2023-10-24 16:00 |

The largest single Bitcoin liquidation order was valued at an impressive $9.98 million and occurred on the BTCUSDT trading pair when this article was written.

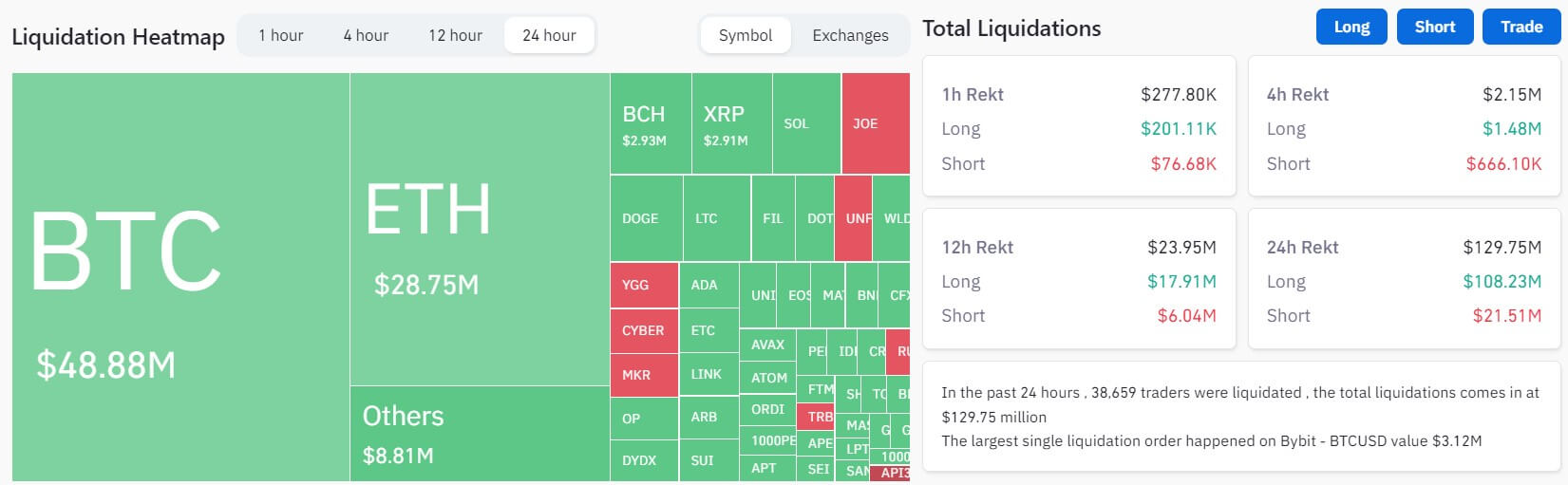

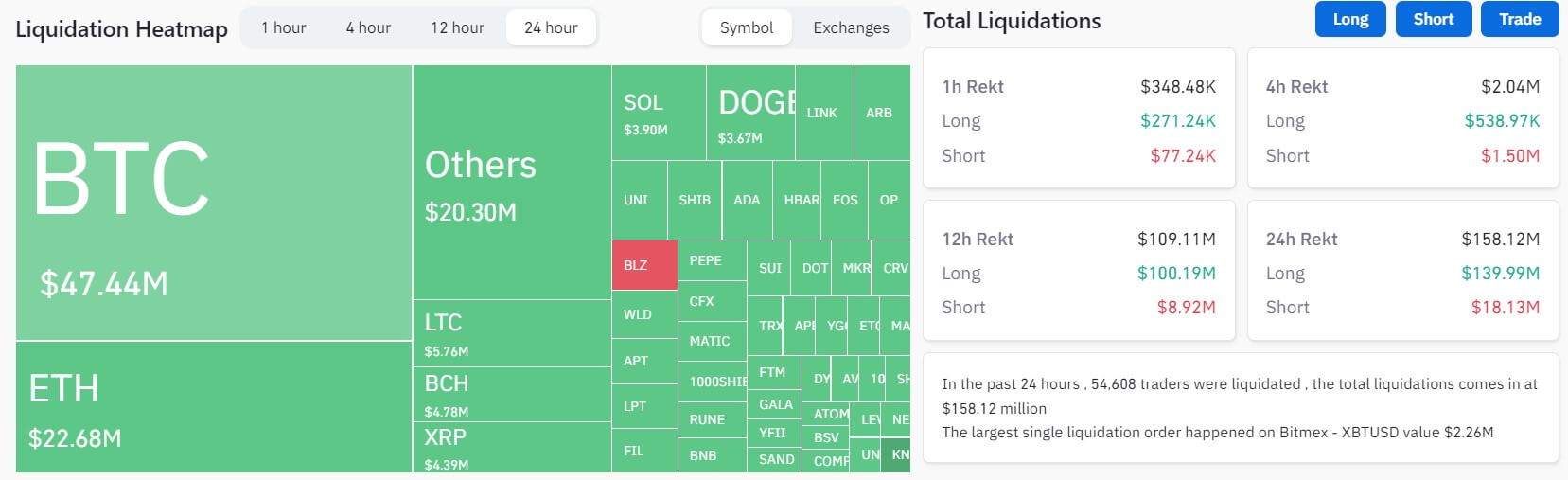

In the past 24 hours, a total of 94,168 traders faced liquidation across the entire crypto market.

Data from CoinGlass shows that Bitcoin (BTC) shorts experienced liquidations totaling $177.15 million, and Ethereum (ETH) shorts had approximately $42.23 million worth of positions liquidated.

At the time of writing, Bitcoin was trading at $34,120, up 11.3% in the last 24 hours, and rallying nearly 20% in the last seven days, data from crypto market tracker Coingecko shows.

It’s worth noting that the majority of the positions that faced liquidation were short positions. Short positions are when an investor sells an asset they don’t own, aiming to profit from its declining price by buying it back at a lower cost later.

Crypto Market Volatility Spurs $400 Million Liquidation CascadeThe cryptocurrency market’s sudden and robust upward momentum caught many traders off guard, leading to a significant surge in liquidations among those who had bet against the rising trend.

This unexpected turn of events underscored the inherent volatility and unpredictability of the crypto market, leaving traders with valuable lessons on the importance of risk management and adaptability in this dynamic financial landscape.

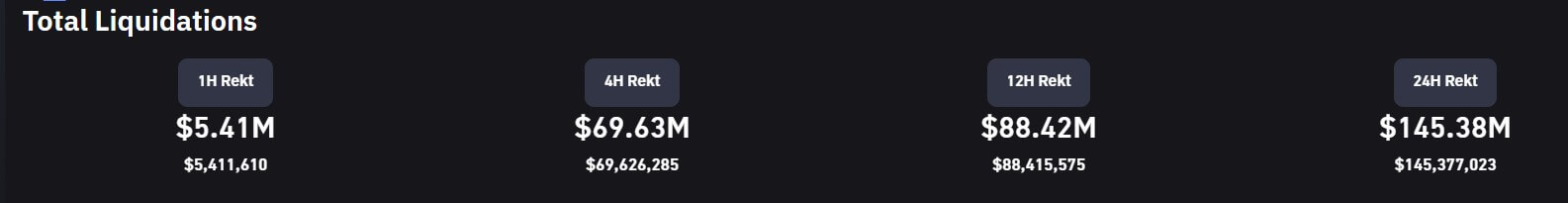

This surge in cryptocurrency prices resulted in nearly $400 million worth of liquidations for leveraged traders over the past 24 hours.

Significantly, the cumulative value of short liquidations in the cryptocurrency market reached $295.82 million, surpassing the value of long liquidations which stood at $106.46 million.

Understanding Long And Short Liquidations In The Bitcoin MarketIn a nutshell, long liquidations happen when investors are forced to sell an asset they expected to increase in value because its price has fallen below a certain point, leading to losses.

Short liquidations exceeding the longs suggests that the prevailing trend among liquidated positions was a pessimistic outlook, with traders expecting more decreases in prices.

Bitcoin had a prolonged surge driven by the anticipation of increased demand from exchange-traded funds, resulting in its price hitting the highest level since May of the previous year.

The token is gaining speculative fervor due to the potential approval of the first US spot Bitcoin ETFs in the upcoming weeks.

BlackRock Inc. and Fidelity Investments are two asset managers competing to provide these kinds of products. Bulls in digital assets claim that the ETFs will increase the cryptocurrency’s ubiquity.

Featured image from VectorStock

origin »Bitcoin price in Telegram @btc_price_every_hour

Eight Hours (EHRT) на Currencies.ru

|

|