2019-6-27 15:31 |

Coinspeaker

Bitcoin Price & Technical Analysis: BTC Ready to Go Ahead

By: Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

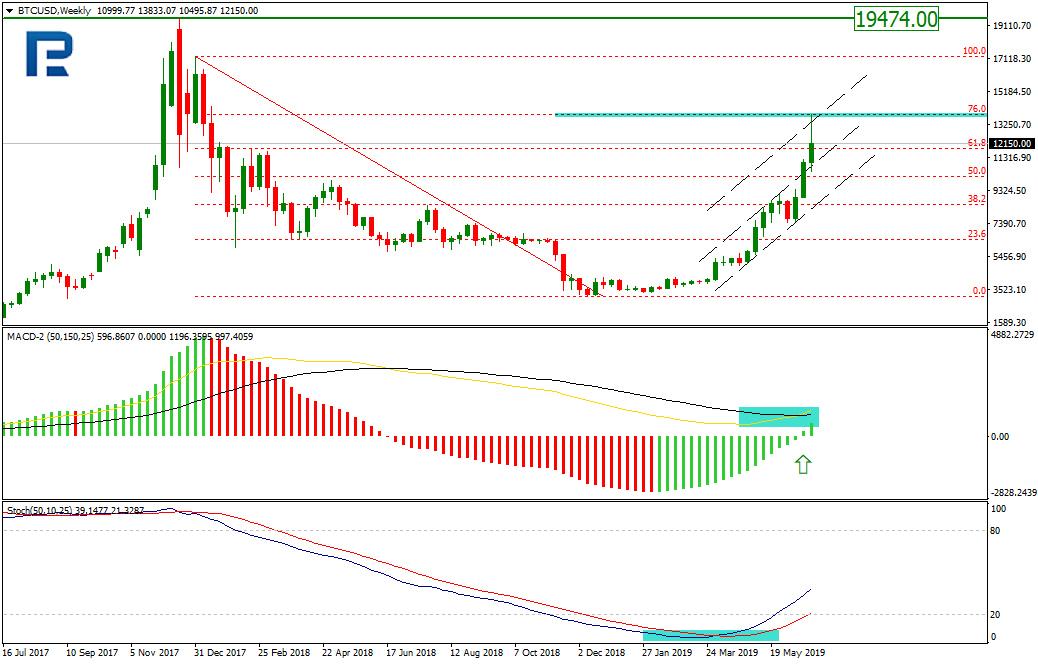

Best Trading Week for BTC in 18 MonthsCFTC Approves BTC FuturesOver the last week, the BTC exceeded even the boldest expectations, having reached 76% Fibo. On W1, it looks like the crypto is not correcting anymore but forming a new long term uptrend, with the historical high of $19,474 being a close target. This is confirmed by both a MACD golden cross and the Stochastic finally leaving the oversold area.

Photo: Roboforex / TradingView

On D1, the BTC started pulling back after reaching $13,857.20. The pullback target lies at the support of $11,100, and then the price may get sent to $8,980 and 7,000.

Photo: Roboforex / TradingView

On H4, the Bitcoin downside move is approaching the local support at 11,100 after the Stochastic divergence. It may take less time for the downtrend to fade out than it did for the previous uptrend, though.

Photo: Roboforex / TradingView

The BTC made +30% over a single week, with the crypto market cap overall rising. With over $20B daily turnover, the flagship crypto is an unparalleled leader, with other altcoins just following its way.

One of the largest BTC drives for now is the fact that the CFTC finally approved Bitcoin futures launch. Currently, the futures will only be traded on a regulated exchange named LedgerX, but, historically, this is definitely a great achievement for the entire market in question, as it means the Futures Commission finally acknowledged the Bitcoin as a legit financial instrument. Now institutional investors, including banks, central banks, and even governments, may start getting interested in it.

Meanwhile, the global markets are pretty much unstable and in desperate need of a safe haven, or at least an alternative to fiat money. This is where the crypto market comes in so handy. It’s not the first time such talks arise, and, moving forward, cryptos may indeed become a risk hedging tool for many investors.

Bitcoin Price & Technical Analysis: BTC Ready to Go Ahead

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|