2020-3-20 18:24 |

Coinspeaker

Bitcoin Price Rises More Than 11% to $5,800 while Hash Rate Decreases

Bitcoin price and the hash rate were falling during the last week. Today, the price bounced, setting a 6 days record since March 13. BTC price has added more than 11% and reached $5,800. Back then, Bitcoin made a quick dive to $4,000 and below. The analysts were not expecting such a sharp move reverse, with many of the industry traders claiming bear trend. Tone Vays, one of the public persons in the so-called ‘maximalist society’, issued a prediction of $2,000 per Bitcoin till May 2020.

Willy Woo confirmed that Bitcoin’s fall will not look like many of us want.

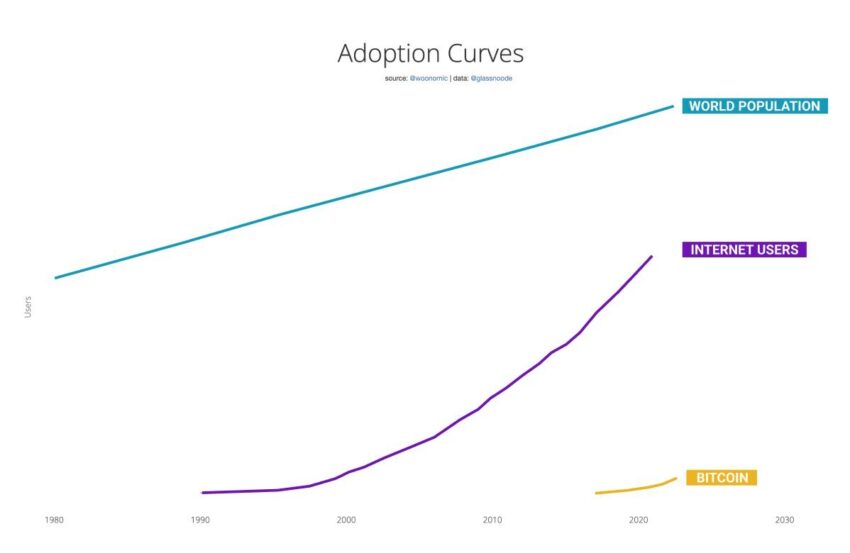

The next key event is confirmation of BTC decoupling from traditional markets. Here's a bunch of charts, many are bullish. I will note that I don't expect a V-shaped bottom, I think there will be time, an accumulation range before moving up.

— Willy Woo (@woonomic) March 19, 2020

Per the Cointelegraph Markets research team, Bitcoin will bounce between $4,000 and $6,000 in the short term. While the European Central Bank announces the ultra big batch of 750 billion euros, the classic market seems like starting a slow recovery. And cryptocurrency sets for a bull trend too. Worth noting that Bitcoin has been holding well around $5,000, showing that ‘safe haven’ imperative is not completely lost. Many of the holders are still here, and this must be a positive sign for Bitcoin bulls.

Bitcoin Price, Hashrate Drop by 40%, Price Try to ReboundSince Bitcoin was testing the bottoms, miners decided to leave the network. As a result, the network is registering an outflow of mining pools, with ‘unknown miners’ taking over their share. However, the power that individuals can offer to the network is not as big as the lack. Thus, the network’s hash rate drops, and the system will automatically decrease difficulty.

Per Glassnode, mining is unprofitable for certain people, at current price.

Due to the declining $BTC price, it is now unprofitable for many miners to continue their operations.

Since its peak on March 7th, the 7DMA of #Bitcoin's hashrate has fallen by ~16% – with hashing power disappearing even faster after the drop to $5k.https://t.co/5bnFHpTXfX pic.twitter.com/X9uw8hOCgD

— glassnode (@glassnode) March 18, 2020

Worth noting that the rest of the miners are still here. It may indicate that they are not selling the coins right after they mined. Those are bull miners, waiting for the future price increase. After the halving, slow mining rigs will leave the network. Only the strong miners will survive, and some experts predict uneasy summer for them.

Summer Promise to be Very Hot for MinersThe block reward halving hits the small mining pools first. It is unclear how many miners will be in the network after the halving. But we can be sure that those will be the large pools and wealthy individual miners. ‘The small guy’ is forced out of the game if the developers won’t introduce substantial changes to the code. Per John Lee Quigley, Miner Update head of research:

“The 40% close price drop we see on Thursday means a lot of miners now are going to either be operating below, their all in a break-even ROI or for money, they’re going to drop a load of cash flow breakeven, which means they have to shut off the rigs. You have little control over these, especially if you’re just operating below the break-even.”

Quigley also notes that many people may start selling their miners. Large players will have to buy them cheap, put at work and increase their profit and presence. This will force out even more miners, and increase the entering barrier for the field.

In Bitcoin, difficulty level adjusts itself automatically every two weeks. If the network experience miners inflow, the difficulty rises, to keep the balance. But when miners flee, the difficulty decreases, to allow the rest of the network to mine without congestion.

Bitcoin’s hash rate shows the ‘health’ of the blockchain. The more miners join the game, the more secure Bitcoin is. Now, as the miners flowing away, Bitcoin is weakening in terms of decentralization. Still, it has the largest number of confirmed nodes among all the cryptocurrencies.

Bitcoin Price Rises More Than 11% to $5,800 while Hash Rate Decreases

origin »Bitcoin (BTC) на Currencies.ru

|

|