2018-12-13 03:08 |

Bitcoin has recovered its $3,500 support level after seeing slight losses to trade just above $3,400. In the past 24 hours, the currency has gained a modest 1.76 percent to trade at $3,500 on most major markets. On Bitfinex, the currency was trading at $3,538 at press time. Most of the other cryptos have seen green as well, with EOS leading the charge at 7.3 percent. The Ethereum competitor has regained the lead over Bitcoin Cash, jumping to the sixth position.

The current battered market provides the best opportunity to get into the market. This is according to leading ratings provider, Weiss Ratings in its latest research on the crypto market. According to the firm, investors underestimate the potential of the technology behind cryptos in the long term. The ratings also come just after Google revealed that Bitcoin was the most searched keyword in the ‘What is’ category in 2018.

The Market Is Still UnstableStability is something we took for granted in the three months before mid-November. However, since then, the industry has been earnestly waiting for the market to find some sort of stability. Looking at the current market, this may not happen this year.

In the past 24 hours, the crypto king has risen from just under $3,400 to reclaim the $3,500 level. This level doesn’t look stable yet and could crumble, especially given Bitcoin’s inability to maintain upward momentum past this level. The daily trading volume hasn’t been promising either. Since the week began, the volume is yet to hit $5 billion, down from $6.9 million registered on Friday.

The Best Time to InvestIt’s been one of the most popular debate topics: is it the best time to buy the dip? Many analysts have suggested that it might not yet be as the market could tank even further. One of them is Vinny Lingham, the founder and CEO of Civic. Langham believes the current risks don’t justify the expected gains.

However, a rating firm disagrees. According to Weiss Ratings, this is the best time to invest. The Jupiter, Florida-based firm stated:

The recent price decline in crypto has proved that people overestimate the potential for technology short term and underestimate it long term. We believe that the cryptoassets will revolutionize financial services — for those who play the long game

Analysts at Weiss recently looked at the anticipated triggers of a bull run in the crypto market. Led by elite DLT engineer Bruce Ng, the firm came up with the launching of Bakkt as the biggest trigger to an expected bull run next year.

Bakkt will launch in January and could bring in the elusive institutional investors. While these investors have been suspected to be doing business in over-the-counter markets, Bakkt would make the process transparent creating more faith in the market.

Bruce wrote:

In the long term, however, the outlook is much clearer: Projects like Bakkt could greatly enhance the liquidity, stability and overall size of crypto, helping to create a multitrillion-dollar global marketplace unlike any we’ve seen before.

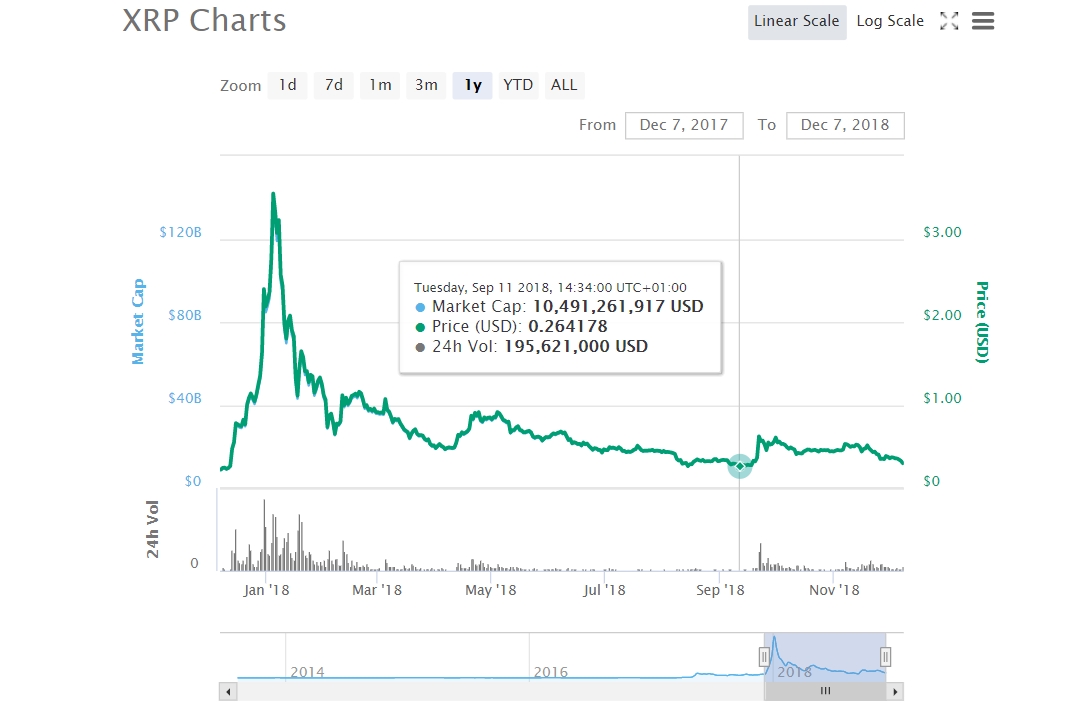

Bitcoin Tops 2018 Google Search‘What is Bitcoin?’ This is a question that has seemingly plagued many. According to Google, more people were curious about Bitcoin on the ‘What is’ section than any other term in 2018. In the ‘How to’ section, how to buy ripple was fourth, perhaps underlining the rising prominence of the world’s most valuable altcoin.

Overall, the world cup was the most searched term, predictably so. Hurricane Florence, Mac Miller, election results and Meghan Markle also made it into the list of the top ten.

The post Bitcoin Recovers $3,500 As Weiss Ratings Reveals This Is The Best Time To Invest appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Safe Trade Coin (XSTC) на Currencies.ru

|

|