2024-10-23 16:00 |

On-chain data shows the Bitcoin Profitability Index is at 202% right now. Here’s how this compares with past bull runs of the asset.

Bitcoin Average Profitability Index Has Been Rising RecentlyIn a new post on X, CryptoQuant author Axel Adler Jr. discussed the latest trend in the Average Profitability Index of Bitcoin. The “Average Profitability Index” is an on-chain indicator that tells us about how the spot price of the asset compares against its realized price.

The “realized price” here is a measure of the cost basis of the average investor or address on the Bitcoin network. The Average Profitability Index is calculated as a percentage, with the 100% mark corresponding to the spot price being equal to the realized price.

When the value of this indicator is greater than 100%, it means the asset is currently trading above the cost basis of the average investor, so the overall market could be assumed to be in a state of profit. On the other hand, it being under this cutoff suggests the holders as a whole are carrying their coins at a net unrealized loss.

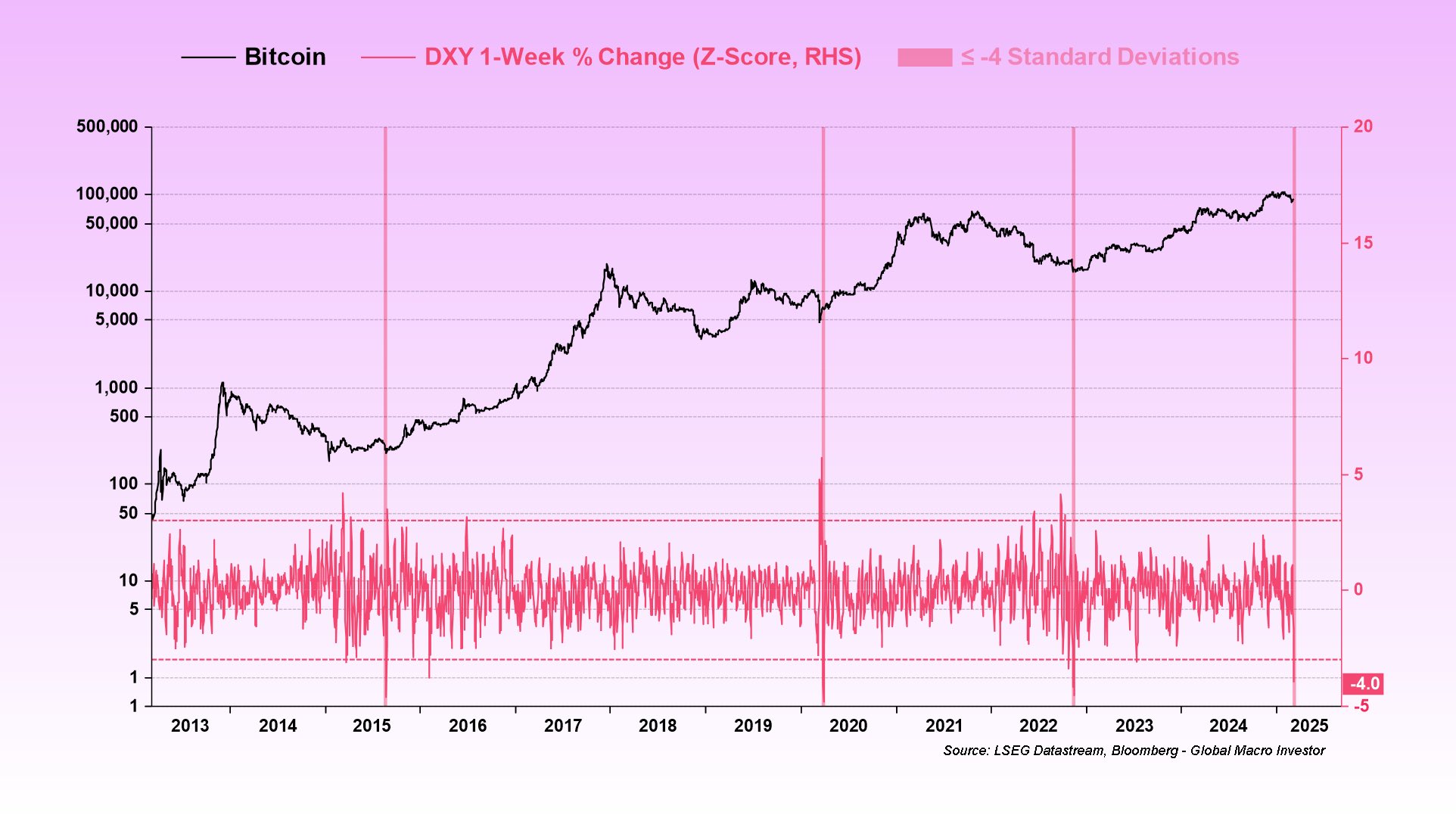

Now, here is a chart that shows the trend in the Bitcoin Average Profitability Index over the past decade:

As displayed in the above graph, the Bitcoin Average Profitability Index has been above 100% since last year, which suggests the investors as a whole have been enjoying profits.

The indicator’s value had spiked to particularly high values earlier in this year when the rally towards the new all-time high (ATH) had occurred. With the latest recovery run that the coin has seen, the indicator has been picking up once again, although it’s still a notable distance away from the level seen during the ATH.

At present, the BTC Average Profitability Index is floating around 202%, which implies the spot price is double that of the realized price. Historically, the indicator reaching extreme levels has generally led to tops for the asset.

This is because the investors’ temptation to participate in profit-taking increases the larger their gains. “When the index rises above 300%, investors are likely to start taking profits actively,” notes the analyst.

The chart shows that the last two times that the Bitcoin Average Profitability Index surpassed this 300% mark was during the heights of the 2017 and 2021 bull runs.

Thus, according to this historical pattern, Bitcoin’s current bullish period may not end until the indicator enters the zone above 300%.

BTC PriceAt the time of writing, Bitcoin is trading at around $67,400, up 1% over the last seven days.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|