2025-1-10 18:30 |

Bitcoin’s price action has been turbulent, with the leading cryptocurrency declining from its all-time high of $108,384 to a recent low of $91,350.

The significant drawdown is largely attributed to a key investor cohort stepping back, reducing short-term demand and creating bearish pressure.

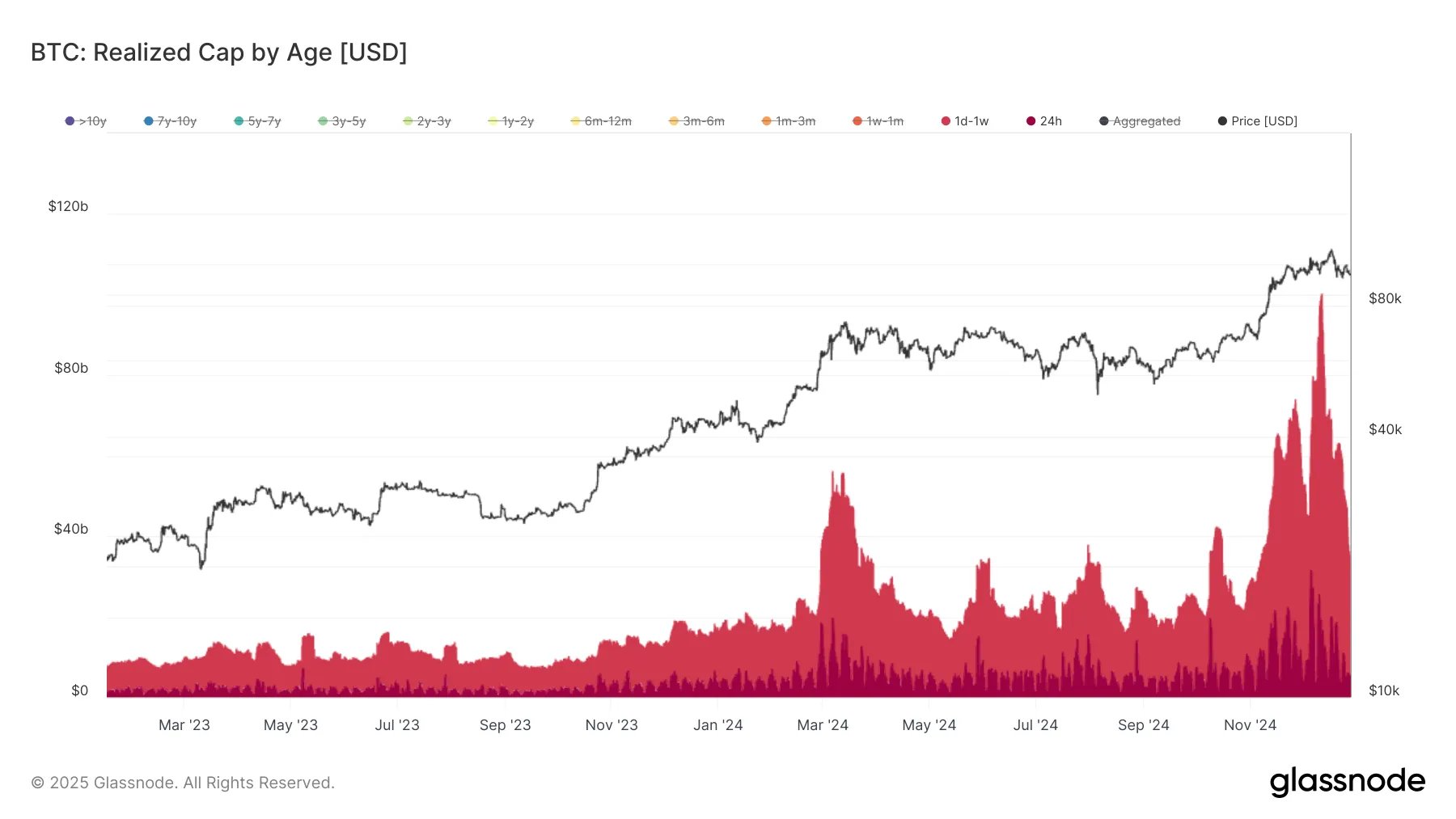

Bitcoin Investors Are Pulling BackThe Realized Cap by Age metric reveals a concerning trend in Bitcoin’s demand. Short-term demand, represented by the capital received in the last seven days, has plummeted by 66% over the past month. Currently, this hot capital is valued at $32 billion, highlighting a steep reduction in short-term inflows into the market.

This drop is critical, as it highlights diminishing confidence among short-term participants, often a driving force in Bitcoin’s momentum. The lack of new capital inflows from these investors reflects growing skepticism and contributes to Bitcoin’s struggle to maintain support above key levels.

Bitcoin Realized Cap By Age. Source: GlassnodeBitcoin’s macro momentum further supports the bearish outlook, with exchange volume momentum nearing a critical bearish crossover. The 30-day moving average is on the verge of slipping below the 365-day moving average, signaling sustained weakness in capital inflows.

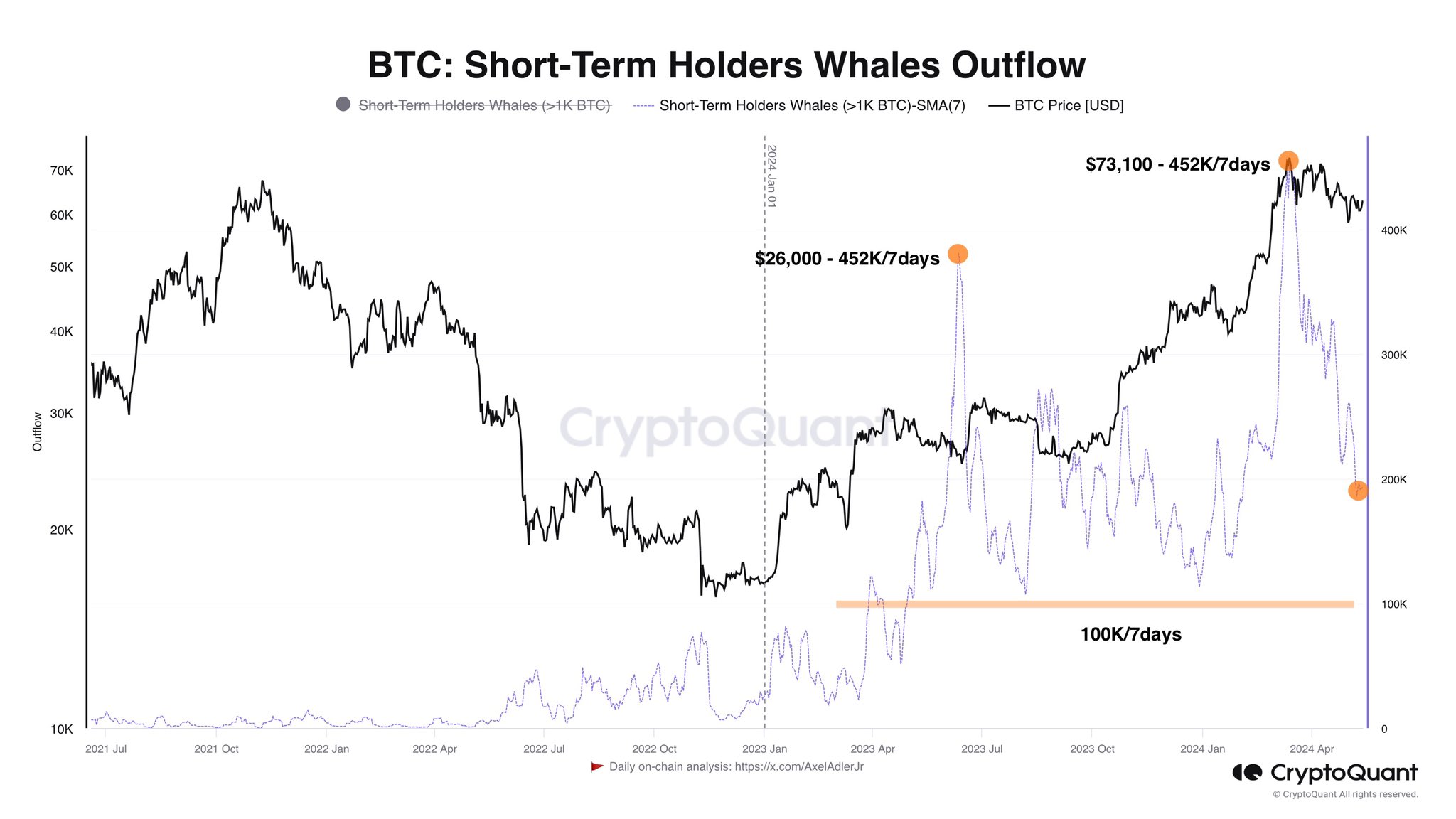

Short-term holders, known for their aggressive buying and selling patterns, are now pulling back. Their reduced activity mirrors the current slowdown in demand and adds to concerns about Bitcoin’s ability to recover in the short term. This group’s cautious approach could hinder Bitcoin’s path to reclaiming higher price levels.

Bitcoin Exchange Volume Momentum. Source: Glassnode BTC Price Prediction: Charting A Path To $100,000Bitcoin is currently trading near $95,000 after recovering from $92,600 and securing $93,625 as a key support level. However, the cryptocurrency faces challenges in sustaining this momentum amid declining short-term demand and bearish macro indicators.

Should these factors persist, Bitcoin could lose the $93,625 support again, leading to a potential drop to $89,800. Such a decline would further deepen the drawdown, testing the resolve of long-term holders.

Bitcoin Price Analysis. Source: TradingViewConversely, Bitcoin’s immediate goal is to breach the $95,668 resistance level. Turning this resistance into support could provide the boost necessary for Bitcoin to reclaim $100,000. Achieving this milestone would invalidate the current bearish outlook and reignite optimism among investors.

The post Bitcoin Price’s Rally to $100,000 Challenged By 66% Decline in Short-Term Demand appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptoindex.com 100 (CIX100) на Currencies.ru

|

|