2019-6-16 09:06 |

Coinspeaker

Bitcoin Price Will Skyrocket in 2021, Here’s Why

It’s already widely known that Bitcoin and cryptocurrency markets are highly volatile and incredibly unpredictable, appearing to move independently of most traditional or expected indicators.

Bitcoin price, which has doubled so far this year after recording heavy losses throughout 2018, is hanging around $8,000 and most other major cryptocurrencies, including Ethereum, Bitcoin Cash, Litecoin, and XRP, have also made significant gains in recent months.

Novak Svrkota, fund manager and analyst from consulting agency KriptoBroker explains that price of Bitcoin is determined by supply and demand.

“Fiat currencies like US dollar, have infinite supply, that increases everyday with rate determined by central banks like FED. Increasing supply is called inflation, meaning that the same amount of money is worth less as time passes. Therefore, keeping your wealth in form of dollar or any other fiat currency doesn’t have lot of sense.

That is the reason why people decide to hold their wealth in form of real-estate, art, shares, gold or any other commodity. Everything revolves around gaining value, but big part of equation is story about money that is constantly losing value. That’s why bottle of Coca-cola costed 5 cents – even today manufacturing and distribution are much more efficient.”

He also noted that Bitcoin “per se” doesn’t have infinite supply. It is grounded at $21 million.

“Bitcoin’s inflation is programmed to decrease every 4 years in event called halvening. Miners are rewarded with Bitcoins for processing transactions. In the beginning that reward was 50 Bitcoins for every 10 minutes. You would probably assume this is a real fortune but at the beginning, Bitcoin was practically worthless.

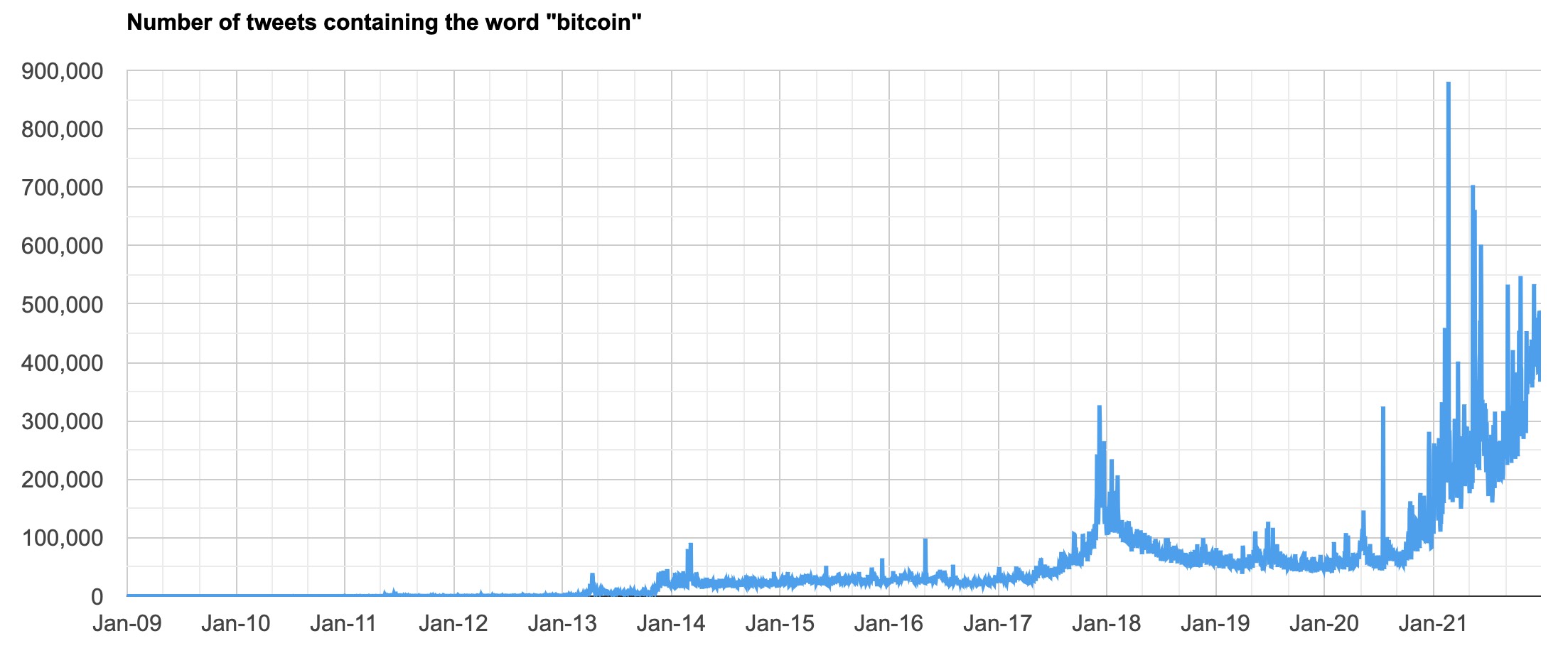

In 2012 we had first halvening where reward was reduced from 50 to 25 BTC and after that, we had big bull market in a late 2013. Then we had 2016 halvening where reward was reduced from 25 to 12.5 BTC, and we witnessed again the bull market in 2017.”

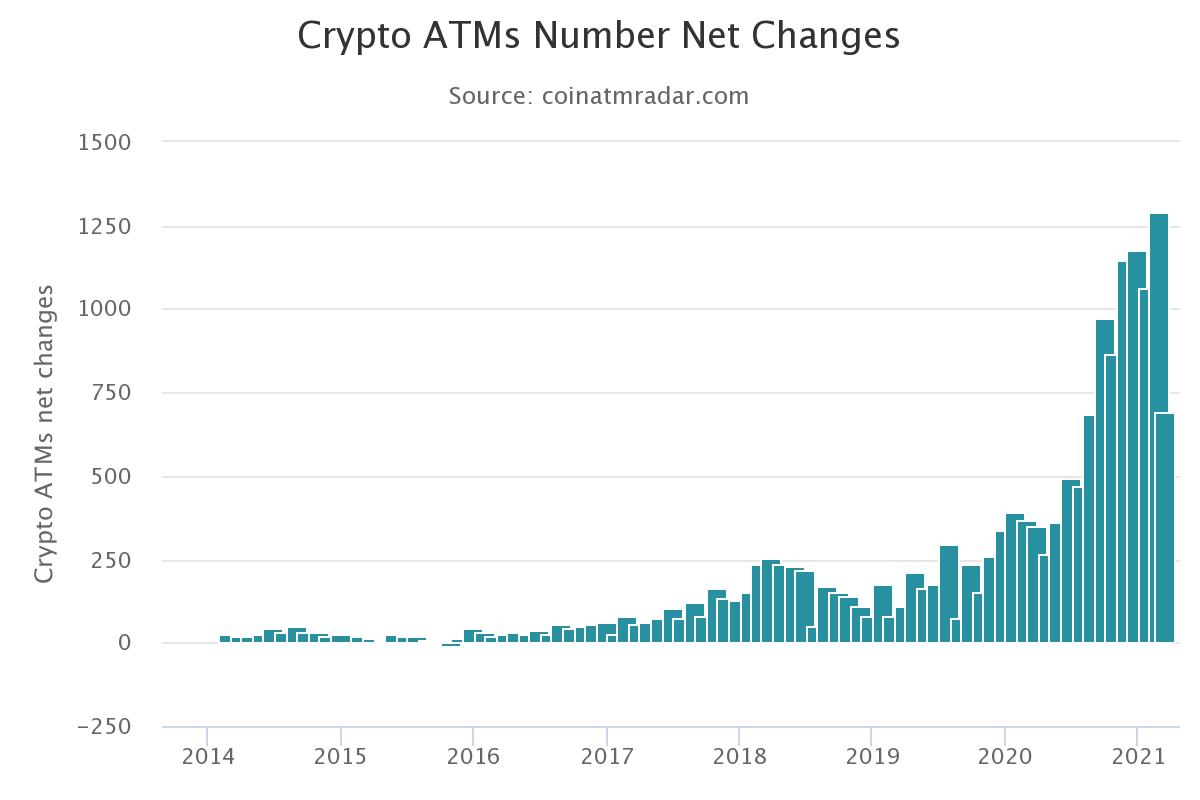

Next halvening is in May 2020 and we are expecting to see huge price increase in 2021 as well. Bitcoin miners currently receive 12.5 BTC each time they successfully mine a block. By the end of May 2020 (the next Halvening) they will instead earn just 6.25 BTC.

The truth is that the Bitcoin price rose from under $1,000 per bitcoin to almost $20,000 throughout 2017 before losing more than 80% of its value last year.

This epic 2017 Bitcoin bull run is thought to have been triggered by expectations institutional investment in the Bitcoin and cryptocurrency market was imminent but when that failed to materialize in the way many thought it would, the market pulled back sharply.

What will happen next year is probably similar to the situation we had in previous years. Earlier this week, a U.S. venture capitalist warned the market is heading for a “supply shock” thanks to next year’s closely watched bitcoin halvening event, now just 341 day away.

Bitcoin Price Will Skyrocket in 2021, Here’s Why

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|