2024-11-8 15:30 |

On-chain data shows the Bitcoin retail volume has sharply increased recently as the cryptocurrency has surged to a new high.

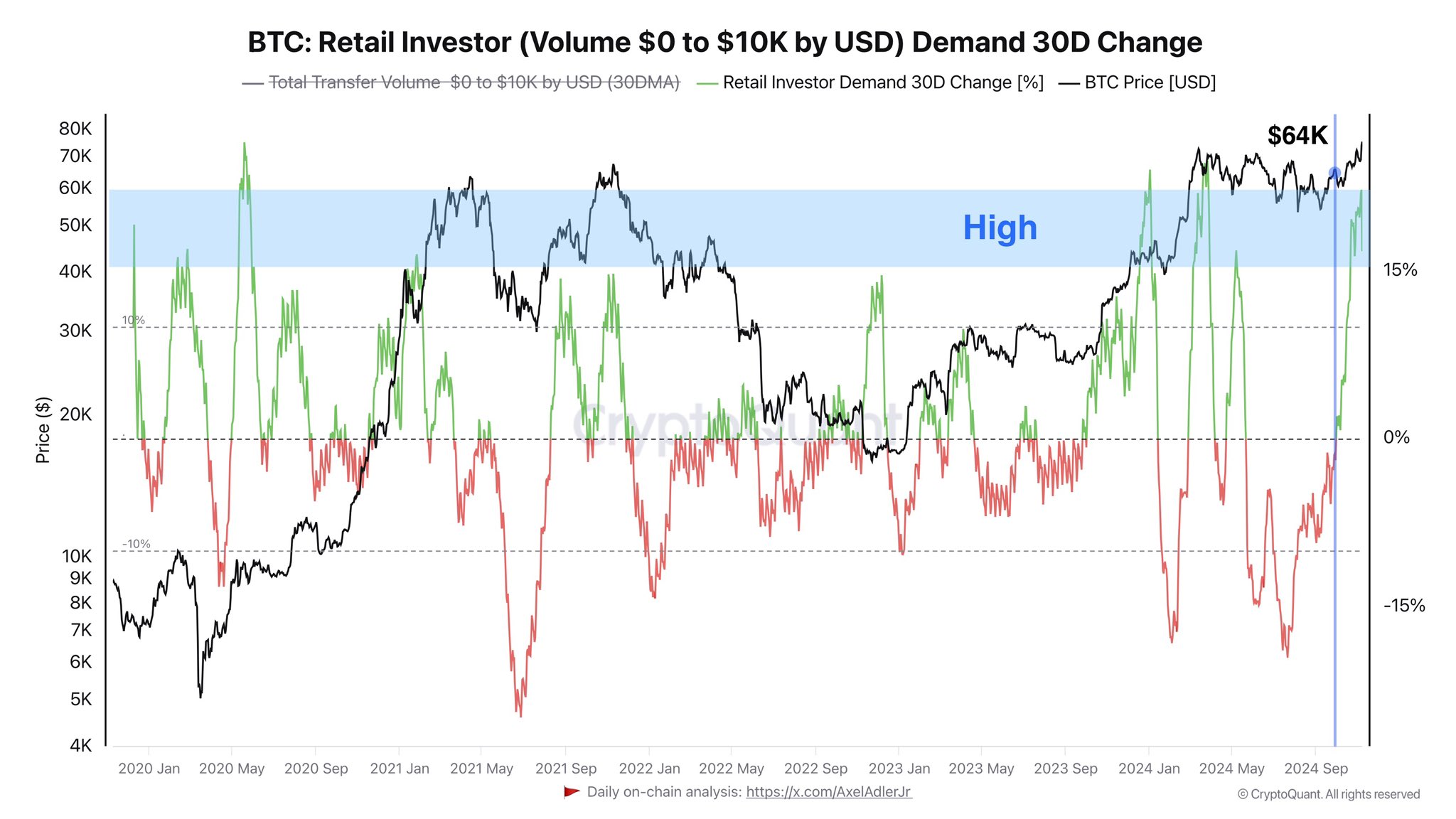

Bitcoin Retail Volume Is Up More Than 15% Over Last 30 DaysAs explained by CryptoQuant author Axel Adler Jr in a new post on X, the demand from retail investors has gone up recently. Retail investors typically refer to the part of the BTC userbase with the smallest holdings.

One way to gauge the demand from these investors is through their transaction volume. Given the small size of their holdings, these holders don’t make too large transfers, so their volume can be determined by only keeping track of the transfer data, which has a value of less than $10,000.

Below is the chart shared by the analyst, which shows the trend in the 30-day change of the retail investor transfer volume over the last few years.

As displayed in the graph, the Bitcoin retail transfer volume saw a negative 30-day change earlier, but it has seen a flip with the recent rally in the asset’s price. The indicator has now surged to significant positive levels, which suggests interest from this group has been sharply growing recently.

Retail investors being attracted to the network isn’t unusual during a volatile period like the one BTC has witnessed recently, as these holders tend to find such times exciting.

The chart shows that this cohort showed a similar burst of demand back during the rally of the first quarter of the year. Similar trends were also observed on multiple occasions in the 2021 bull run.

Historically, rallies that have failed to amass retail interest have usually ended up not lasting for too long, as the influx of investors tends to sustain such runs. From this perspective, the current rally appears safe, as retail volume has increased by more than 15% over the past month.

Another indicator for measuring demand related to Bitcoin is the Coinbase Premium Index. This metric keeps track of the difference between the Bitcoin prices listed on Coinbase (USD pair) and Binance (USDT pair).

This indicator does not reflect the demand from retail investors but from American institutional investors, who have a strong presence on Coinbase.

As CryptoQuant head of research Julio Moreno pointed out in an X post, the Bitcoin Coinbase Premium Index has recently shot up into the positive region.

A positive value of the index suggests BTC is trading at a higher price on Coinbase as compared to Binance, which in turn implies the US-based whales are showing demand for the cryptocurrency.

BTC PriceBitcoin is looking to explore another high as its price has surged back to the $75,900 mark.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|