2024-5-7 22:00 |

Well-known cryptocurrency analyst and trader Rekt Capital has revealed an intriguing finding regarding Bitcoin’s price trend in a recent analysis. His ground-breaking prognosis reveals that the crypto asset is mirroring historical price action that took place during a bull cycle eight years ago.

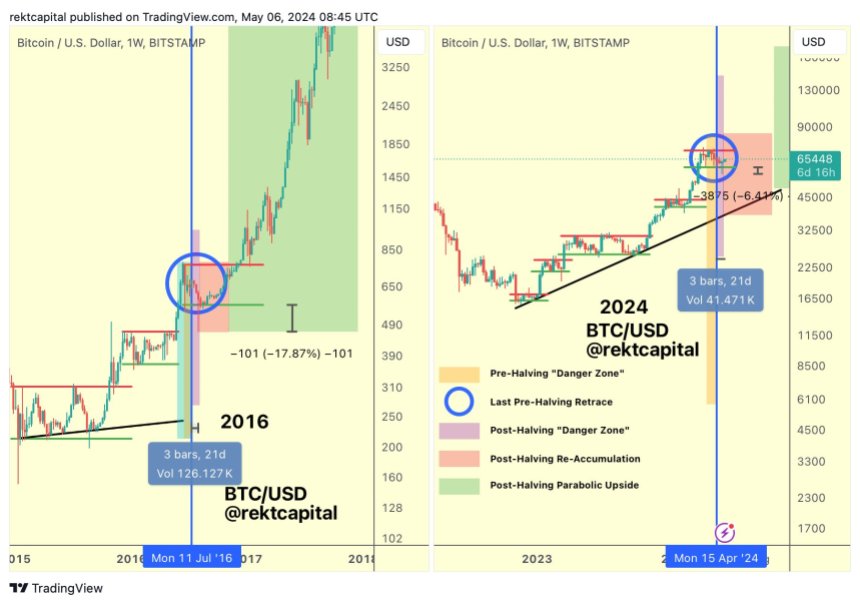

Similar Historical Price Tendency In BitcoinRekt Capital asserted that the way Bitcoin is reiterating a past price trend from a cycle 8 years ago is amazing. Given the magnitude of the 2016 bull cycle, BTC could be poised for significant growth in the upcoming months. During the 2016 bull cycle, BTC witnessed a notable growth of nearly 3,000%, following the conclusion of the Bitcoin Halving event.

Moving on, Rekt Capital drew attention to his previous post regarding Bitcoin’s post-Halving movement, which he dubbed the Post-Halving Danger Zone. According to the analyst, the digital asset is currently caught up in this zone.

He further noted that Bitcoin has veered to the negative below the current Re-Accumulation Range Low, repeating the pattern that began in 2016. In 2016, the move below the re-accumulation range was about 17%. However, this divergence in 2024 is down by 6%.

Rekt Capital previously affirms in 2016, about 21 days after the Halving, Bitcoin saw a lengthy -11% decline before transitioning toward the upside.

Thus, if there should be downside volatility in this cycle around the Re-Accumulation Range Low, 2016 data indicates that BTC could turn to the upside in the next 10 days, considering the post time.

Even though the Post-Halving “Danger Zone” ends in the upcoming days, particularly four days from now, Rekt Capital stated that 2016 data proves that there may be some negative volatility at the $60,600 Range Low in the interim.

Pre-Halving Danger Zone For BTCNotably, the expert also identified a Danger Zone before the event, where previous Pre-Halving retraces have always started. According to Rekt Capital, pre-Halving retracements have historically been seen in Bitcoin between 14 and 28 days before the event, and this cycle hasn’t been any different thus far.

He stated that Bitcoin saw its first pre-Halving retrace of -18% about 30 days before the Halving, while in 2016, the pre-Halving retrace started 28 days before the event, suggesting BTC could move in the same direction as that of 2016. Due to this, Rekt Capital is confident that a potential danger zone could occur after Halving.

However, the retracement from the current all-time high has now proven to be deeper and longer than past retracements, spanning several weeks. Consequently, the expert predicted a high probability that Bitcoin prices may have reached a bottom.

At the time of writing, the price of Bitcoin was seeing a positive sentiment, rising by 0.43% to $64,126 in the past day. Both its market cap and trading volume have increased by 0.50% and 24.43%, respectively, in the last 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|