2026-1-17 03:00 |

Sentora’s terse X post on Friday cut to the chase: “This week saw a massive shift towards BTC accumulation with -$1.65 billion in net outflows from exchanges. This indicates a strong preference for cold storage holding, effectively creating a supply shock that removes significant liquidity from the sell-side order books.”

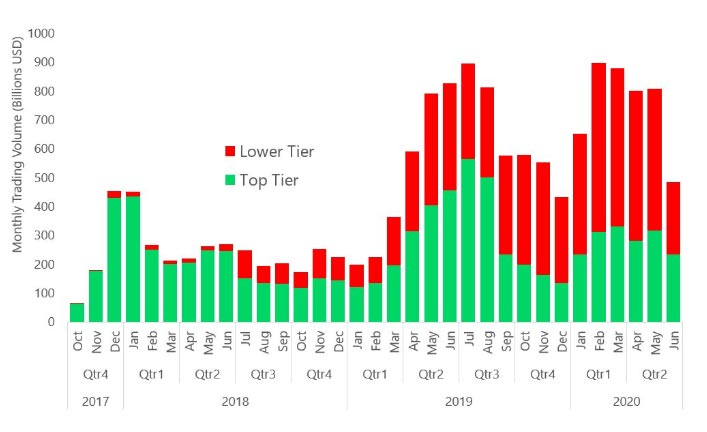

The datapoint, echoed by the image Sentora shared showing Bitcoin priced near $95,260 with total on-chain fees of $1.60M and exchange net flows of -$1.65B, shows a market increasingly moving coins off exchanges and into long-term storage.

That trend shows up in price action. Bitcoin changed hands around the mid-$95,000s on Friday, recovering from a brief run above $97,000 earlier in the week before traders pared back positions amid regulatory chatter.

Why Does the Outflow Number Matter?When large volumes leave centralized exchanges, especially in the hundreds of millions or billions, the immediate pool of coins available for sale shrinks. Traders and institutional players pointing to “cold storage” accumulation see this as a classic supply-shock setup: less available inventory on exchange order books can amplify a buying impulse, turning modest demand into steeper upside moves if fresh bids appear.

Analysts have been flagging this dynamic for weeks as a potential tailwind for Bitcoin. Still, the market isn’t running away. Headlines about U.S. regulatory uncertainty, including delays and debates around the Digital Asset Market Clarity Act, dented confidence at times this week, producing short, sharp pullbacks after the midweek rally.

Regulatory developments were the proximate cause when Bitcoin slipped from intraday highs back toward the $95k area. Traders are watching both the policy calendar and ETF flows for confirmation of a sustained trend. Institutional flows remain a mixed signal.

Spot Bitcoin ETFs have at times provided steady demand, but other data shows rotation and intermittent outflows across some funds, a reminder that capital is large but mobile. That makes the exchange-balance story especially important.

Even modest, steady accumulation into cold wallets can have an outsized effect on price if ETF and spot demand re-accelerates. Technically, traders say $90,000 is a nearby floor while $97,000–$100,000 is the immediate band of resistance to clear before the market feels comfortably bullish again.

If Sentora’s outflow signal continues, and on-chain metrics keep showing declining exchange inventories, the path of least resistance is higher, though timing could be abrupt; supply shocks have a way of sparking fast moves once demand lines up. For now, investors appear to be choosing patience: hold the coins, remove liquidity, and let price discovery work itself out.

Whether this week’s -$1.65 billion is the start of a longer accumulation cycle or a one-off repositioning will depend on how policy, ETF flows and macro headlines evolve next week. For traders and hodlers alike, the message is clear: liquidity is thinning, and that changes the game.

origin »Bitcoin price in Telegram @btc_price_every_hour

SIMBA Storage Token (SST) на Currencies.ru

|

|