2018-8-29 08:43 |

After all the pessimism surrounding the fall of Bitcoin, the bulls have finally taken the charge. On Tuesday, August 28, the Bitcoin price climbed by $300, rising above $7000 finally giving some hope to the investors. In addition to the Bitcoin price, the recovery was reflected in the overall market that added $12 billion to the overall valuations.

It looks like investors have decided to move ahead from their expectations of the arrival exchange-traded-funds (ETFs). This month the regulatory watchdog – Securities and Exchange Commission (SEC) – rejected a series of ETFs claiming that the market players are still not ready to handle risks and volatility of the crypto market, and thus fall short in protecting the investor’s interest as per the agency. Moreover, several cryptoanalysts and experts say that they don’t foresee Bitcoin ETFs to be coming anytime before 2019.

Last week, while commenting on the Bitcoin ETFs, Mati Greenspan – eToro senior market analyst described ETFs as something “not necessarily a defining moment for crypto” but which “could potentially help put a bottom on prices.” Last week, the U.S Commodities Futures Trading Commission (CFTC) released a Commitments of Traders (COT) released a report showing that there is a decline in the bearish position of the non-commercial contracts of Bitcoin (BTC).

Last week on CNBC’s Fast Money programme, analyst Brian Kelly reported that the Bitcoin futures market is signally a significant increase in demand and maturity. He said:

“Here’s CME Futures open interest of large holders. [As of] April, you’re starting to see a big increase… about an 85 percent growth rate. If you extrapolate that out, by February 2019, you’re going to have a very robust market here.”

With the SEC reviewing its decisions on #bitcoin ETFs, @BKBrianKelly breaks down when the #crypto funds could finally come to market. pic.twitter.com/LQtj2BQisE

— CNBC's Fast Money (@CNBCFastMoney) August 23, 2018

Bitcoin Hash Rate on a Steep Rise in AugustThe strength of the Bitcoin network is growing further as the Bitcoin hashrate has attained a new all-time record of 62 quintillion hashes per second. In the month of August itself, the hash rate has surged by 50%. A higher hashrate means an increase in the speed at which computations take place on the Bitcoin network which, in turn, means there is a higher miner engagement on the Bitcoin network.

In the last six months, the Bitcoin hashrate has surged by 150 percent which is pretty impressive considering the fact that Bitcoin price has corrected by 70% since its all-time high in December 2017. Max Keiser, a former Wall street trade and financial analyst, said that he is very much confident that going further, the price of Bitcoin will follow the hashrate.

Based on my HR analysis, new ATH incoming. $28,000 still in play. pic.twitter.com/hYgPti1cqn

— Max Keiser (@maxkeiser) August 28, 2018

Not Everyone Bullish About BTC Price RiseAlthough a few analysts have been showing positive indicators for the bitcoin price going ahead, some still believe that the bear market phase is not completely over. Erik Voorhees, the founder and CEO of ShapeShift, said that bear will continue to rule until the market shows signs of stability and achieves major resistance levels. Voorhees said:

“I don’t expect it (bear market) to end soon, although I do think that the rate of collapse has slowed considerably. Generally in these bubbles, after you go through several months of a downtrend you hang out in a range for a while… But I think we are done with a majority of the collapse.”

While considering the parabolic chart patterns of the Bitcoin price in the past, Venture Capitalist Anthony Pompliano said that he expects Bitcoin to correct further by more than 50% and reach up to $3000 before finally starting its journey northwards.

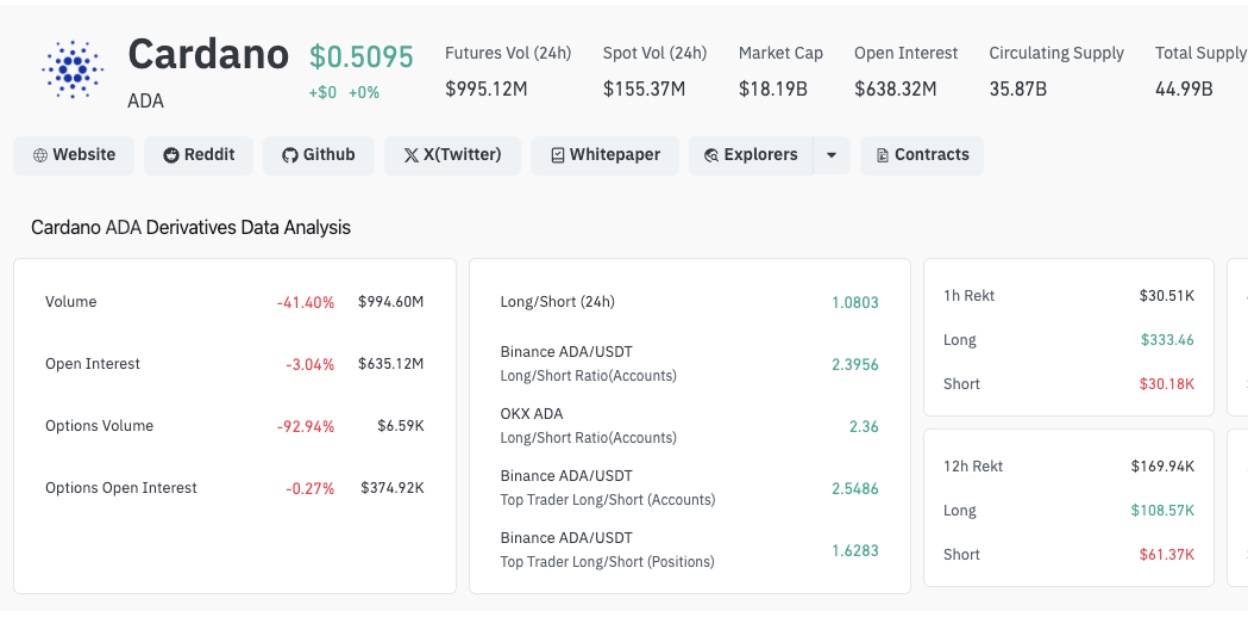

At the press time, Bitcoin is trading for the price of $7052 with a market cap of $121 billion, according to the data on CoinMarketCap. Along with Bitcoin, major top-ten altcoins like Ripple, Cardano, and Litecoin surged by 7-10% on Tuesday.

The post Bitcoin Puts All the Pessimism at Rest, Rises Above $7000 appeared first on CoinSpeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|