2020-11-18 21:00 |

Bitcoin and the aggregated crypto market are pushing higher today, with BTC breaking above $17,000 while Ethereum helps lead altcoins higher as well The benchmark cryptocurrency hasn’t seen much selling pressure at this level, despite it long being viewed as resistance It has struggled to break above this level a few times, but the selling pressure here has not catalyzed any sharp selloff Where it trends next will depend largely on whether or not it can firmly surmount this level before tonight’s daily candle close A firm close above here could help further perpetuate what one firm is describing as the “longest and most stable” rally that Bitcoin has ever seen

Bitcoin’s intense uptrend is showing no signs of slowing down anytime soon. The crypto is now pushing $17,000 as bulls look to make a sustainable break above this crucial level.

Whether or not it is surmounted in the near-term will depend largely on whether or not bears attempt to reverse the uptrend at this point. There are already serious signs of exhaustion amongst sellers, so they may not be in a position to catalyze a selloff.

Where the entire market trends next will depend entirely on Bitcoin and how it reacts to this crucial level.

Bitcoin Pushes Towards New Yearly Highs as Selling Pressure FadesBitcoin has yet to face any intense selloffs throughout the course of its recent uptrend.

At the time of writing, BTC is trading up just over 2% at its current price of $17,010, which marks a slight break above this crucial level.

Bulls have tried to spark multiple rejections at this level, but they don’t appear to be too strong for the time being.

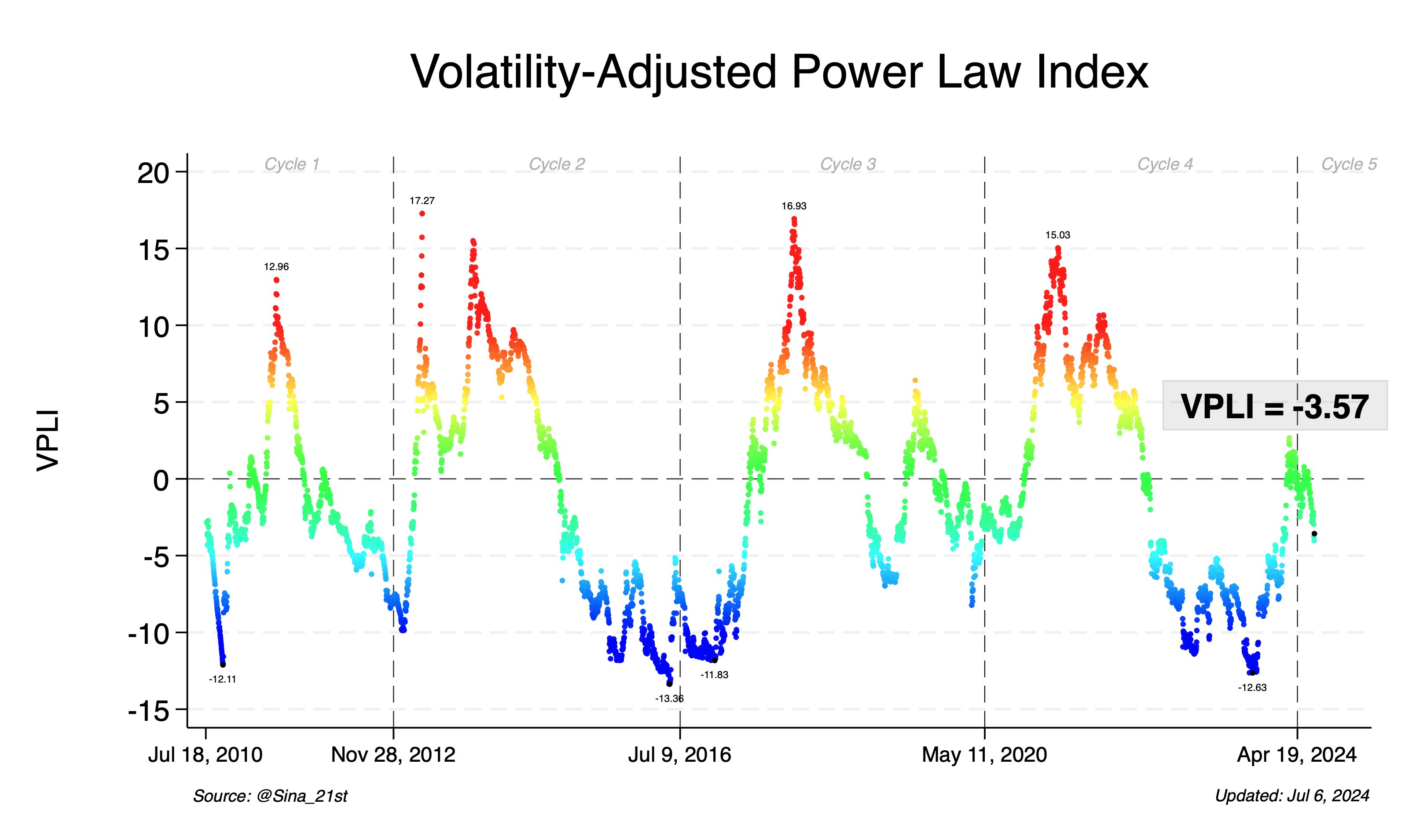

Firm: BTC Seeing the “Longest and Most Stable” Rally EverOne trading firm spoke about Bitcoin’s recent uptrend in a tweet, explaining that over the past 73 days, bulls have sent its price rocketing by roughly 73%.

They deem this the “longest and most stable” rally that Bitcoin has seen in its history, as vertical movements like this are typically fast and short-lived.

“This BTC move is becoming the trendiest (longest & most stable) rally in BTC’s history – 73 days and +73% now with only two 10% retracements along the way,” they explained.

Image Courtesy of QCP Capital. Source: BTCUSD on TradingView.The coming few days should provide insights into the sustainability and longevity of this ongoing rally and into just how far it may extend before bears gain some traction.

Featured image from Unsplash. Charts from TradingView. origin »Level Up Coin (LUC) на Currencies.ru

|

|