2020-10-1 16:13 |

Several on-chain metrics are pointing to a bullish 2020 closeout for Bitcoin (BTC).

The top-ranked crypto by market capitalization is up almost 50% year-to-date (YTD). However, while the bull case for BTC remains strong, price drawdowns below the $10,000 could occur in the short-term, providing an opportunity for more accumulation of cheaper bitcoin.

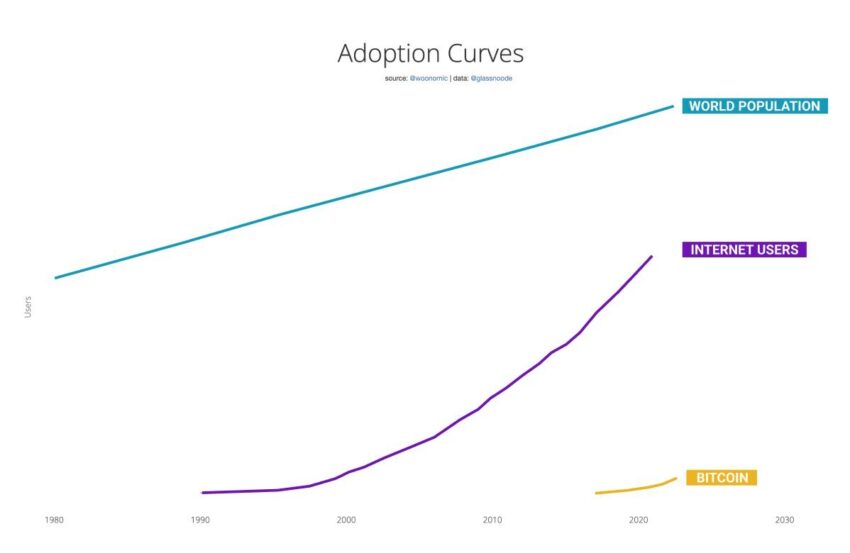

Bullish Q4 2020 in Store for Bitcoin?Tweeting on Sept. 30, Bitcoin analyst Willy Woo provided evidence supporting a bullish end to 2020 for the BTC price. According to Woo, the current spike in activity by new participants signals an imminent upward movement in price.

Data from on-chain analytics platform Glassnode shows a significant uptick in the number of new entities. However, this surge is yet to trigger any meaningful price advance, which Woo describes as divergence.

With price action still locked in sideways accumulation, the Bitcoin analyst opines that the current divergence is bullish for BTC.

Source: TwitterThe divergence shown in the chart above is likely due to institutional buyers electing to utilize “iceberg orders” — large buy orders deliberately divided into smaller limit orders to obfuscate the actual size of the position.

Microstrategy, the Nasdaq-listed company that recently adopted BTC as a treasury asset, reportedly used a similar technique during its $425 million bitcoin acquisition. Iceberg orders also eliminate the occurrence of massive market movements on single bulk purchases.

Apart from new entities, the Bitcoin difficulty ribbon chart is another indicator of an upcoming upward advance for BTC. The difficulty ribbon tracks the impact of mining on the BTC price.

The general rule of thumb with the metric is that compression phases translate to bearish price action while expansion phases signal upward price growth.

As part of Woo’s analysis, the statistician revealed that the Bitcoin difficulty ribbon is out of the compression phase, which held sway since the coronavirus price crash of Black Thursday in mid-March. The metric has now flipped bullish with the start of “healthy expansion.”

While the Q4 2020 outlook for bitcoin appears bullish, BTC remains unable to stay above the $11,000 price mark. However, bitcoin has also set a new record for the most consecutive days above $10,000.

The post Bitcoin Set for Bullish End to 2020 Based on Multiple Indicators appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|