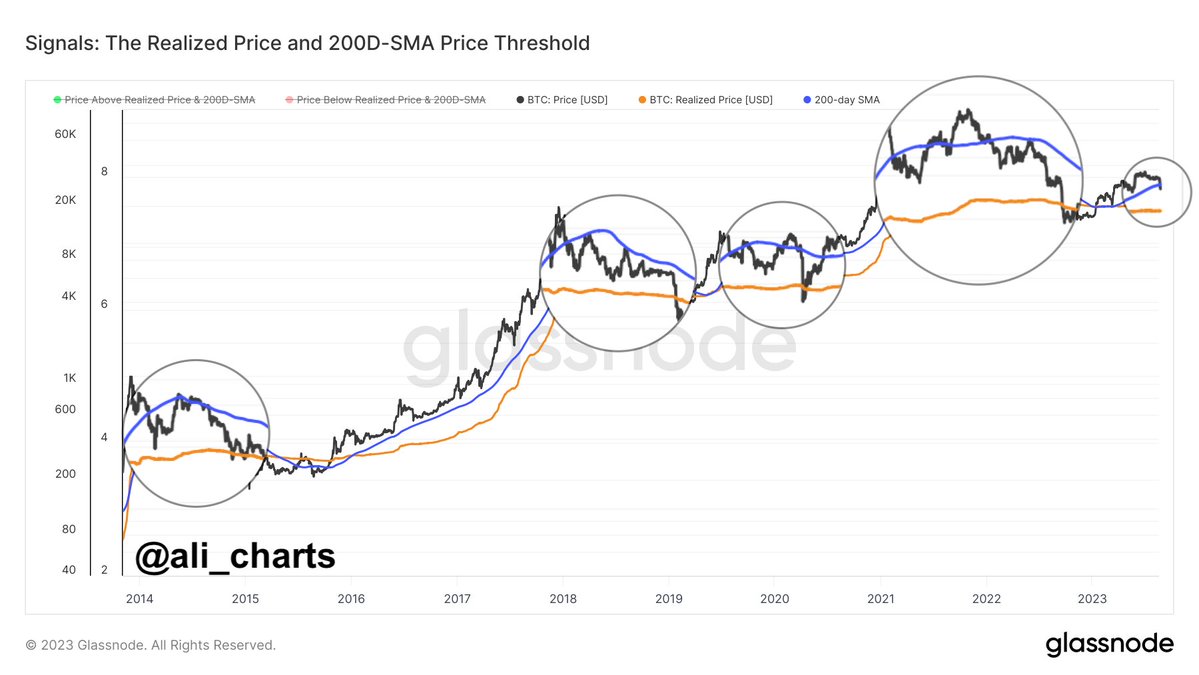

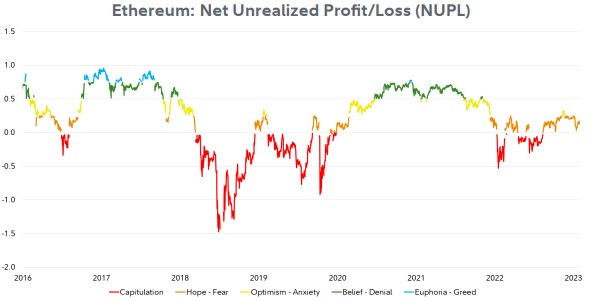

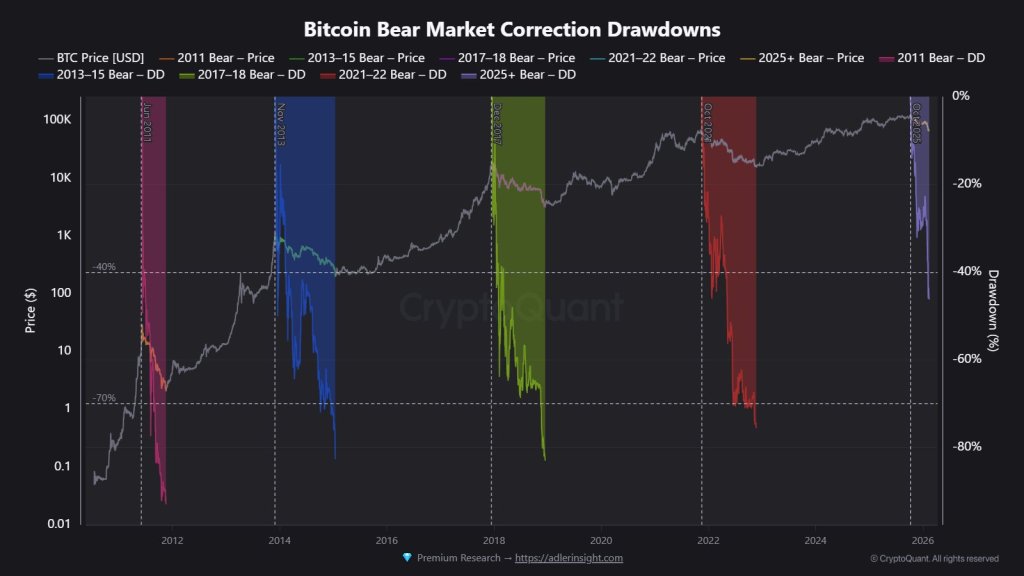

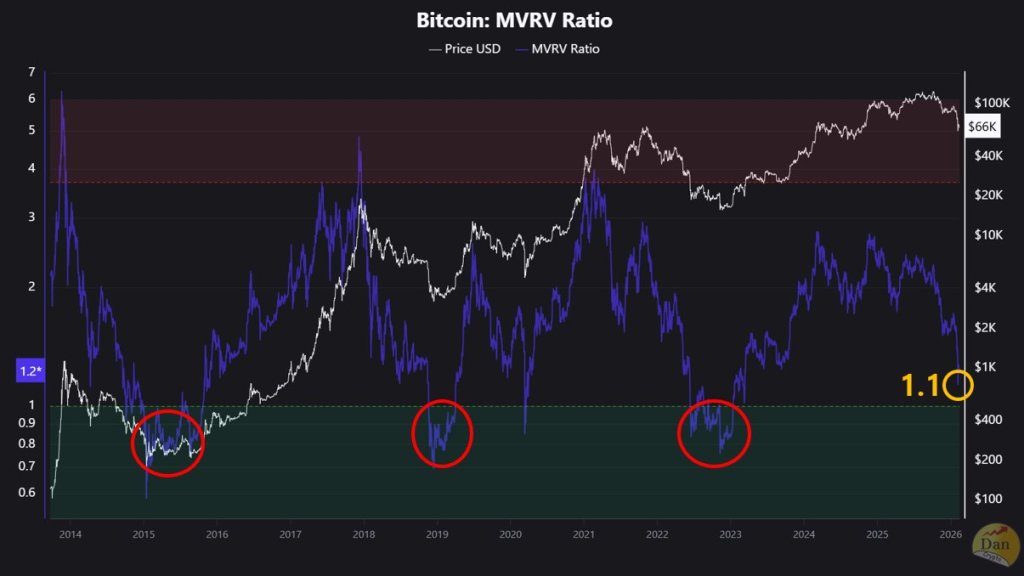

Fidelity, a leading financial services provider, has recently released a report on Ethereum (ETH) that sheds light on some key metrics to watch for the cryptocurrency in the coming months. The report highlights several important indicators, including the 50-day and 200-day moving averages (MA), the realized price, the Net Unrealized Profit/Loss (NUPL) ratio, Market Value to Realized Value (MVRV) Z-Score, percent in profit, and the Pi Cycle indicators, all of which can provide valuable insights into market sentiment and potential price movements.