2019-8-6 23:00 |

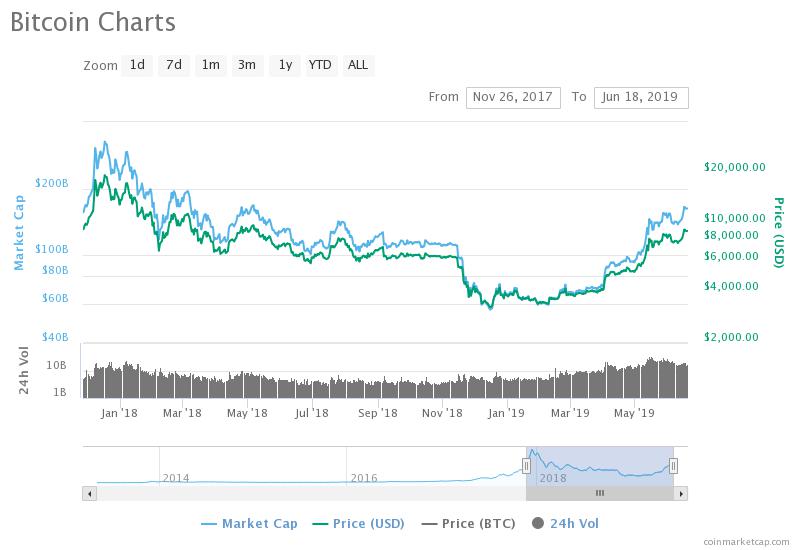

Bitcoin is at an interesting price point in its decade or so on the market. The first-ever crypto-asset designed by Satoshi Nakamoto is no longer in a bear market, but not yet in a bull market, as it has yet to set a new all-time high or break past the remaining bear market resistance.

That same bear market may help predict future price action, as a similar trend line has appeared at the top of the current rally that looks eerily similar to a trend line that kept Bitcoin from ever revisiting $20,000.

Bearish Trend Line Hasn’t Been Broken, But Bulls Are Ready For ActionMost crypto analysts, investors, and traders believe that Bitcoin has already started its next bull run. But bears have still managed to keep their presence known, and Bitcoin was rejected at $13,800 as a result. Since then, the leading crypto asset by market cap has struggled to retest previous local highs – the only remaining obstacle before the asset’s previous all-time high is retested next.

Related Reading | Bitcoin NVT Ratio: Top Predicting Signal Hits Highest Peak, Is a 50% Drop Ahead?

The rejection and flash crash at $13,800 stopped Bitcoin just before it broke out of its bear market resistance, and has caused it to be restricted to a downtrend line that it is now brushing up against once again.

A closer look. Previous parabola observed this line…. pic.twitter.com/ulJyHx046g

— dave the wave (@davthewave) August 5, 2019

As noted by crypto analyst Dave the Wave, the current bearish downtrend line that Bitcoin can’t seem to get through appears to follow a path similar to the downtrend line following Bitcoin’s rejection at $20,000.

Bitcoin Price Fractal Fails, But Trend Line Still IntactThe two parabolic rallies and tops have played out similarly, albeit with different price action despite similar downtrend lines. Bitcoin had been following a fractal of the 2018 bear market closely until bulls buying the dip stopped the price of BTC from falling further. In late 2017 into early 2018 downtrend, Bitcoin price formed an M-shaped double-top before an Adam and Eve bottom pattern ultimately failed. This time around, an Adam and Eve bottom is in the process of confirming but still needs to break past the aforementioned down trend line.

Same sideways movement seen before the second big dip…. pic.twitter.com/RgCjIDxKHI

— dave the wave (@davthewave) July 30, 2019

If Bitcoin breaks through the down trend line here, bullish continuation and a retest of $13,000 is almost a given. Bitcoin will need to break through that resistance in order to have a clear runway for $20,000. Beyond that, a new all-time high and a bull market is in the cards.

Related Reading | “Golden” Bullish Bitcoin Price Signal: Are 5000% BTC Gains Ahead?

If Bitcoin is rejected here, it’ll fall back deep below the down trend line and could possibly retest lows below the $9,000 range it failed to break below the last time it visited. Further downside could jeopardize Bitcoin’s bull run foundation, and possibly cause an extended correction now that the parabolic rally has been broken.

Featured image from ShutterstockThe post Bitcoin Price Previous Bear Trend Could Predict Potential Price Action Ahead appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|