below the $100,000 mark. The price has managed to push above the $93,000 level but is struggling to break through the $97,000 resistance, creating some uncertainty among investors who anticipated a quicker move above $100,000. Despite this struggle, BTC remains fundamentally strong, and the price action continues to show resilience.

While the delay in surpassing the $100,000 level might cause some confusion and hesitation, it’s important to note that consolidation phases are often part of healthy market movements. Investors should be prepared for the possibility that BTC may take some time before it can decisively break above $100,000. In the event that the price fails to hold current levels, it may experience further consolidation or retrace to find liquidity around $85,000, where strong support could emerge.

Such a pullback would likely be seen as an opportunity for long-term holders, as Bitcoin’s fundamentals remain intact. After finding support, BTC could resume its upward trajectory toward the $100,000 level and potentially break into new all-time highs. As always, investors should closely monitor the market for signs of further price stabilization.

Featured image from Dall-E, chart from TradingView

origin »Bitcoin (BTC) на Currencies.ru

|

|